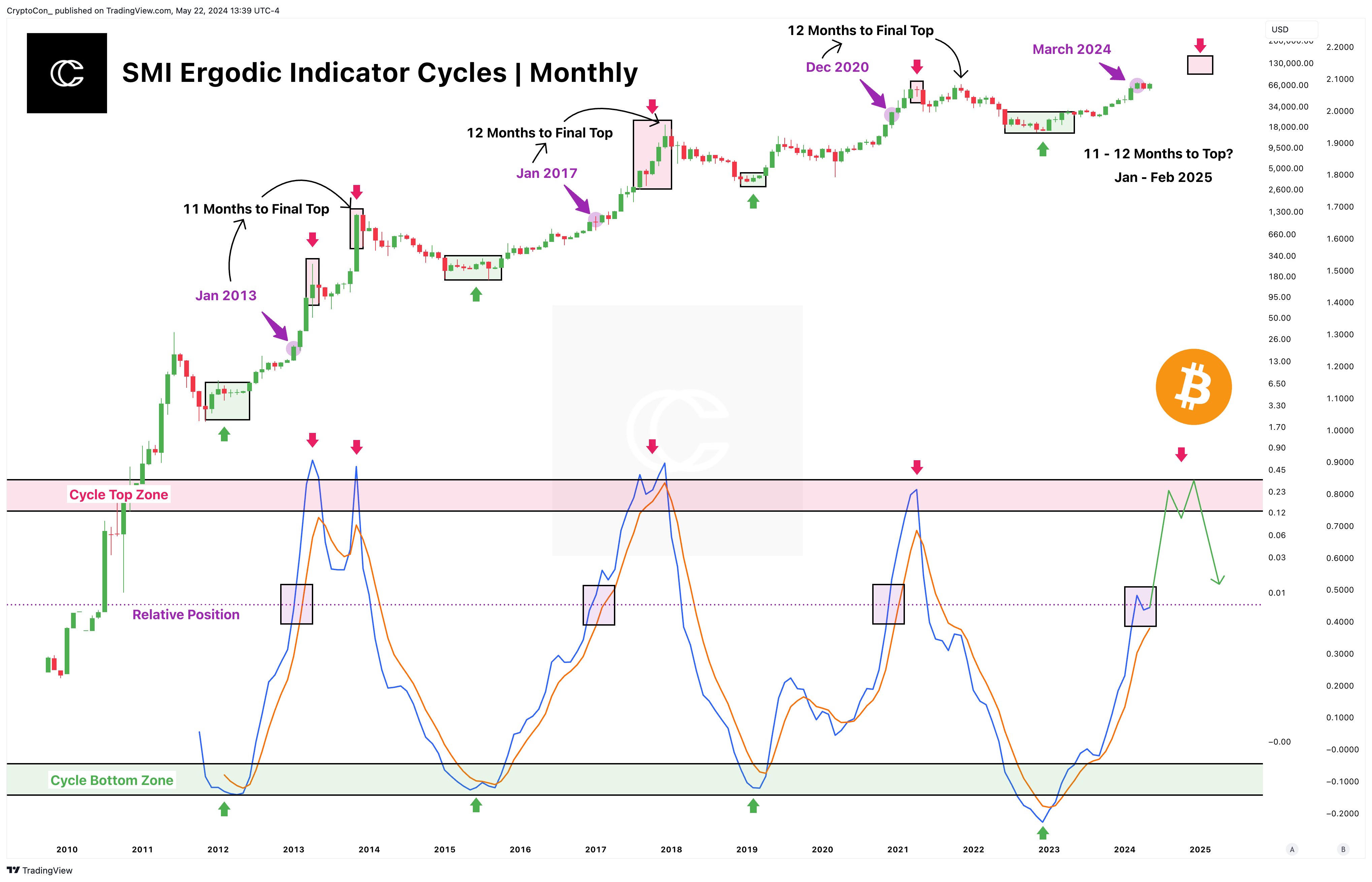

As an experienced cryptocurrency analyst, I have closely monitored the market trends and price movements of Bitcoin (BTC) throughout various cycles. Based on historical data analysis and trend identification using technical indicators like the Stochastic Momentum Index (SMI), I believe that we are around a year away from the peak of this ongoing BTC bull cycle.

Based on historical patterns of Bitcoin‘s bull markets and the current optimism among investors in the cryptocurrency market, Crypto Con, a well-known crypto analyst and supporter, has made an estimate for when Bitcoin may reach its peak during this cycle.

Bitcoin Peak To Happen Less Than A Year

Based on historical analysis, Crypto Con has determined potential indicators of when Bitcoin, the largest cryptocurrency by market value, may peak during its current cycle. The erudite assessment suggests that according to the Stochastic Momentum Index (SMI) Ergodic Indicator, Bitcoin currently holds its expected place in this bull run.

Based on their analysis, Crypto Con believes that there’s significant potential for further growth in the cryptocurrency market over the coming days. This means that Bitcoin’s current value, which is roughly a year away from previous peak cycles, suggests that the next peak will likely occur between January and February of 2025. However, their primary focus is on December 2024, which they predict will be the month with the highest growth rate during this cycle.

As a crypto investor, I’ve noticed that Crypto Con’s latest remarks suggest that the recent market correction, which was a normal and expected part of the market cycle, could act as a significant catalyst for pushing Bitcoin’s price upwards.

The post read:

As an analyst, I believe the Stock-and-Flow Model (SMI) indicates that Bitcoin’s current position is in line with where it should be within the market cycle. Based on this analysis, we are approximately one year away from the next cycle peak. This would place the cycle top around January-February 2025. However, I am keeping a close watch on December 2024 as a potential month for the cycle’s peak, given our current rate of progress.

As a crypto investor, I’d interpret the analyst’s prediction in this way: Based on the expert’s previous analysis, Bitcoin could hit a peak price of $149,000 before the year ends. The expert expressed his viewpoint by stating, “Bitcoin is projected to achieve a level 7 price target of $149,000 by the end of this year.”

According to Crypto Con’s forecast, their prediction aligns closely with the most accurate Log Regression Curves and the projected cycle peaks for the year 2021. By this time, the more conservative layer 6 – which previously indicated the 2013 market peak – intends to attain a level of approximately $108,000.

While making his forecast, the expert identified a price stabilization, representing a fresh trend in this market phase. Nevertheless, with diminishing volatility, this stabilization has proven to be reliable.

Determining BTC’s Peak Through Fibonacci Extension

As a crypto investor, I’ve observed that Crypto Con employed the Fibonacci Extension tool to pinpoint Bitcoin’s price peak during this cycle. Based on the cycle retracements visible in his chart, the first two cycles came relatively close to touching the 2.618 extension. In contrast, the last cycle reached the 1.618 extension.

If the 1.618 point recurs during this Bitcoin price cycle, it’s predicted that BTC will reach a value of $159,128. This is merely one potential scenario among many others, and I would categorize this forecast as optimistic for this particular market cycle.

As I pen down these words, Bitcoin is gradually picking up steam and inching closer to the $70,000 mark, signifying a 5% surge over the last week. However, its market capitalization has dipped by 0.25%, while its trading volume has witnessed a decline of 12% within the past 24 hours.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Justin Bieber ‘Anger Issues’ Confession Explained

- All Elemental Progenitors in Warframe

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

2024-05-23 17:48