As a seasoned researcher with over two decades of experience in financial markets, I’ve seen my fair share of bull and bear cycles. The current state of Bitcoin is intriguing, to say the least. The MVRV Ratio and CQ Bull & Bear indicators suggest that the market is on edge, waiting for a catalyst to break out of its consolidation phase.

As a researcher, I’ve been monitoring the cryptocurrency market and according to my analysis based on CoinMarketCap data, Bitcoin is hovering around the $62,000 mark currently, with minimal price fluctuations over the past day. Notably, Bitcoin has entered a phase of minor consolidation since recording slight gains on Friday. For long-term traders, it’s worth noting that Bitcoin has been stuck in a range-bound movement since March. While there’s a lot of anticipation among investors for a bullish breakout in Q4 2024, certain market conditions need to be met before this can happen.

Bitcoin Futures Liquidation Forms Local Price Bottom — A Return To $65,000 Inevitable?

Bitcoin MVRV, CQ Bull & Bear Indicators Show Market Uneasiness

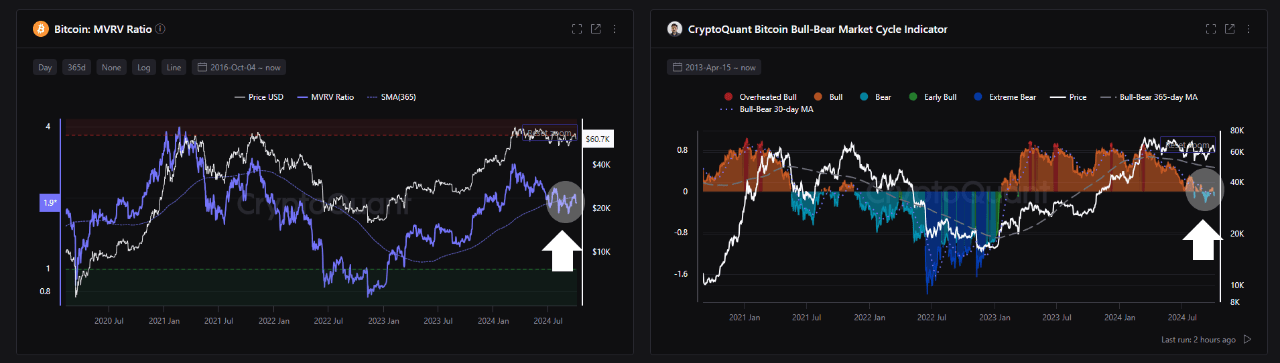

According to an analyst named burakkesmeci in a post on CryptoQuant, there appears to be a strong possibility of major price changes in the Bitcoin market right now. The MVRV Ratio and CQ Bull & Bear metric, as per his analysis, suggest that Bitcoin investors are currently displaying a high degree of market readiness or expectation.

The MVRV Ratio, in simpler terms, measures the current Bitcoin price against the price it was last actively traded on the blockchain. This ratio helps determine whether Bitcoin seems underpriced or overpriced when compared to its actual value based on past transactions.

When the Market Value to Realized Value (MVRV) ratio surpasses its 365-day Simple Moving Average (SMA), it typically suggests a bullish momentum, as investors are experiencing an annual profit on their assets. Nevertheless, Burakkesmeci points out that Bitcoin’s MVRV, currently at 1.90, has been lingering slightly below its SMA 365 (2.03) since July, indicating that the Bitcoin market is maintaining a stable position, poised for a potential breakout.

The analyst has noticed a similar repeating trend in the CQ Bull & Bear indicator, which gauges recent price fluctuations compared to extended-term price trends. As per burrakesmeci’s interpretation, the CQ Bull & Bear reading has been slightly under its 365-day moving average (0.46) since August, suggesting that the Bitcoin market may be in a temporary standstill.

Factors That Will Spark A Bitcoin Rally

According to burakkesmeci’s analysis, Bitcoin might see an upward surge if certain conditions are met. Firstly, he suggests that the Federal Reserve should embark on a cycle of reducing interest rates, possibly by lowering them step-by-step. Notably, after a 50 basis points cut in September, predictions indicate another potential 25% reduction at their November FOMC meeting.

Burakkesmeci points out another positive sign: a potential quantitative easing, where the U.S. government plans to increase money supply in the economy. This could encourage people to venture into riskier investments like Bitcoin due to the increased liquidity.

Currently, the price of Bitcoin stands at approximately $62,009, representing a minor decrease of 0.02% over the past day. Simultaneously, its daily trading volume has decreased by around 53.80%, reaching a value of about $12.97 billion.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-06 09:22