As a seasoned analyst with over two decades of experience in financial markets, I have seen my fair share of critical moments and market-defining events. The approaching expiration of $11.8 billion in Bitcoin options on December 27, 2024, is one such event that has piqued my interest.

Bitcoin (BTC), currently valued at $89,701, is approaching a crucial milestone, marking the beginning of potential market fluctuations. As we move closer to December 27, 2024, when approximately $11.8 billion in Bitcoin options expire, traders are gearing up for heightened volatility. This impending expiration involves both call and put options, which could significantly impact Bitcoin’s price trend in the last days of 2024.

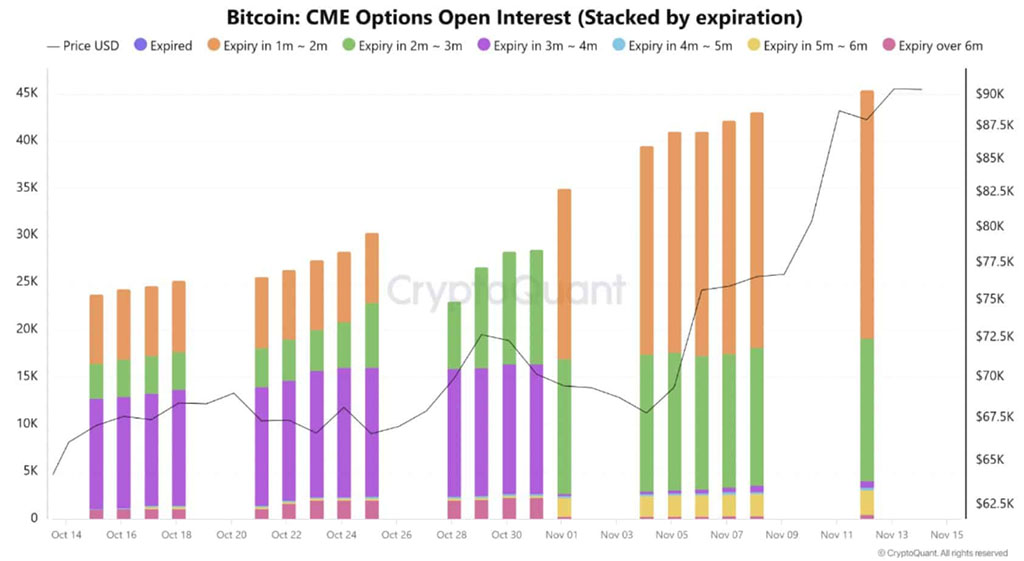

Source: CryptoQuant

As an analyst, I’ve noticed a significant surge in optimistic sentiments surrounding the cryptocurrency post-2024 US elections. Some experts predict it could reach $100,000, driven by growing capital investments and market dominance exceeding 60%. Yet, reaching this target isn’t without hurdles, particularly with massive options contracts due to expire.

The increasing popularity of Bitcoin is clear as the value in the options market has reached an unprecedented peak of $50 billion. Yet, this enthusiasm heavily relies on Bitcoin’s near-term performance, especially considering the upcoming expiration of approximately $11.8 billion worth of option contracts.

Bitcoin Price Hovers Above $90K

As a crypto investor, I’m currently observing Bitcoin’s price hovering around $90K, which seems to be a delicate equilibrium of bullish and bearish influences. Over the last 24 hours, we’ve seen some price corrections crop up, hinting that the market’s surge might not sustain indefinitely. The coming days could see Bitcoin’s short-term direction being significantly influenced by the dynamics in the options market.

Approximately 7 out of every 10 call and put options with an expiration value of $11.8 billion are call options, based on data from Coinglass. This suggests that investors are quite optimistic about Bitcoin reaching $100K. If this price point is attained, a significant number of these call options might be exercised, potentially leading to high selling pressure as traders cash in their profits.

Nevertheless, this might not signify the end of market fluctuations. The expiration of these options might trigger a temporary dip due to an influx of sellers among those who hold call options, closing their positions. If put options, which are essentially bets on a price decrease, start to exceed calls, the market mood could change, amplifying the downward pressure.

Deribit Leads the Charge in Bitcoin Options Market

In the Bitcoin options market, it’s clear that a single platform, Deribit, dominates with an impressive 74% share of all trades. Other notable players like CME and Binance follow closely behind, each accounting for approximately 10.3%. This significant presence of Deribit suggests that the primary stage for wagers on Bitcoin price fluctuations is primarily there.

Bitcoin options traders find themselves in a delicate position. High bullish expectations have many eagerly waiting for a surge past the $100,000 mark. Yet, if prices fail to sustain above that level before contract expiration, it could create a chain reaction of selling pressure, potentially preventing Bitcoin from holding or surpassing this value. The actions taken by these options will play a significant role in determining Bitcoin’s performance at this critical price point.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-11-15 15:45