The Bitcoin community is buzzing with anticipation as we get closer to the final days before the highly anticipated 2024 bitcoin halving takes place. This significant event has everyone talking and guessing about what might happen next in the world of cryptocurrency.

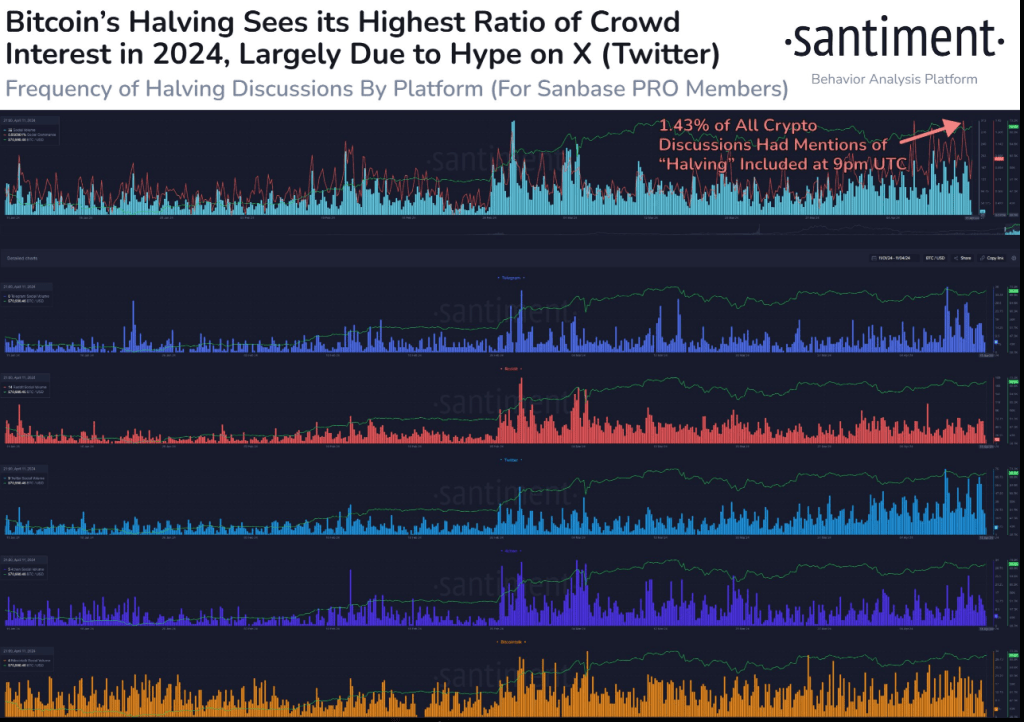

Based on information from Santiment, social media is filled with lively debates about the upcoming halving event. This heightened online conversation may lead to substantial price fluctuations in the unpredictable crypto market, causing anxiety and uncertainty among investors due to the fear of missing out or fear, uncertainty, and doubt.

Social Media Surge Fuels Speculation On Bitcoin’s Fate

Analysts have taken note of the increased buzz on social media about the upcoming halving event. They believe that these spikes in online conversation can signal significant changes in investor attitudes and market trends, potentially leading to price fluctuations.

Some people think that the intense debates might lead to an increase in prices, but others are more skeptical. They warn that the current stagnant market situation could lessen the significance of the event.

With only a week left until #Bitcoin’s halving event, public interest in the topic has reached its yearly peak around 9pm UTC. These surges in conversation could signal imminent price reversals for the crypto market. The markets have displayed such patterns before.

— Santiment (@santimentfeed) April 12, 2024

Unique Dynamics Surrounding Bitcoin 2024 Halving

Upcoming bitcoin halving brings distinct conditions unlike past occurrences. With current pricing surpassing earlier peak, it introduces an uncertainty factor for estimating the length and force of upcoming bull market.

Bitcoin could be headed towards new heights due to the combination of less availability and increasing interest from Exchange-Traded Funds (ETFs), according to experts’ insights.

Antoni Trenchev, the co-founder of Nexo, emphasizes the significance of recognizing market demand fluctuations, specifically focusing on the demands of large Bitcoin investors (whales), including experienced Bitcoin users, novice buyers, and those invested in Bitcoin ETFs.

Related Reading: XRP To Blast Off? Analyst Predicts ‘Realistic’ 5x Surge To $3

Trenchev proposes that the increased desire for a particular asset could make the upcoming shortage even more significant, potentially leading to a less prolonged but more vigorous bull market.

Expert Perspectives: Optimism Vs. Caution

Some experts are hopeful but also wary about the possible results of the halving, while others advise against placing too much significance on it.

Steven Lubka, Swan Bitcoin’s Private Clients Head, advises keeping a calm perspective during the halving buzz. According to Lubka, although the halving could cause temporary price swings, its influence on the market in the long run might be less dramatic.

With the Bitcoin halving countdown nearing its end, the cryptocurrency world is faced with a blend of excitement and apprehension. Some expect major market shifts, while others prepare for a more subdued reaction.

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Where was Severide in the Chicago Fire season 13 fall finale? (Is Severide leaving?)

- All Elemental Progenitors in Warframe

- How to get all Archon Shards – Warframe

- A Supernatural Serial Killer Returns in Strange Harvest Trailer

- Mindhunter Season 3 Gets Exciting Update, Could Return Differently Than Expected

- What Happened to Kyle Pitts? NFL Injury Update

- Inside Prabhas’ luxurious Hyderabad farmhouse worth Rs 60 crores which is way more expensive than SRK’s Jannat in Alibaug

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2024-04-13 17:11