As a seasoned crypto investor with over a decade of experience in this wild and unpredictable market, I must say that the current Bitcoin rally has me both exhilarated and cautious. The all-time highs we’ve been witnessing are nothing short of breathtaking, but as someone who’s seen more than a fair share of crypto winter, I can’t help but keep an eye on the potential pitfalls.

This week, the price of Bitcoin has continued to climb, reaching new record highs nearly every day. Many people are now asking when Bitcoin might break through the $100,000 barrier.

Instead of focusing on immediate investment goals, some market players are instead looking at the distant future and the potential longevity of Bitcoin, the world’s leading cryptocurrency. Recent analysis of blockchain activity suggests an unexpected price fluctuation in Bitcoin might occur earlier than anticipated.

Will The Rising Bullish Sentiment Sustain The Rally?

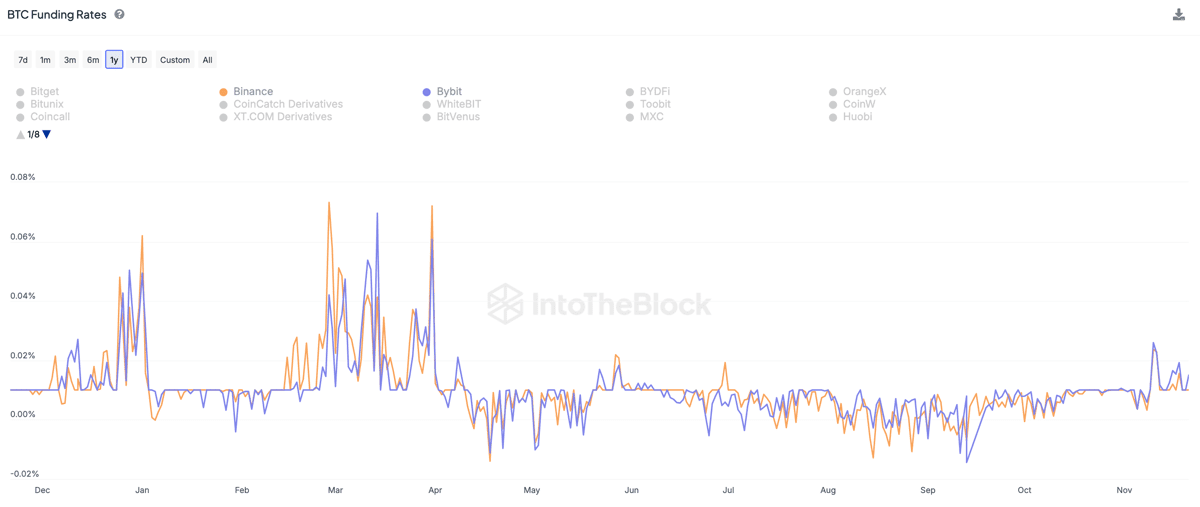

As reported by market intelligence platform IntoTheBlock, the Bitcoin funding rates have experienced a significant increase over the past few days. The key measure to consider in this context is the “funder rate” metric, which monitors the periodic fee that changes hands between traders within the derivatives (perpetual futures) market.

When the funding rate is higher or positive, it means that long-term traders are essentially compensating those with short-term positions. This regular payment flow usually indicates a robustly optimistic outlook in the market, suggesting a strong bullish trend.

In simple terms, when the funding rate has a negative value, it indicates that those who have taken short positions (betting on a decrease) in the derivatives market are actually paying those with long positions (betting on an increase). This pattern suggests a prevailing pessimistic or bearish outlook within the market.

According to IntoTheBlock, fees for Bitcoin perpetual swaps have risen by over 10% and as much as 20% on prominent trading platforms. This persistent increase in funding rates might suggest that the market is becoming excessively speculative, which could lead to adjustments or corrections.

Based on IntoTheBlock’s analysis, one factor fueling this positive market outlook is the potential U.S. government stance on cryptocurrency during Donald Trump’s administration. The idea of “strategic Bitcoin reserves” becoming more likely under the new U.S. president has led investors to anticipate that Bitcoin could reach values exceeding six figures.

Currently, the main cryptocurrency is approximately worth $98,400, marking a 1% rise over the last day.

Bitcoin Perpetual Futures Market Remains Restrained — What It Means

In a recent post on the X platform, Glassnode revealed that the Bitcoin perpetual futures market “remains restrained.” This suggests that several traders are still approaching the market with caution despite the steady price climb of BTC in recent weeks.

According to Glassnode data, Bitcoin’s funding rates are currently around 0.01%, which is lower than the 0.07% seen in March 2024 when Bitcoin reached a peak price. This implies that there could be potential for further increase in the value of Bitcoin, the leading cryptocurrency.

Read More

- Binance Unveils Binance Alpha for Early-Stage Crypto Projects

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Connections Help, Hints & Clues for Today, March 1

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The games you need to play to prepare for Elden Ring: Nightreign

- Paul McCartney Net Worth 2024: How Much Money Does He Make?

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- The Babadook Theatrical Rerelease Date Set in New Trailer

2024-11-23 22:19