As a seasoned crypto investor with a decade of experience under my belt, I must say that the recent surge in Bitcoin’s price to $60,000 is music to my ears. The consistent accumulation by whales and sharks, coupled with the decrease in exchange BTC supply, paints a bullish picture for the crypto market at large.

Bitcoin reached $60,000, a level not seen since August 29, marking a recovery. According to CoinMarketCap, this leading crypto jumped by 3.98% on Friday, wrapping up an impressive weekly run. Santiment, a notable blockchain analysis firm, shared their thoughts on the price surge, suggesting that shifting market conditions could potentially sustain Bitcoin and other cryptocurrencies’ upward trend.

Bitcoin Accumulation, Exchange Outflow Signal Bullish Sentiment

On Friday’s X post, Santiment highlighted significant changes in the Bitcoin market that might stimulate increased involvement from individual investors over the next few weeks.

According to our on-chain analysis team, there’s been continuous buildup of significant Bitcoin holdings by whales and sharks. When these big investors persistently buy large quantities of an asset, particularly during market dips or volatile times, it suggests they are optimistic about the asset’s future returns.

Bitcoin is nearly reaching its previous $60,000 market value for the first time since August 29th, having dropped below it earlier. The combined actions of large-scale investors (sharks and whales) buying in and a decrease in Bitcoin on exchanges create a favorable environment for cryptocurrency to surge once more.

— Santiment (@santimentfeed) September 13, 2024

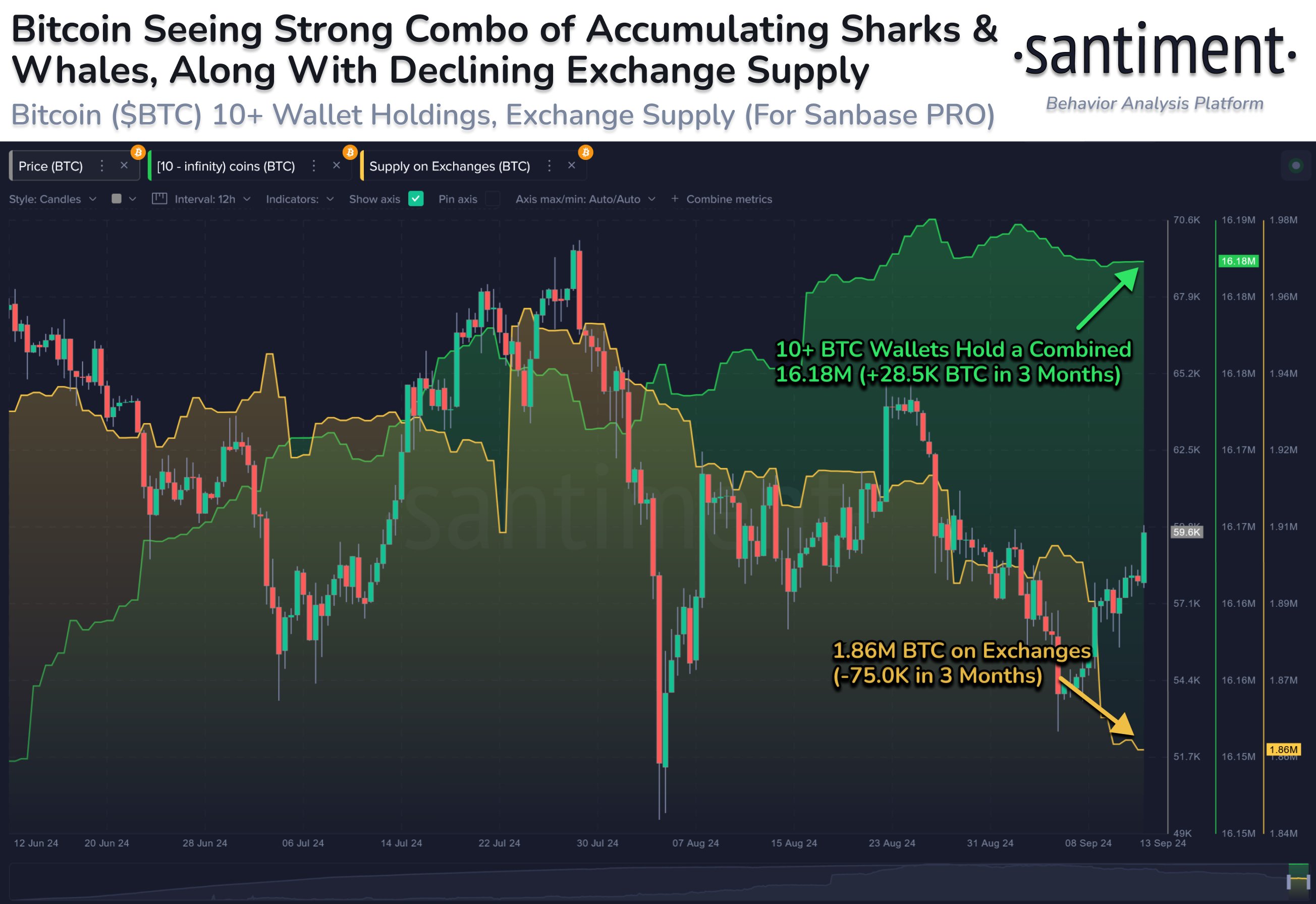

Based on Santiment’s analysis, Bitcoin investors with large holdings, specifically those managing wallets containing 10 Bitcoins or more, have accumulated approximately 28,500 Bitcoins over the past three months, increasing their collective ownership to a staggering 16.18 million Bitcoins. This substantial amount of Bitcoin is currently valued at an impressive $978.29 billion.

Additionally, Santiment has found that the supply of Bitcoin on exchanges is decreasing. This suggests that investors may be holding onto their Bitcoins, either because they’re optimistic about its future value or they plan to keep it rather than sell. Conversely, a higher amount of an asset on exchanges usually indicates that investors are selling or preparing to sell, possibly due to uncertainty or expected price drops.

According to data from Santiment, around 75,000 Bitcoins, worth roughly $4.54 billion, have been withdrawn from cryptocurrency exchanges over the past three months. This reduction now leaves approximately $1.86 million BTC on these platforms. Santiment suggests that this trend – with large investors consistently buying and a decrease in Bitcoin supply on exchanges – could signal an impending significant price surge for Bitcoin, and potentially the broader cryptocurrency market.

Massive Bullish Divergence Signals Potential Altcoin Rally

Meanwhile, it’s worth mentioning that crypto expert Michël van de Poppe has pointed out a significant weekly bullish discrepancy on the TOTAL3/BTC chart, which represents the total value of all cryptocurrencies aside from Ethereum, expressed in Bitcoin.

In simpler terms, this bullish divergence suggests that the selling force is becoming less intense, and it’s likely that alternative cryptocurrencies will soon outperform Bitcoin as the market leader. This idea supports van de Poppe’s long-term forecast that altcoins might surpass Bitcoin in both market share and performance over the next few months.

Currently, Bitcoin is being transacted at approximately $60,369 per unit, representing a daily increase of 4.25%. Simultaneously, the overall cryptocurrency market capitalization stands around $2.1 trillion, having experienced a 2.55% growth over the past day.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-09-14 14:10