As a seasoned crypto investor with a knack for deciphering market trends and a penchant for on-chain data analysis, I find the recent dip in Bitcoin’s Daily Realized Profit Loss Ratio below 1 intriguing. This shift from profit-taking to loss-realization could potentially signal a reversal in the Bitcoin price movement.

Recent analysis of on-chain data indicates that Bitcoin investors might be done with their prolonged phase of cashing out profits. This could potentially signal an upcoming change in the price trend, possibly pointing towards a price increase in the near future.

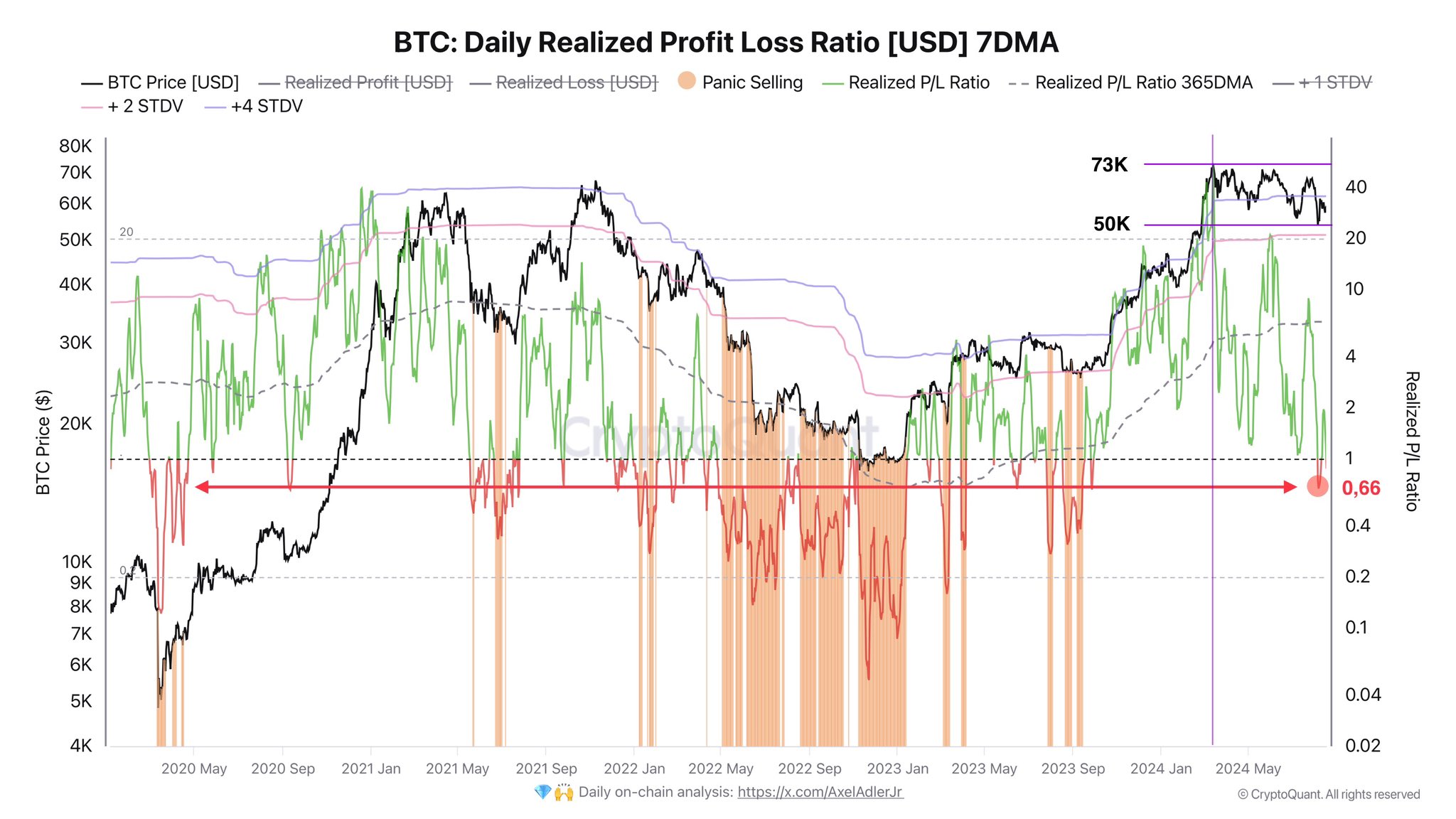

Bitcoin Daily Realized Profit Loss Ratio Has Dipped Below 1 Recently

In my analysis, I’ve noticed a shift in the balance between realized profits and losses within the Bitcoin market. Specifically, I’ve been monitoring the “Daily Realized Profit Loss Ratio,” a metric that sheds light on the comparative scale of investor profits versus losses.

As an analyst, I examine the transaction history of each coin sold, focusing on the price at which it was previously moved. If the preceding sell price for any coin is lower than its current market value (spot price), it signifies that the coin is being transferred at a profit.

In a similar manner, selling coins of the reverse kind results in realizing losses. This indicator combines these gains and losses across the market and calculates their ratio to determine its value.

If the indicator exceeds 1, it means that investors are making more money from selling (realizing profits) compared to incurring losses. Conversely, when the indicator is at or below 1, it suggests a higher prevalence of market participants experiencing losses rather than profits.

Over the years, I’ve closely monitored various investment trends, and one that has consistently intrigued me is the Bitcoin Daily Realized Profit Loss Ratio. As someone who started investing in cryptocurrencies early on, I can attest to the rollercoaster ride they offer. The chart you see here showcases the evolution of this ratio over time, providing a fascinating insight into the market’s behavior. It’s an essential tool for anyone looking to navigate the complex world of digital currencies, offering valuable insights that could potentially help maximize returns or minimize losses. Keeping an eye on such trends has proven invaluable in my own investment journey, and I encourage others to do the same.

Over the past year, the Bitcoin Daily Realized Profit/Loss Ratio, as shown in the graph, has predominantly exceeded 1. In fact, for much of this period, the ratio has substantially surpassed the 1 mark, indicating that a considerable amount of profit-taking has been observed.

The cause for this is the surge in Bitcoin’s value over this timeframe. As you can see from the graph, the highest point of selling, or profit-taking, occurred around the record high (peak) in March, as one might anticipate.

In the timeframe after Bitcoin’s all-time high (ATH), it’s worth noting that profit-making significantly overshadowed loss-making. This price consolidation occurred within a range, suggesting a continued desire for realizing profits. However, it seems this trend may have waned recently, possibly due to the prolonged sideways movement with no clear indication of change.

The balance has now shifted, with setbacks becoming more prominent. It’s worth noting that this change often happens as we approach the concluding stages of consolidation phases, according to the analyst.

To date, the lowest the ratio has dipped is 0.66, which isn’t extremely low when considering previous periods of loss. Consequently, it seems that the current downtrend might continue further before Bitcoin initiates another bullish surge.

BTC Price

Currently, Bitcoin’s price trend appears to be stable, hovering near the $58,400 mark.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Best Japanese BL Dramas to Watch

- List of iOS 26 iPhones: Which iPhones Are Supported?

2024-08-20 06:40