As a seasoned analyst with over a decade of experience in the financial markets under my belt, I have seen my fair share of market volatility and unpredictability. The recent events surrounding Bitcoin have been no exception, with the premier cryptocurrency experiencing a bearish pressure at the beginning of October, only to make a turnaround later in the week.

To begin October, Bitcoin‘s price didn’t meet the widespread predictions, instead dipping towards $60,000 on the 3rd. This downward trend might be due to the increasing geopolitical tensions in the Middle East following Iran’s missile attack on Israel, which seems to have caused this market pressure.

On the other hand, it appears that the leading cryptocurrency is showing signs of a rebound towards the end of the week, surpassing $62,000 again on Friday. Recent analysis suggests that this recent increase in Bitcoin’s value could be linked to decreasing selling activity.

4,000 Long Positions Liquidated On October 1 — What Next?

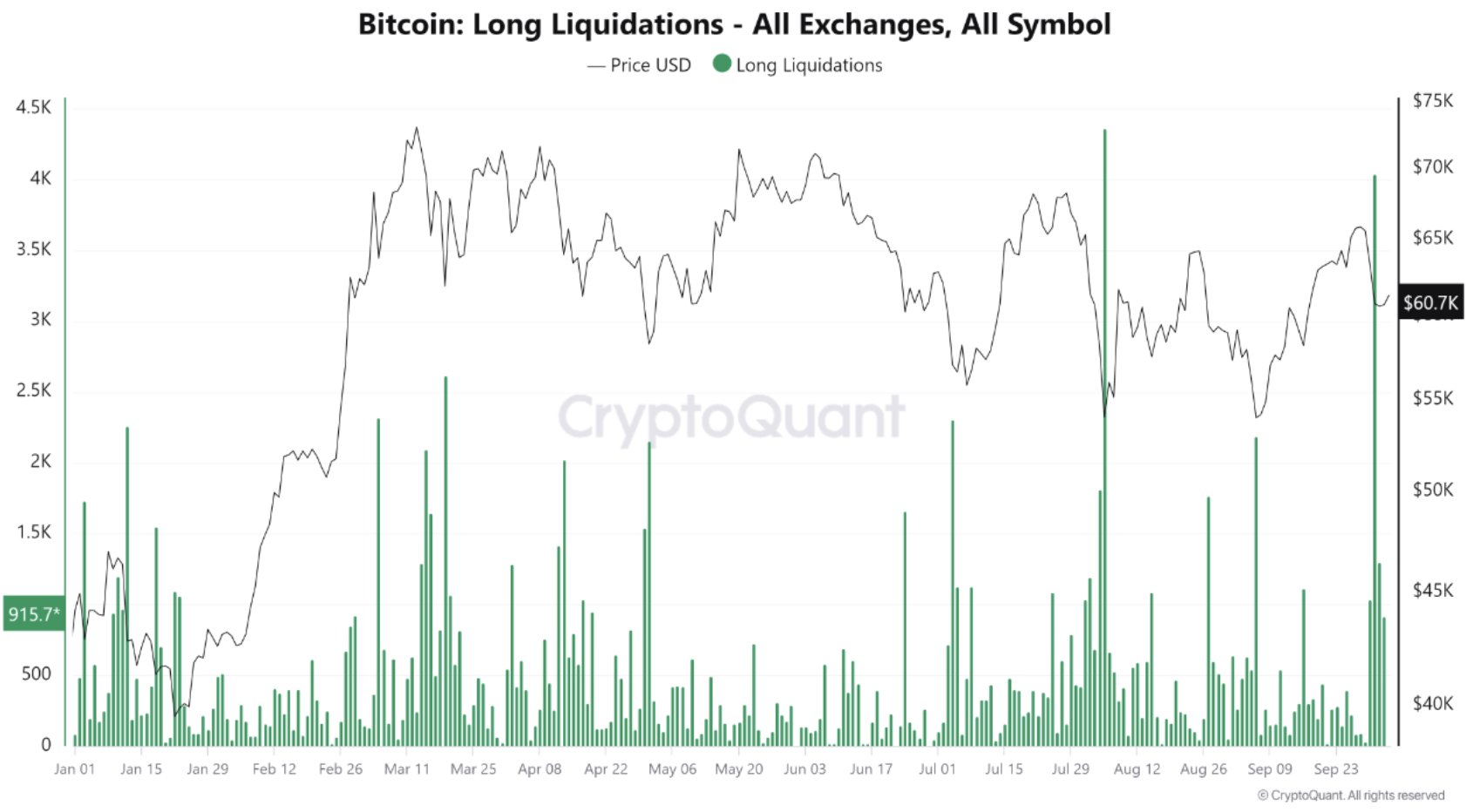

A recent analysis by user Caueconomy on the CryptoQuant platform focused on how the current wave of Bitcoin futures market long position liquidations has alleviated downward price pressure for Bitcoin.

In simpler terms, when investing in Bitcoin futures, a trader makes a positive bet by purchasing a futures contract if they believe the price of Bitcoin will increase in the future. However, if the cost of Bitcoin drops below the initial price stated in the contract, the trader experiences a loss.

Based on information from CryptoQuant, approximately 4,000 long positions were closed out (or liquidated) during the recent price drop on October 1st. This event is the second-largest liquidation incident this year. While liquidations indicate high selling activity and investor losses, they may also signify crucial changes in market sentiment.

In times of steep price drops and market-wide sell-offs, analysts at CryptoQuant have observed that these events can trigger the formation of temporary price floors or bottoms. This is because during such periods, the number of contracts being bought tends to decrease dramatically due to liquidations, thereby lessening the overall pressure to sell in the market.

Additionally, it was noted by the analyst that Bitcoin’s price could potentially bounce back temporarily owing to lessened selling pressure. Yet, Caueconomy emphasized the crucial role of heightened investor demand in boosting Bitcoin’s price to achieve a complete resurgence.

Bitcoin Price At A Glance

It seems that the price of Bitcoin may have hit a temporary low near the psychologically significant $60,000 point, then bounced back significantly, currently trading at approximately $62,000 – representing a rise of more than 2.5% over the last 24 hours.

Despite a significant one-day surge, Bitcoin’s weekly 5% price drop remains unchanged. Yet, with lessening selling pressure and a positive trend in October, it appears that Bitcoin might soon reclaim its $65,000 value once more.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-05 22:16