As a seasoned analyst with decades of experience under my belt, I’ve seen my fair share of market volatility, but the events of the past 24 hours in the cryptocurrency sector have left me quite intrigued. The Bitcoin flash crash, followed by a swift recovery, has been a rollercoaster ride that has left even the most hardened traders with whiplash.

Over the last day, it appears that the cryptocurrency futures market has experienced a significant number of forced closures or “liquidations,” following the sudden drop in Bitcoin‘s value, also known as a flash crash.

Bitcoin Has Witnessed Significant Volatility During The Last Day

Yesterday, I witnessed some extraordinary price fluctuations in Bitcoin (BTC). In just a short span, we saw a peak at an astonishing $103,500 and a sudden plunge to $90,500 – both occurring within a narrow time frame that left me breathless. The swift descent to the lower level was so steep it can only be termed as a flash crash, leaving me on the edge of my seat.

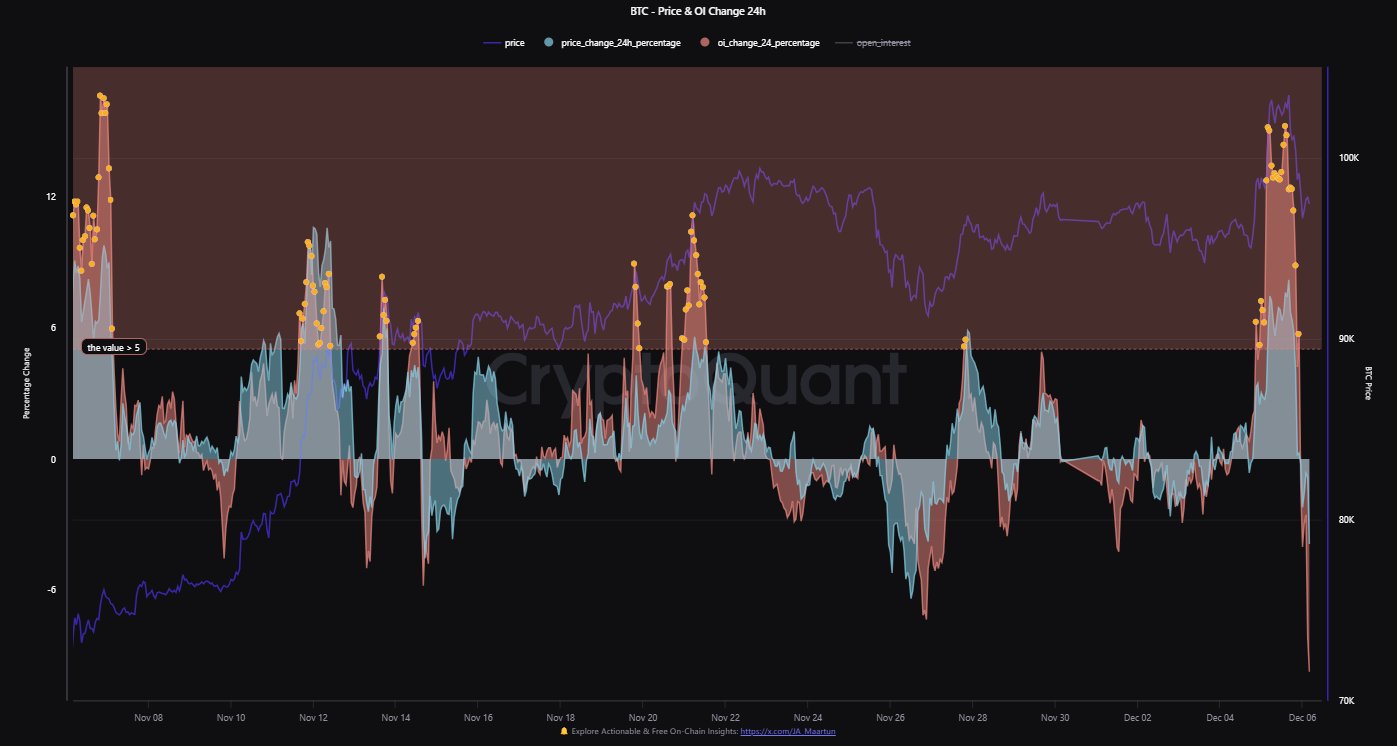

Below is a chart that shows how the asset’s recent trajectory has been like.

The short, intense drop (or “red candle”) in the graph didn’t last long, as the cryptocurrency swiftly regained its footing and climbed back up to higher prices. After this recovery, the coin is currently being traded at approximately $98,000. This represents a decrease of around 5% compared to its previous peak.

Just like Bitcoin (BTC), other leading digital assets have generally shown a downtrend in their prices. However, Ethereum (ETH) and Solana (SOL) have demonstrated remarkable resilience; they’ve only dropped by about 2% over the last 24 hours.

The recent turmoil affecting the entire market has led to a great deal of disruption within the derivatives segment of the cryptocurrency industry.

Cryptocurrency Longs Have Just Witnessed A Liquidation Squeeze

As per CoinGlass’s findings, there’s been a significant increase in liquidations within the cryptocurrency derivative market due to the sudden and steep fluctuations in asset prices across the board.

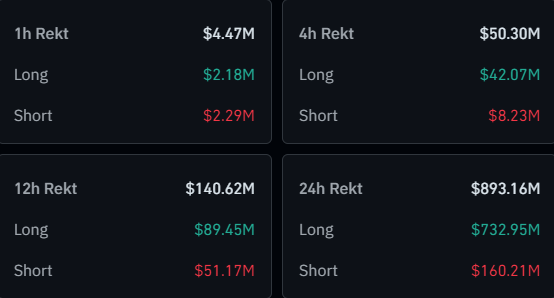

In the table shown, it’s clear that positions on cryptocurrency derivatives amounting to $893 million have been closed in the last 24 hours. This is referred to as “liquidation,” which happens when an exchange automatically terminates a contract due to significant losses.

Approximately 82% (or about $733 million) of these liquidations stem from long positions, largely due to the significant bearish trend experienced by Bitcoin and other cryptocurrencies. In simpler terms, most of the liquidations are a result of investors betting on a decrease in value, which is why the long positions dominate so heavily.

In simpler terms, an occurrence such as the recent one, where many assets are quickly sold off, is often referred to as a “squeeze.” Given that most participants in this squeeze were holding long positions (buying assets with the expectation of selling them later at a higher price), it can be called a “long-squeeze.

Recently, the derivatives market has experienced a tightening, which might be seen as a natural result of the increasingly heated market conditions preceding it. As highlighted by Maartunn from the CryptoQuant community in a recent post, the Open Interest escalated parallelly with the rise in Bitcoin value.

As a researcher, I often observe that when derivative positions escalate during a rally, it’s typically because the surge is fueled by leveraged positions. These rapid price movements can unwind unpredictably in a volatile fashion.

During the latest Bitcoin surge, Open Interest surged over 15%, an unusually large increase. When the price shifted, many of the leveraged long positions were trapped in a squeeze, intensifying the downward momentum and contributing to the severe decline in prices. This is why the crash was particularly steep.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-12-07 09:40