As a seasoned researcher who has witnessed the ebb and flow of the crypto market for years, I find the recent decline in Bitcoin’s mining Hashrate intriguing. While the bullish run has been impressive, the fact that the Hashrate remains relatively stagnant despite the soaring BTC price suggests a certain level of uncertainty among miners.

The latest on-chain data suggests a decline in Bitcoin‘s Hasrate, which could be interpreted as a sign that miners might doubt the sustainability of its current surge.

Bitcoin Mining Hashrate Has Declined Since Its All-Time High

The term “Hashrate” represents a measurement that monitors the combined computational strength used by miners within the Bitcoin system. This metric’s worth can be expressed in hashes per second (H/s) or the more user-friendly and larger scale, terahashes per second (TH/s).

When this metric shows an upward trend, it signifies that more miners are entering the network and existing ones are growing their mining operations. This pattern suggests that blockchain presents a profitable venture for those validating the chain.

Alternatively, a decrease in the indicator might mean that certain miners are choosing to withdraw their mining equipment from the network, possibly due to the fact that they are no longer able to make a profit.

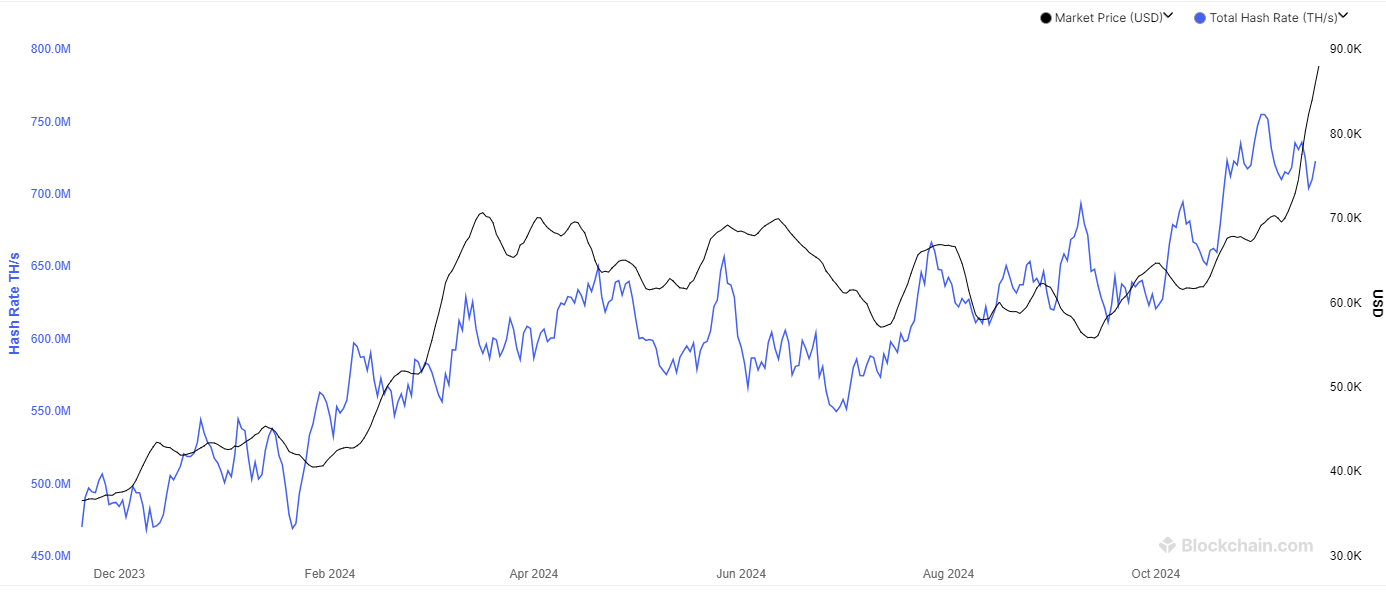

Here’s a graph displaying the 7-day moving average of Bitcoin Mining Hasrate for the last twelve months.

According to the graph, the daily average of Bitcoin’s Hasrate significantly increased previously and reached new highs. Yet, it has decreased since reaching approximately 755 million Terahash per second (TH/s) earlier in this month.

The earlier uptrend in the indicator resulted from the positive price action that the asset had been enjoying, as the price is directly linked to the miners’ revenue.

These chain validators earn their income in two different methods: through transaction fees and block rewards. Transaction fees fluctuate based on network traffic and may significantly vary from one day to another. Conversely, the block reward comes with strict limitations applied to it.

For approximately four years, the block reward in Bitcoin is set at a specific value. After this period, an occurrence known as Halving reduces it by half. This consistent reward system means that the daily Bitcoin earnings from mining are relatively stable and predictable, providing miners with a steady income flow.

The value of these rewards, which are denominated in USD, can be adjusted freely. As the price increases, it boosts the block reward earnings for the miners (referred to as “block subsidy revenue”). This is why we often observe a growth in the hashrate during bullish market phases.

Lately, Bitcoin has been reaching new record levels, yet surprisingly, the Hashrate remains relatively quiet. Currently, the Hashrate is approximately 723 million, representing a drop of over 4% from its peak. This downward trend might suggest that miners anticipate some hurdles in the ongoing rally.

BTC Price

At the time of writing, Bitcoin is floating about $91,900, up over 8% in the last seven days.

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- Where was Severide in the Chicago Fire season 13 fall finale? (Is Severide leaving?)

- All Elemental Progenitors in Warframe

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- A Supernatural Serial Killer Returns in Strange Harvest Trailer

- General Hospital: Lucky Actor Discloses Reasons for his Exit

- Mindhunter Season 3 Gets Exciting Update, Could Return Differently Than Expected

- Analyst Says Dogecoin Has Entered Another Bull Cycle, Puts Price Above $20

- Inside Prabhas’ luxurious Hyderabad farmhouse worth Rs 60 crores which is way more expensive than SRK’s Jannat in Alibaug

- What Happened to Kyle Pitts? NFL Injury Update

2024-11-19 14:10