As a seasoned analyst with over two decades of market experience under my belt, I must say that the current state of Bitcoin’s Average Profitability Index is indeed intriguing. At 221%, it’s undeniably high, yet not quite at the stratospheric levels we saw during previous bull runs.

The current average return for Bitcoin investors, as indicated by on-chain data, stands at approximately 121%. This raises the question of whether such significant profits have historically signaled a market peak.

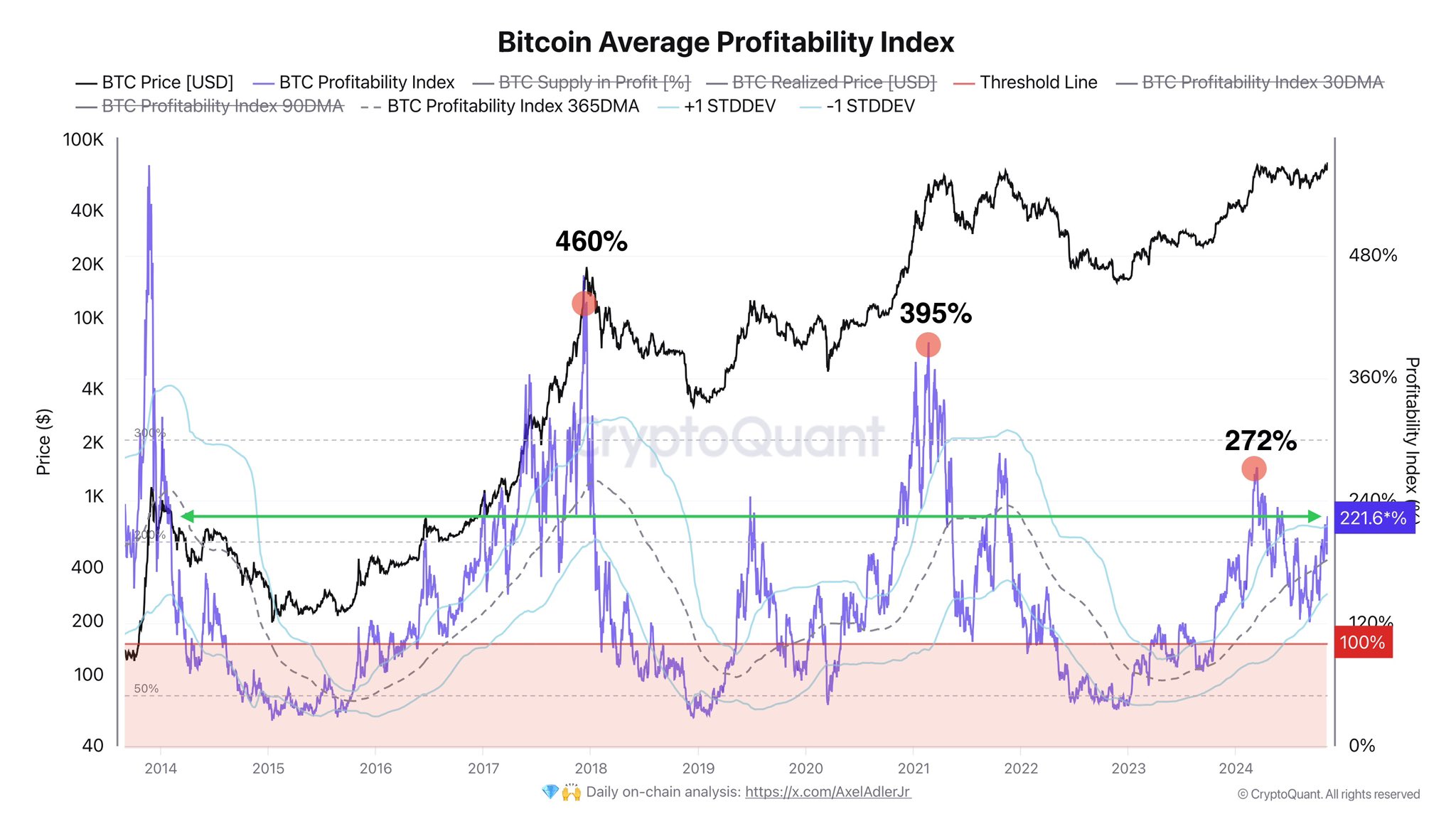

Bitcoin Profitability Index Is Currently Sitting Around 221%

On his recent article for X, CryptoQuant’s writer Axel Adler Jr delves into the current development of a key statistic concerning Bitcoin: the Bitcoin Realized Price Index. This “Realized Price Index” is a measure specifically for Bitcoin that evaluates its market value by comparing it with its actual price.

In this context, “realized price” means the typical cost or initial value that a standard Bitcoin investor has paid for their holdings. We calculate this figure by considering transaction data recorded on the blockchain, taking the last price at which each coin in circulation was traded as its present cost basis.

If the Average Profitability Index surpasses 100%, it signifies that the current market price of the cryptocurrency exceeds its historical value, or realized price. This pattern implies that on average, investors are realizing a profit from their investments.

From another perspective, when the indicator falls below this level, it suggests that the overall Bitcoin market is holding bitcoins with an accumulated unrealized loss. Conversely, when the index reaches 100%, it signifies that all holders together are only recovering their initial investment, not yet realizing any profit.

Here’s a graph illustrating the evolution of the Bitcoin Average Profitability Index over the last ten years.

It’s clear from the graph that the Bitcoin Average Profitability Index has experienced a significant rise lately, coinciding with its surge towards a fresh record high price.

Currently, the indicator stands approximately at 221%, implying that investors have realized substantial profits. To be more precise, collectively, Bitcoin addresses show a net profit of 121%.

Typically, as investors’ profits increase, they may find themselves tempted by the lure of cashing out their earnings, a practice known as profit-taking. At present, the Average Profitability Index is at a significant level; however, it remains unclear if this level is substantial enough to make a widespread selloff a potential risk.

As a researcher examining the provided graph, I’ve noted that the analyst has highlighted the maximum levels reached by the metric during past bull markets. Interestingly, it seems that the peak in 2017 stood at approximately 460%, while the most recent run in 2021 peaked slightly lower, at around 395%.

In the course of this ongoing cycle, I’ve observed that the highest the index peaked was 272%, which occurred during its previous peak in March of this year. As of now, the indicator hasn’t reached this level, not even the peaks from past cycles. This suggests that Bitcoin might still have ample potential for growth before a top becomes likely.

BTC Price

At the time of writing, Bitcoin is trading around $76,200, up more than 9% over the past week.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Gold Rate Forecast

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- CNY RUB PREDICTION

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Delta Force Redeem Codes (January 2025)

2024-11-09 15:40