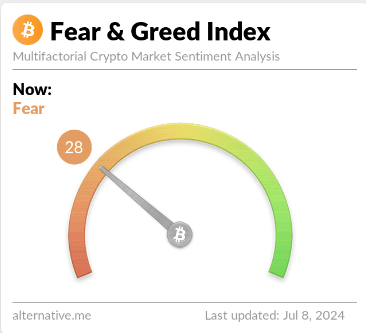

As a researcher with experience in the cryptocurrency market, I find the current state of the Bitcoin Fear & Greed Index intriguing. The index’s value of 28, which represents extreme fear among investors, is a stark contrast to the extreme greed we saw just a few weeks ago. Historically, such extreme sentiments have often preceded significant price movements in Bitcoin and other cryptocurrencies.

The current Bitcoin sentiment, as indicated by the data, is approaching the level of excessive optimism or “extreme greed.” This condition has historically been a potential warning sign for some investors, suggesting that the market may be overheated and due for a correction. However, it’s important to remember that past performance is not always indicative of future results, and various factors could influence Bitcoin’s price behavior. Therefore, it’s essential to keep an eye on market developments and consider diversifying your investment portfolio.

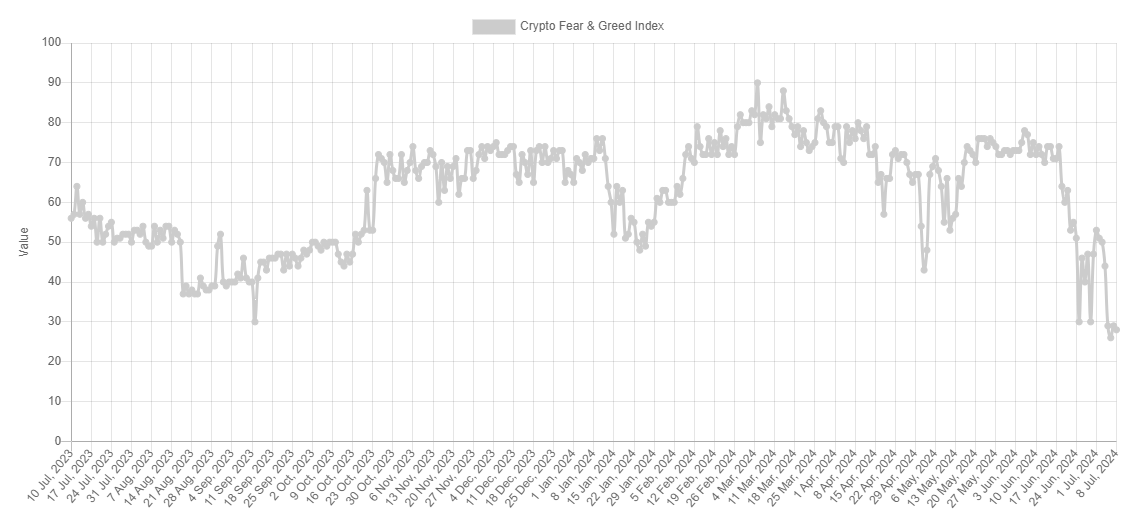

Bitcoin Fear & Greed Index Has Continued To Decline Recently

The “Fear & Greed Index,” a tool created by Alternative, reflects the general emotion driving trading behavior in the Bitcoin and crypto markets at the moment.

The index takes into account five elements to gauge sentiment: volatility, trading activity, social media buzz, market influence, and Google search popularity. It employs a numerical scoring system ranging from zero to one hundred for expressing attitude.

Investor sentiment is reflected in the indicator’s values. Those exceeding 53 indicate a prevailing sense of greed, while readings under 47 point towards fear being more prominent. Values within the range of 47 to 53 signify a neutral sentiment.

Now, here is what the Bitcoin Fear & Greed Index is looking like right now:

From my perspective as a crypto investor, the Bitcoin Fear & Greed Index stands at 28 right now. This indicates that on average, other investors are exhibiting fear in the market. The level of fear appears significant given that this reading falls quite deeply into the fear zone.

The current level of the indicator is nearly touching a significant area referred to as “extreme fear.” This emotion is manifested among investors when the index dips below the 25-mark. Correspondingly, there exists a comparable zone for heightened greed, which is labeled as “extreme greed,” and appears when the index soars above 75.

As a crypto investor, I’ve noticed that during the initial part of the previous month, the market sentiment was quite optimistic and the metric was hovering around the positive side. However, the sudden market downturn has significantly changed the tide, leaving me feeling quite pessimistic and with a sentiment that’s now firmly in the negative region.

As a researcher studying the historical trends of cryptocurrencies like Bitcoin, I’ve noticed an intriguing pattern. Contrary to popular belief, these digital currencies often exhibit movements that go against the general expectation of the crowd. The more intensely people believe in a particular direction, the higher the likelihood becomes for a reversal in trend.

As a crypto investor, I’ve observed that when the market sentiment becomes extremely bullish or bearish, it often leads to significant price movements. Historically, major cryptocurrency market tops and bottoms have tended to form when the market has been in these extreme sentiment zones.

Some traders adopt a contrarian approach to investing, meaning they go against the crowd. They buy stocks when most investors are exhibiting excessive fear and sell when investors show extreme greed. According to Warren Buffet’s wisdom, “it is wise to be fearful in times of greed and greedy in times of fear.”

Based on my analysis as a researcher, the Bitcoin Fear & Greed index nearing the extreme fear zone might indicate potential buying opportunities for cryptocurrency investors. Historically, such conditions have often preceded price increases.

BTC Price

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin’s price hasn’t bounced back significantly after its recent downturn. Currently, it hovers around the $56,700 mark.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-07-08 20:46