According to on-chain information, the next significant demand area for Bitcoin is approximately $56,000. If the downtrend persists, Bitcoin may return to this price point.

Bitcoin Has Next Major On-Chain Support Around $56,000

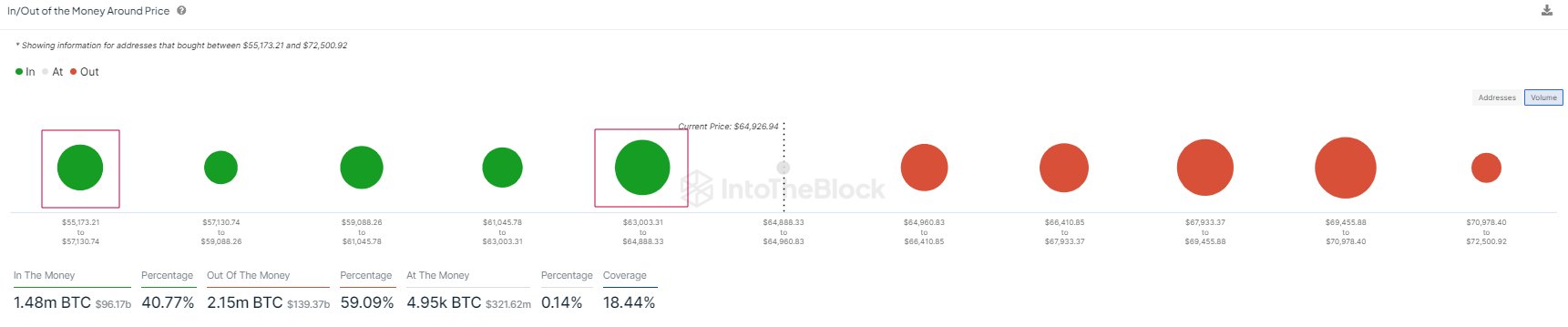

Based on information from market intelligence source IntoTheBlock, Bitcoin’s latest decline in value might necessitate the price range near $56,000 for providing potential support.

In the context of on-chain assessment, the significance of a level as a potential support or resistance point hinges on the quantity of coins that last changed hands among investors at that price. The following chart illustrates how different price ranges around the current market price appear in terms of this cost distribution.

In the given graph, the dot’s magnitude signifies the quantity of Bitcoin bought within the indicated price bracket. Notably, the $63,000 to $64,890 zone seems to have an abundant investor presence. To provide more clarity, approximately 1 million investors purchased around 530,000 Bitcoins at these prices.

In simpler terms, when an asset’s price reaches the original investment cost for an individual, they might feel inclined to take action since this price point carries significant meaning for them.

Investors who previously made successful trades before the price retested may choose to place additional wagers, hoping that the profitable trend from the past will recur in the future.

In other words, the purchasing impact would only matter for the market if a significant number of investors bought coins during a narrow price range, specifically between $63,000 and $64,890.

The support level represented by the range should have prevented BTC from falling, but it appears that the coin has dropped below this level in recent trading. This could indicate that the support has weakened or even failed.

According to IntoTheBlock’s chart analysis, the next significant level of possible support for Bitcoin lies between $55,200 and $57,100. If the current price drop persists, this range could become a key factor in the market.

“According to the analysis by the firm, even though Bitcoin may not necessarily reach this level, it’s important to consider this price range as a reference while the coin’s value is testing recent lows. A fall to the average price within this range ($56,000) would represent a nearly 10% decrease from the current Bitcoin price.”

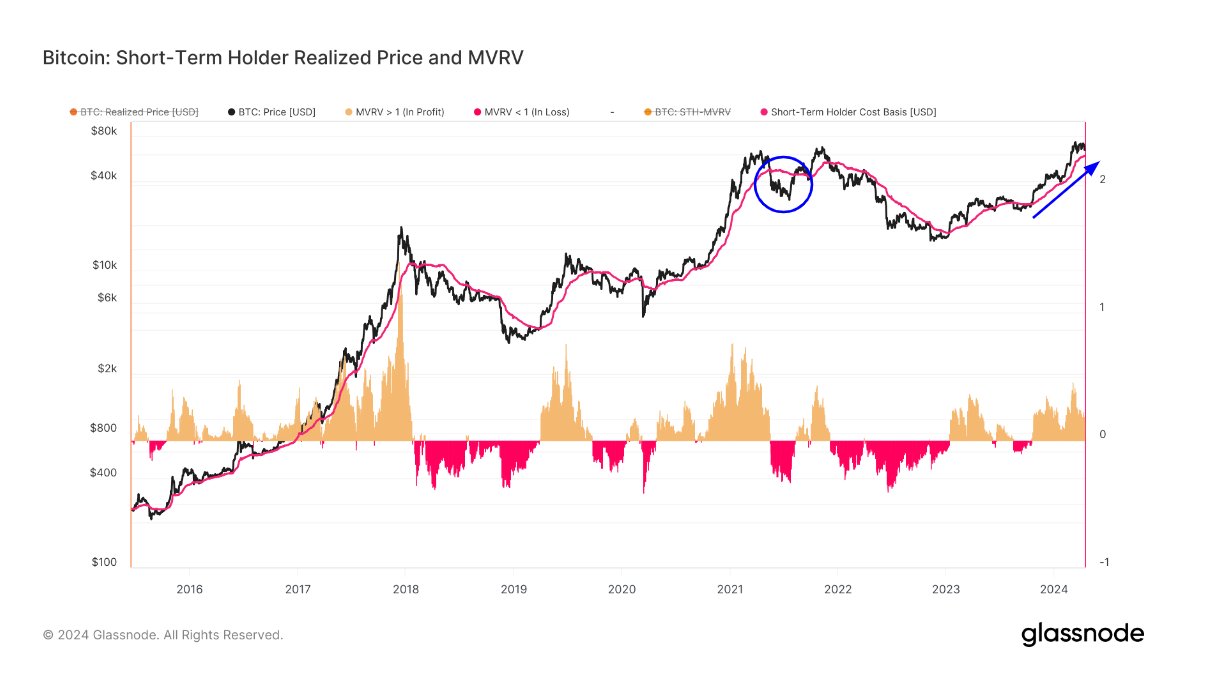

Prior to reaching this current level, there’s another significant on-chain mark that Bitcoin might revisit. According to analyst James Van Straten in a recent post, the average cost for short-term holders, referred to as Realized Price, hovers around $58,800 at present.

Investors who purchased an asset within the last 155 days are referred to as short-term holders (STHs). Historically during bull markets, the price at which these investors realized their gains has held significance. This price level has frequently acted as a support for the asset.

In the past, dips beneath this level have typically resulted in shift towards bearish trends. According to Straten, if we fall below this point, he would acknowledge a bear market akin to May 2021.

BTC Price

Over the last 24 hours, Bitcoin experienced a nearly 7% decrease in value. As a result, any gains it previously made have been erased. Currently, the cryptocurrency is being traded at approximately $62,100.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-04-16 18:04