As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of bull runs and bear phases. The current situation with Bitcoin is intriguing, to say the least.

Over the last week, Bitcoin‘s price didn’t build on its previous strength, slipping below the $60,000 mark once more in August. At present, the leading digital currency is worth approximately $59,131 and has shown no major fluctuations in value over the past day.

It seems that recent on-chain analysis suggests the Bitcoin price might be approaching its lowest point and preparing for an upturn.

Is Bitcoin Price Resuming Its Bull Run?

An analyst using a pseudonym on the CryptoQuant’s Quicktake platform has pointed out a potentially beneficial time to purchase Bitcoin, the leading cryptocurrency. This assessment is derived from recent fluctuations in Bitcoin’s hash rate and the possible effects these changes might have on Bitcoin’s overall value.

As a researcher, I’d express this in my own words as follows: Every day, I calculate the miner’s profit per unit of computational power (terahash per second or TH/s) by dividing the total daily earnings of Bitcoin miners by the current network hash rate. Essentially, this figure serves as an estimate of the profits that miners receive based on their contributions to the network’s overall computational power.

The graph presented illustrates the correlation between Bitcoin’s price and its hash rate. As the analyst explained, the blue boxes in the graph represent instances where the hash rate hit lower values, coinciding with periods when the value of Bitcoin was also at or close to its lowest points.

Currently, the cost per Bitcoin hash is significantly below $0.1, reaching its lowest point since 2023. Historically, instances of very low hash prices have been followed by Bitcoin’s price bottoms, with a subsequent recovery often taking place afterward. Given that the current hash price has reached an all-time low, it seems as though Bitcoin’s price may be nearing its lowest point and gearing up for a potential resurgence.

BTC Market Back In Bear Phase?

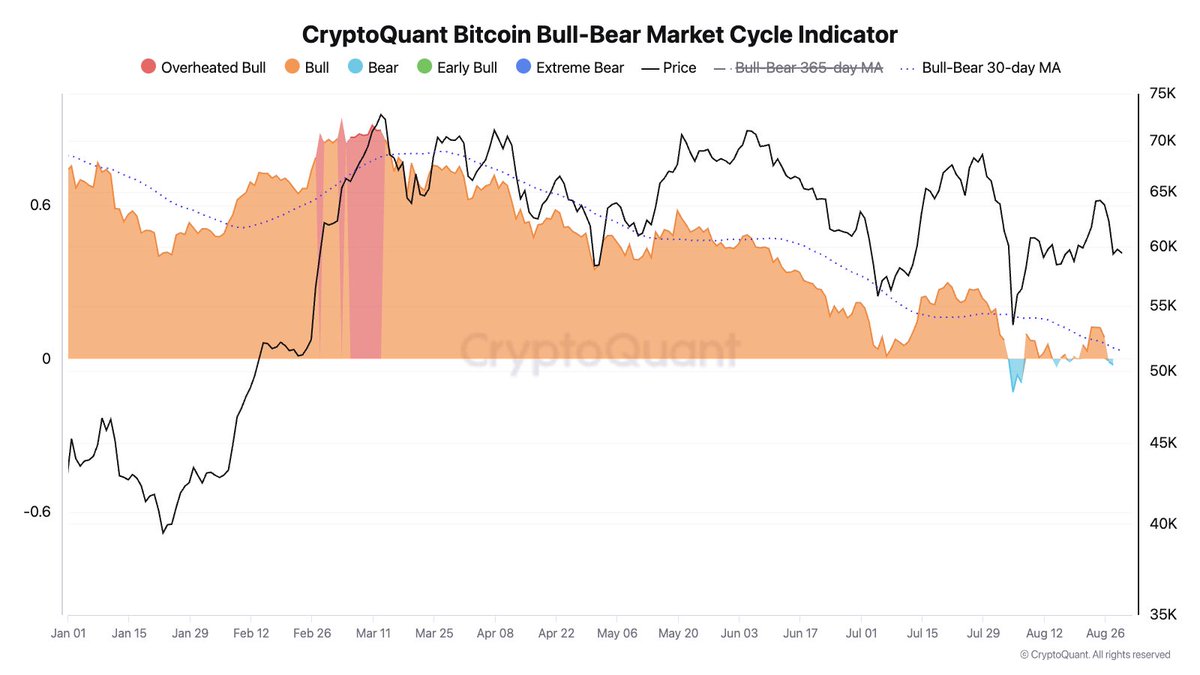

In a new post on X, CryptoQuant’s head of research Julio Moreno revealed that the Bitcoin market cycle indicator is back in the bear phase. As shown in the chart below, this indicator has been swinging from the bull to the bear phase in the past few weeks, mirroring the current inconsistencies in the market.

Additionally, Moreno issued a cautionary note regarding Bitcoin’s recent drop in value falling beneath $60,000. As per his analysis, should the price dip below $56,000, there may be a higher likelihood of a substantial correction.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

2024-08-31 17:46