As a seasoned financial analyst with extensive experience in cryptocurrency markets, I have closely monitored the Bitcoin trend and its various indicators over the years. The recent development where Bitcoin has once again surpassed the realized price of short-term holders (STHs) is an intriguing bullish sign that warrants attention.

A financial analyst has noted that the price of Bitcoin has risen once again above the amount initially paid by short-term investors. This development could potentially indicate positive momentum for the cryptocurrency.

Bitcoin Is Back Above The Realized Price Of Short-Term Holders

According to a recent update from Maartunn, the community manager at CryptoQuant, Bitcoin’s price has surpassed the average purchase price for short-term investors, as represented by the Realized Price. The Realized Price serves as an indicator that monitors the overall cost basis of Bitcoin holders within the market.

If the metric value surpasses a cryptocurrency’s current market price, it is a sign that the typical investor in that sector is likely sitting on unrealized gains. Conversely, when the indicator falls below Bitcoin’s price, it suggests that market losses hold more weight than profits.

In our ongoing conversation, it’s not the total Realized Price for the entire userbase that holds significance, but rather that of a specific group: short-term holders (STHs). These STHs are individuals who acquired their Bitcoin within the previous 155 days.

As a crypto investor, I can tell you that the group of Bitcoin (BTC) investors who have held their coins for relatively short periods of time make up one segment of the larger BTC market. The other major category is referred to as long-term holders (LTHs), who have kept their Bitcoins for extended durations.

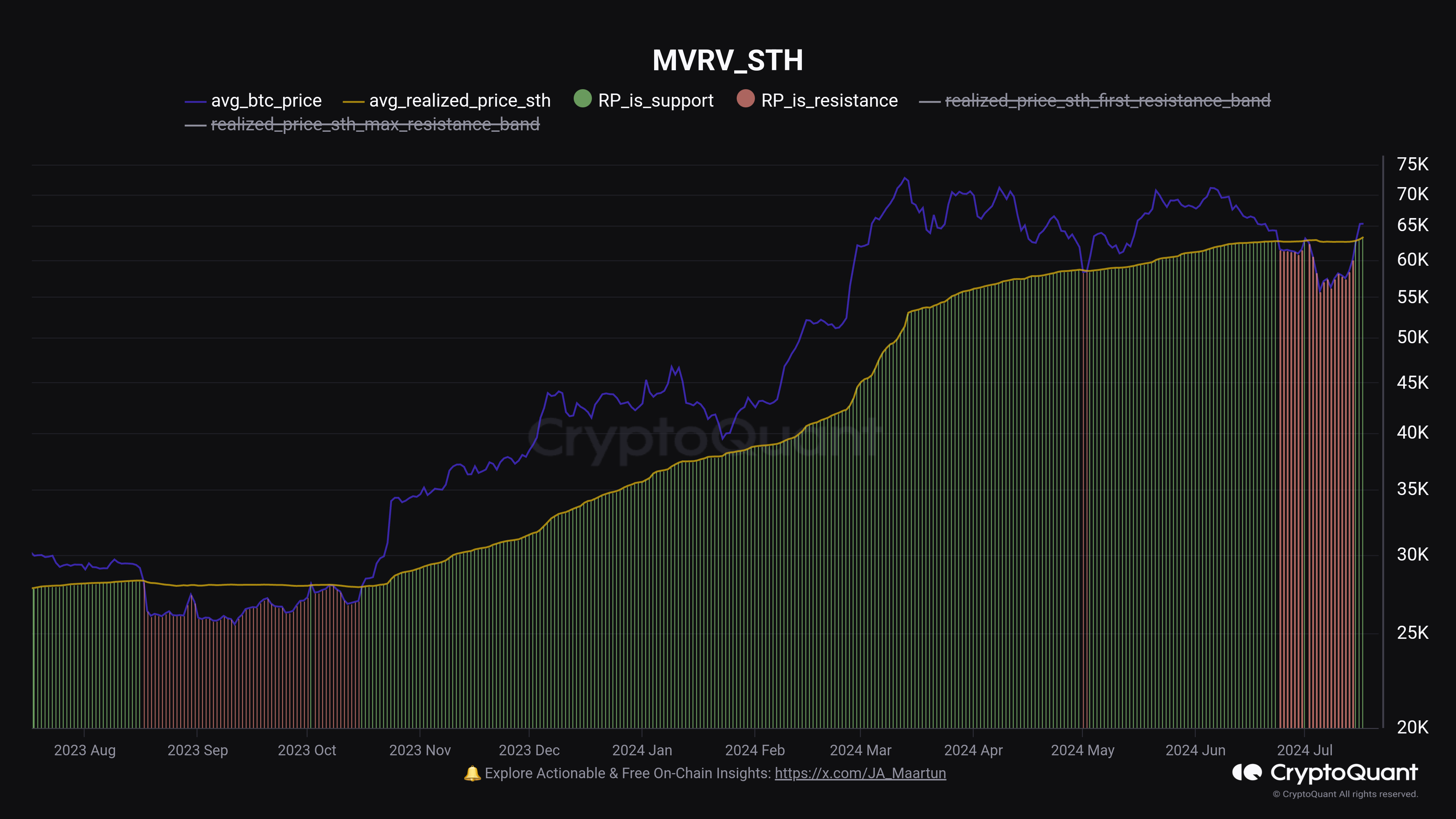

Based on my extensive experience in the cryptocurrency market and having closely monitored Bitcoin’s trends for several years, I’d like to draw your attention to this chart depicting the development of the Realized Price for a particular cohort of Bitcoin holders over the past twelve months. This metric is significant as it represents the price at which each coin was last spent or moved in the market. Analyzing this trend can provide valuable insights into the behavior and sentiment of long-term investors.

In the graph before you, it’s clear that the Bitcoin spot price fell below the Realized Price for the STHs (Short-Term Holders) last month. This indicates that these holders experienced a net loss.

Following a period of being under the metric, the cryptocurrency has bounced back and surpassed it during its recent surge, consequently putting the underperforming group back in the black.

As a researcher studying market trends, I’ve observed that when an asset breaks above a significant resistance level after a prolonged period below it, this is often a promising sign. The chart illustrates that the last occasion this occurred was in October of last year. Following this breakout, the coin experienced a sustained upward trend, ultimately reaching a new all-time high (ATH).

The historical significance of Bitcoin (BTC) surpassing its Simple Moving Average Realized Price lies in the investor mindset. Inexperienced investors, often referred to as Short-Term Holders (STHs), tend to be reactive to price fluctuations. Notably, they may exhibit a response when their average purchase price is challenged.

During bearish market conditions, investors might choose to sell when the price reaches their initial investment amount out of fear that the price increase is temporary. Conversely, in bullish markets, they may opt to buy more since they view their initial investment as an opportunity to boost profits.

Recently, Bitcoin (BTC) has managed to break through this threshold. This indicates that large-scale investors, or “whales,” are not currently putting up significant opposition. Consequently, a bullish attitude persists among these investors.

BTC Price

Yesterday, Bitcoin surpassed the $66,000 mark, but it has experienced a decline since then. Currently, the digital currency is valued at around $64,800.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-07-19 03:04