As a seasoned crypto investor with a decade-long journey in this dynamic and intriguing market, I find the recent developments quite encouraging. The accumulation of Bitcoin by long-term holders, despite the market volatility, is a testament to their conviction in the digital gold’s potential.

In spite of the turmoil surrounding the recent drop in the cryptocurrency market and the sense of panic earlier this week, long-term Bitcoin investors, often referred to as ‘HODLers,’ have been buying more Bitcoins over the past month, according to on-chain analysis.

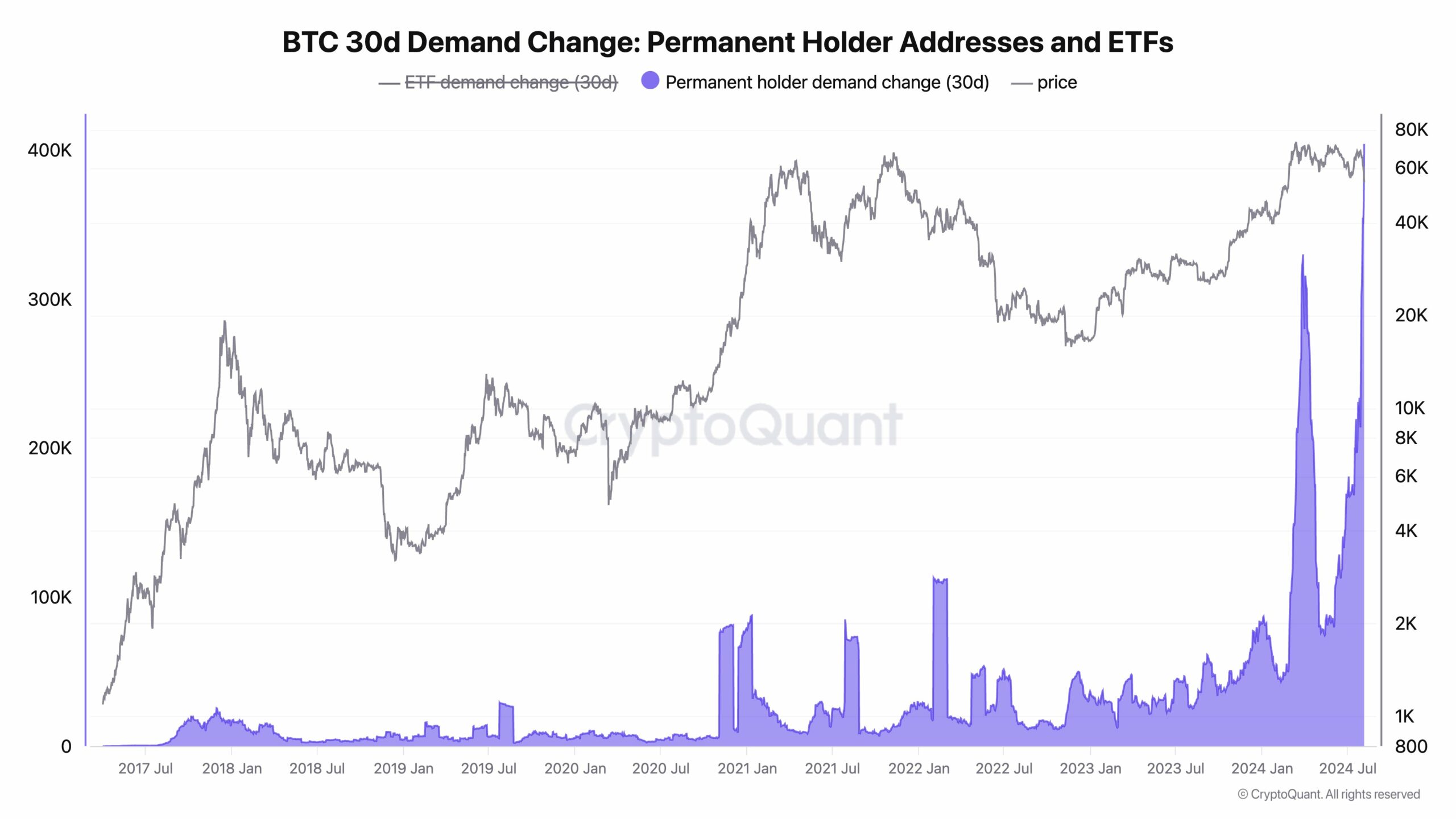

According to CryptoQuant CEO Ki Young Ju’s report, permanent Bitcoin holders added approximately 404,448 BTC worth around $23 billion over the past month. As shown in the chart below, the accumulated BTC by these long-term holders is approaching their record high once again.

Courtesy: CryptoQuant

As an analyst, I’m anticipating that within the next year, diverse entities such as conventional financial institutions, governments, and corporations will make their Bitcoin purchases during the third quarter of 2024.

As an analyst, I too expressed my belief that retail investors might find themselves regretting their decision not to seize BTC dip opportunities. To date, it appears that retail investors have chosen to remain cautious, possibly due to concerns over the Mt. Gox situation, macroeconomic factors, and potential German government sales.

For the past two days, worries about a U.S. recession have temporarily eased, causing a significant surge in both the U.S. and Japanese stock markets. This positive trend has also been reflected in the crypto market, where Bitcoin (BTC) and alternative coins (altcoins) have experienced a recovery of over 15% from their lows on Monday.

Bitcoin Price Eyeing Recovery Above $60,000

As a crypto investor, I’m optimistic about Bitcoin’s potential. Ki-young Ju suggests that as long as the Bitcoin price remains above $45,000, it could surge even higher, potentially hitting new record highs within the next year. Interestingly, this week alone, we saw a dip below $50,000 twice, but the market has shown resilience and bounced back each time.

Ju mentioned that while some indicators show a downtrend now, he anticipates an upturn in the following fortnight. Yet, he warned that if the negative signs persist for over a month, it could lower the likelihood of a turnaround.

If the Bitcoin price remains over $45K, there’s a possibility that it could reach a new record high within the next twelve months, in my opinion.

Certain signs point towards a potential downturn, but there’s still a chance for these indicators to bounce back. It’s crucial to monitor the situation closely over the next week or so to see if this trend persists.

If it…

— Ki Young Ju (@ki_young_ju) August 6, 2024

Cryptocurrencies like Ethereum are also jumping on the trend, as its value has soared over $2,500. Interestingly, investments into Ethereum exchange-traded funds (ETFs) have increased significantly, even amidst the high market fluctuations of the past two days.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-08-07 11:36