As a seasoned researcher who has witnessed the rollercoaster ride that is the crypto market, I find the current state of Bitcoin holders particularly intriguing. With over 95% of Bitcoin addresses showing profits, it’s hard not to feel a sense of FOMO (Fear Of Missing Out) for those who missed the boat early on.

Almost all Bitcoin owners (around 95%) have made a profit due to the recent surge in its market value, according to on-chain analysis.

Very Few Bitcoin Addresses Are Still Underwater

On their latest blog post on X, IntoTheBlock – the market intelligence platform – has provided insights into the current state of profitability among Bitcoin holders. To gather these findings, they relied on on-chain data analysis.

IntoTheBlock examines the purchase history of every wallet on the network to determine the typical cost at which they bought their cryptocurrencies. Wallets that purchased their coins at a price lower than the current market value are considered to have accumulated some net unrealized gains.

In a similar manner, those who hold addresses representing losses are referred to as “loss holders.” The analytics company refers to initial investors as “in-the-money,” while those holding less profitable investments are labeled “out-of-the-money.

To put it simply, if the cost at which someone bought a cryptocurrency wallet matches the current market price, they wouldn’t be making any profit or loss. In other words, they would be in a neutral position, often referred to as “breakeven” or “at par”.

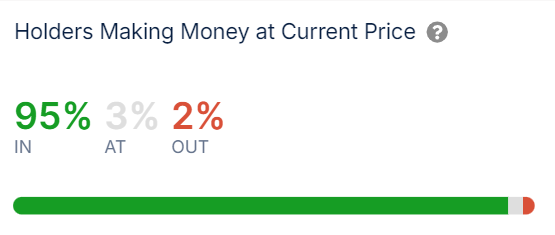

At present, let me describe the current distribution of addresses on the Bitcoin network within these three classifications:

It’s clear from what we see here that approximately 95% of Bitcoin owners are experiencing a profit right now. Approximately 3% of them have neither gained nor lost money (break-even point), and the remaining 2% find themselves in a position where they’ve yet to recoup their initial investment.

As a result, there’s currently a significant imbalance in the market with most profits being accumulated by those who hold assets, due to the recent surge in their prices.

According to IntoTheBlock, around 95% of Bitcoin wallets are currently making a profit, which suggests that the market’s outlook is optimistic. In the past, similar figures have indicated robust bullish trends; however, they could also signal an overzealousness in the market that might lead to an eventual correction.

Investors who have profits from their investments are often inclined to cash out at any given moment, which could lead to a significant number of them selling off simultaneously for profit-making purposes. Consequently, a large number of investors showing profits might indicate an increased likelihood of a widespread selloff, suggesting potential market overheating due to excessive profit-taking.

Currently, many Bitcoin addresses are cashing out their profits, suggesting there might be another round of profit-taking. It’s uncertain if the demand will be sufficient to counteract this selling wave or if we’ll witness a peak in Bitcoin prices.

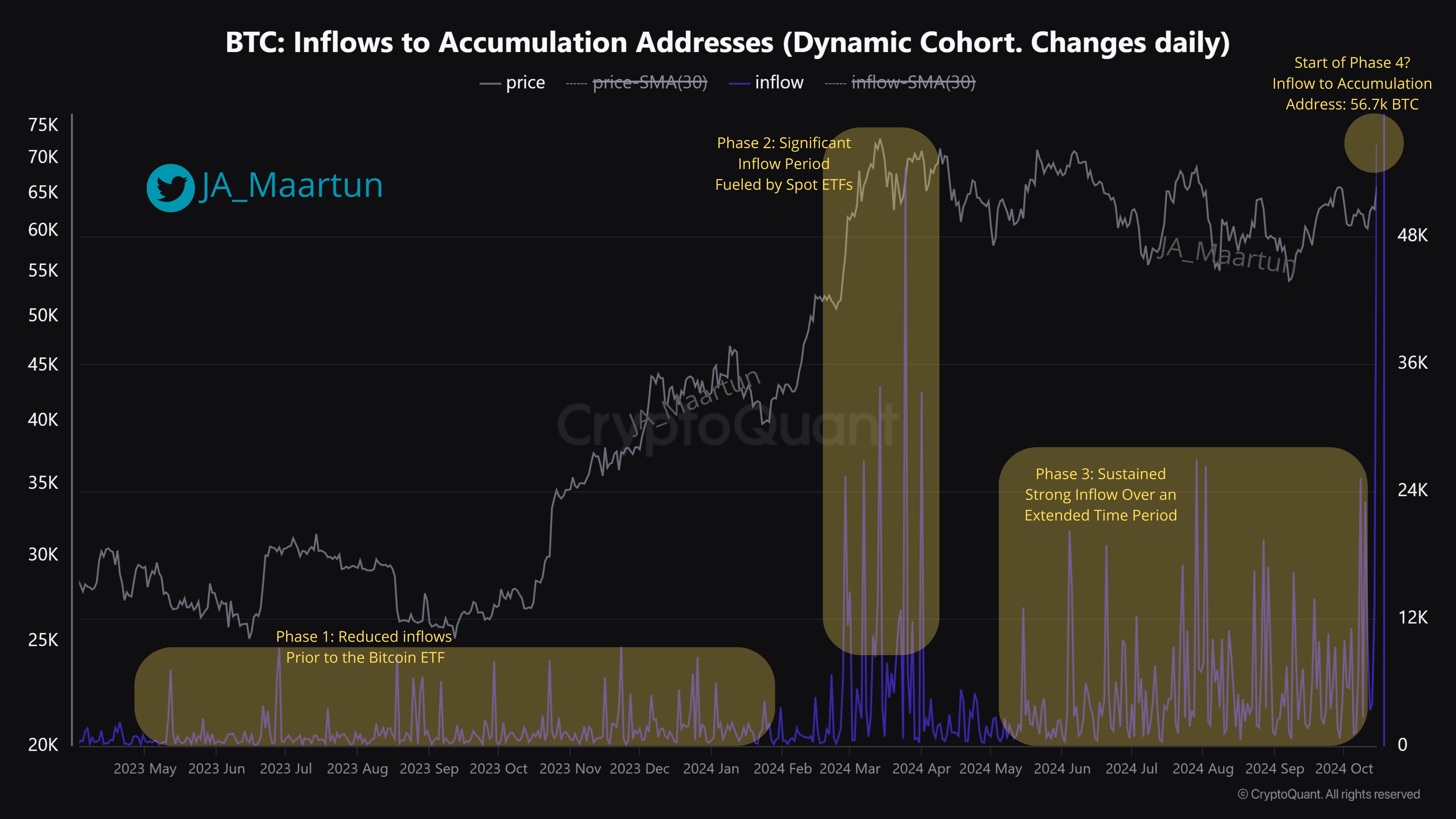

In a positive development, there’s been a significant increase in Bitcoin transfers to “storage wallets” as highlighted by the CryptoQuant team’s community manager, Maartunn, in a recent update.

The term “accumulation addresses” refers to digital wallets that have never executed a sell transaction on the network. These long-term investors, often called HODLers due to the misspelling of ‘hold’, have recently increased their holdings by 56,700 Bitcoins. This could be indicative of them initiating another round of accumulation, implying a potential new phase in Bitcoin ownership.

BTC Price

At the time of writing, Bitcoin is trading around $67,400, up more than 11% over the past week.

Read More

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

2024-10-18 07:34