As a seasoned analyst with over two decades of experience in traditional finance and the burgeoning crypto market, I find myself constantly astounded by Bitcoin’s relentless march toward new highs. The recent 9% retracement to $90,700 was a mere blip on the radar for this resilient digital asset.

Bitcoin experienced a 9% drop from its record peak of $99,800, just shy of the significant $100,000 mark. This dip lowered Bitcoin’s value to a minimum of $90,700 on Tuesday, causing unease among certain investors.

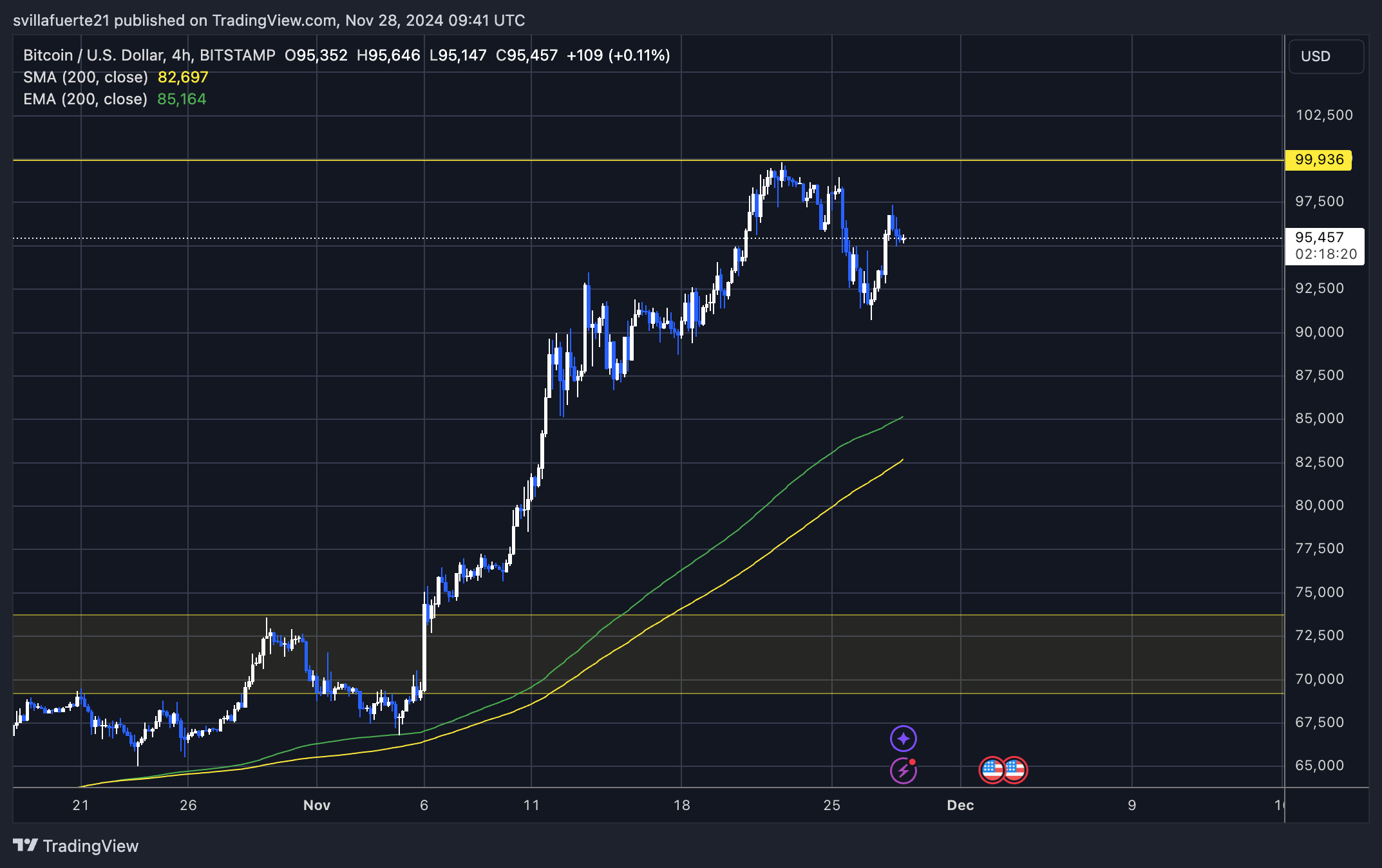

Nevertheless, the price has bounced back, demonstrating its robustness as it moves upward again, approaching significant resistance points. Although it’s been quite turbulent, Bitcoin’s overall positive trend continues, and the general market outlook is hopeful.

Leading analyst, Axel Adder, shares crucial on-chain data indicating that the robust appetite for Bitcoin remains consistent at its current price points.

As per Adler’s perspective, this investment behavior suggests that investors consider downturns as chances to amass more Bitcoin, demonstrating their faith in its potential for future expansion. Yet, he also brought attention to robust support at lower price points, which might be activated if the ongoing recovery fails to hold steady.

Over the coming days, it’s essential to keep an eye on Bitcoin as it attempts to regain momentum and possibly surpass the $100K mark. With continued strong demand and favorable market circumstances pointing towards a possible breakthrough, we’ll see if Bitcoin can maintain its upward trend or if more consolidation is in store. The upcoming period could bring a significant price shift for Bitcoin.

Bitcoin Data Reveals Investors’ Entry Prices

As a researcher, I’m observing an extraordinarily optimistic price trend in Bitcoin, fueled by escalating interest from both institutional and individual investors. The insights gleaned from on-chain analysis by CryptoQuant analyst Axel Adler underscore the crucial price factors that are molding today’s market landscape.

As per Adler’s analysis, Bitcoin’s current price is being held steady within a price range that aligns with the typical investment level of two significant groups of investors: those who look at daily data ($96,800) and those who consider both daily and weekly data ($95,300). These price points serve as robust support areas, suggesting that there is substantial buying interest at these levels.

Furthermore, the typical transaction value between $1 and $1 million, currently set at approximately $84,000, offers an additional cushion during potential market downturns. This suggests that even in a less optimistic outlook, Bitcoin is likely to maintain stability near $84,000 before continuing its growth trend.

The information supports the optimistic view about Bitcoin that’s commonly shared among experts and financiers. Many of them think we’re still at the beginning of this cycle, as the high interest and solid backing points indicate that Bitcoin could keep up its positive trend in the coming days.

Regardless of whether Bitcoin maintains its current prices or undergoes a short-term decline, there’s generally an upbeat outlook among experts regarding future growth. This phase could represent a significant milestone in Bitcoin’s history, setting the stage for potential record-breaking gains.

BTC Nears $100K

At the moment, Bitcoin is being bought and sold at approximately 95,200 dollars. This significant figure could influence its next major shift. If Bitcoin manages to stay above this price, it might lead us towards a possible attempt to reach the eagerly awaited 100,000 dollar mark.

Prior to surpassing this psychological landmark, the following substantial resistance point is found at approximately $98,800. Breaking through this level could potentially spark a major surge, pushing Bitcoin past its previous record high and into the six-figure range for the first time.

Nevertheless, the risks remain significant. If Bitcoin doesn’t manage to stay above the $90,000 threshold, it could experience a more pronounced drop. In this case, the next key support lies at approximately $85,500 – a crucial level that must be defended to uphold Bitcoin’s bullish momentum.

Market observers closely follow these critical thresholds, as Bitcoin’s path has a substantial impact on overall market opinion. With robust interest and acceleration, the upcoming days are crucial in predicting whether BTC will break through $100,000 or maintain its current position before continuing its upward trend. Given the market’s volatile nature, traders and investors are preparing for major shifts ahead.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-11-28 19:16