As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the latest insights from Julio Moreno at CryptoQuant. The Bull-Bear Market Cycle Indicator’s shift towards a bear market phase is an interesting development, especially considering the unprecedented bullish run Bitcoin experienced earlier this year.

Recently, Julio Moreno, the Head of Research at CryptoQuant, pointed out an important shift in the Bitcoin market using their Bull-Bear Market Cycle Indicator. His new analysis suggests that Bitcoin could be entering a bear market period.

Understanding the Indicator

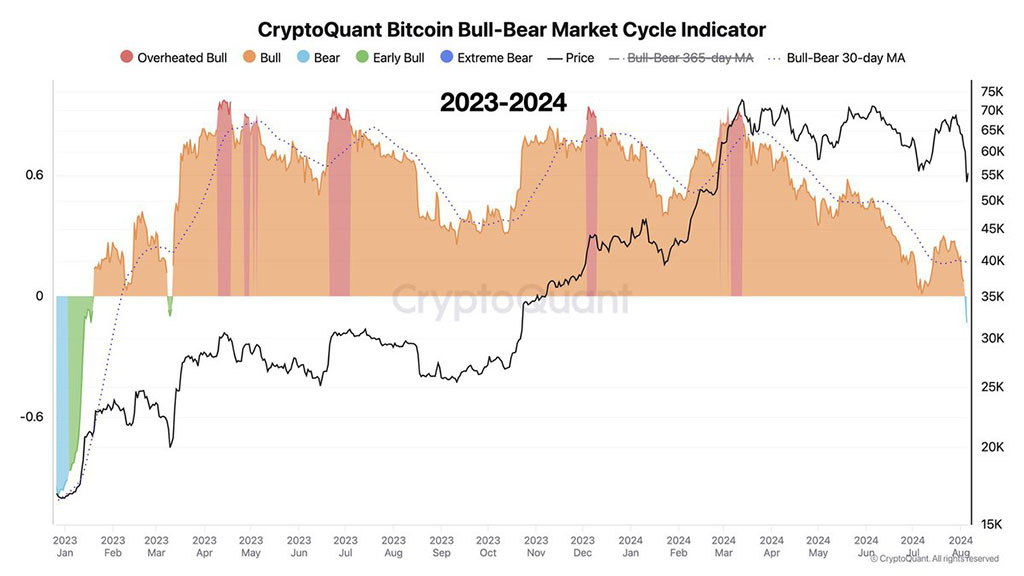

CryptoQuant’s Bull-Bear Market Cycle Indicator examines the P&L Index, combining multiple on-chain metrics about unrealized and realized profits and losses. The indicator evaluates Bitcoin’s market phase by comparing the P&L Index to its 365-day moving average (MA). If the Index exceeds the MA, it suggests a bullish market, whereas a drop below the MA points towards a bearish trend.

The Bull-Bear Market Cycle Indicator makes analysis easier by tracking how much the Profit and Loss Index varies from its 365-day moving average (average). At the start of the year, as Bitcoin’s price set new peak values, this indicator shifted into the “extremely bullish” zone, suggesting a significant gap from the average.

Based on the latest data from CryptoQuant, Bitcoin’s current status on the Bull-Bear Market Cycle Indicator shows it falling below the zero line. This decline indicates that the Profit and Loss (P&L) Index has dipped beneath its moving average (MA) for a period of 365 days, which is typically a sign that we might be entering a bear market phase. It’s important to note that this is the first time since January 2023 that such a signal has been given by the indicator.

Photo: CryptoQuant

Recent Market Trends

At the moment, Bitcoin is being exchanged at approximately $57,000, representing a nearly 14% drop over the last seven days. This downward trend has sparked worries among financial experts. As per 10X Research, despite efforts to bounce back, Bitcoin has encountered significant resistance between $56,000 and $57,000. The report points out continuous withdrawals from Bitcoin spot ETFs and a shortage of deposits from stablecoins, suggesting dwindling buying enthusiasm and potentially questioning market robustness.

Based on past patterns, bearish signals like the one we’re experiencing now (as seen during the COVID-19 crisis in March 2020 and the China mining ban in May 2021) have typically been temporary. So, it’s possible that the current downtrend could also be short-lived. However, the impact on Bitcoin’s price trend will heavily rely on future market dynamics and investor decisions.

Looking Ahead

In the coming months, including August and beyond, Bitcoin’s trajectory will largely be influenced by global economic trends and upcoming events. The FOMC meeting in September might significantly impact its course. Initially seen as a safeguard against inflation, recent market fluctuations may alter Bitcoin’s behavior.

2024 brings a sense of hopeful anticipation, as analysts predict a possible increase in Bitcoin’s value. Some forecasts even suggest a potential maximum worth of approximately $120,000 if the current bearish signals change to the expected bullish market trends. Yet, investors are advised to closely monitor market fluctuations and economic indicators that could potentially impact Bitcoin’s future price movements.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-08-08 11:45