Bitcoin, the most widely used cryptocurrency globally, has been experiencing increased selling in recent times as we draw near to the upcoming fourth Bitcoin halving on April 20, 2024. Contrarily, signs of bullish activity have emerged from on-chain data preceding this event.

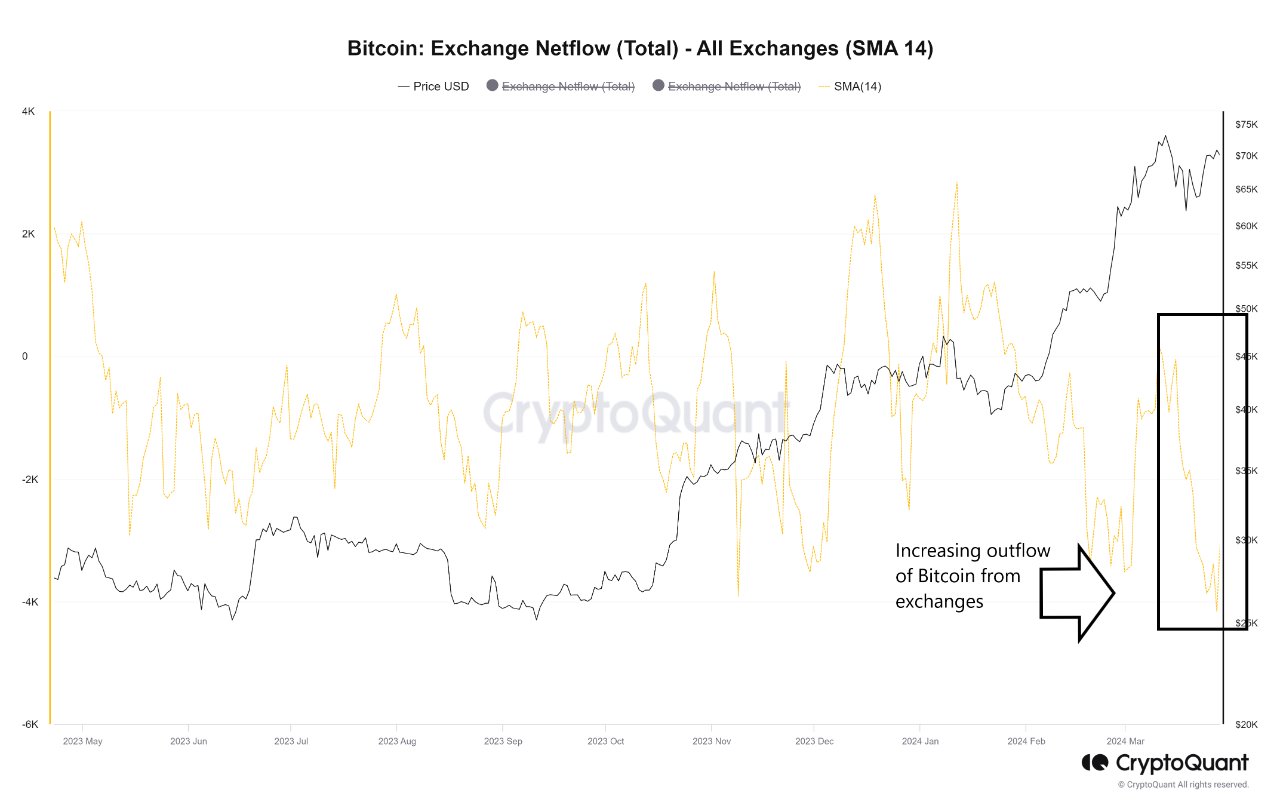

According to data from CryptoQuant, which tracks on-chain Bitcoin activity, the number of Bitcoin being withdrawn from exchanges has hit its peak since early 2023. This indicates that investors are actively accumulating the cryptocurrency in anticipation of a potential supply shortage following the upcoming halving event. Moreover, the belief that this supply squeeze could cause the price to rise significantly is another possible motivation for these exchange withdrawals.

Photo: CryptoQuant

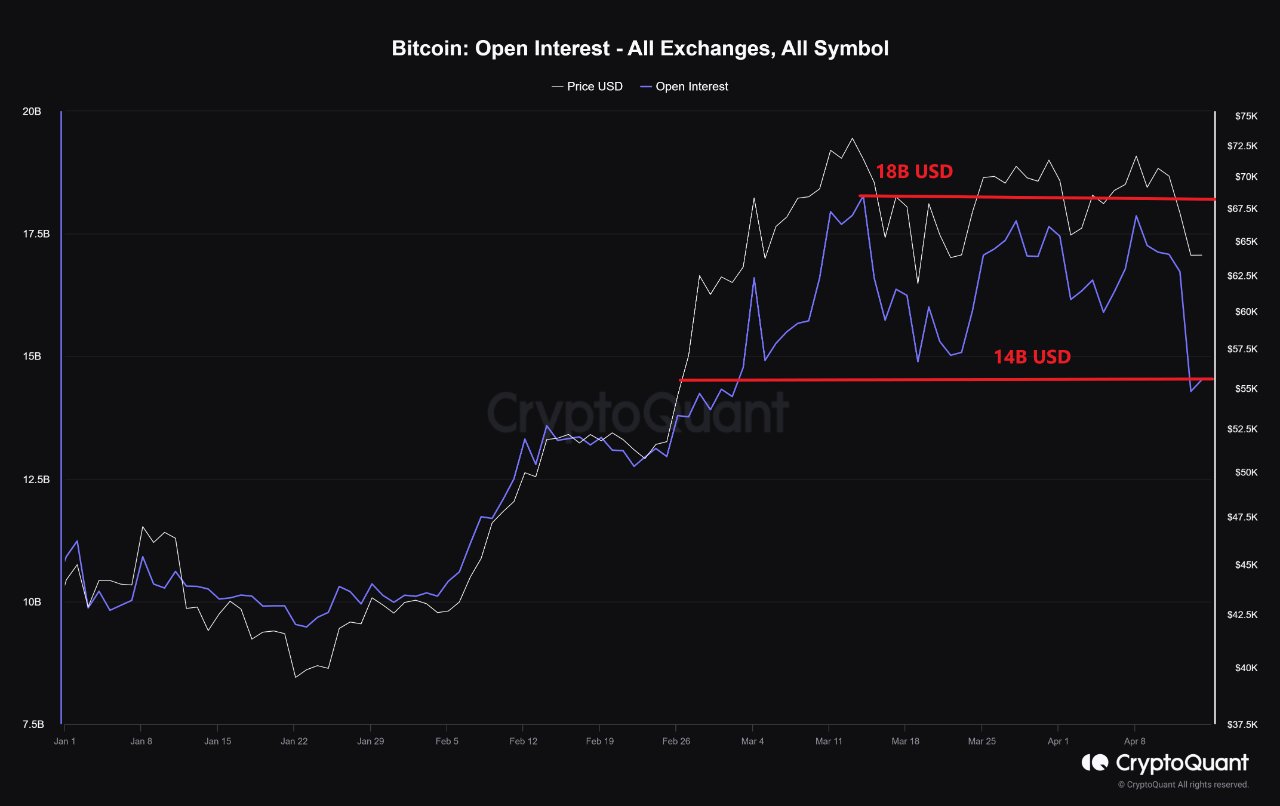

- Also, the developments taking place in the Bitcoin derivatives market are on a positive note. CryptoQuant analyst Burak pointed out that the open interest in derivatives exchanges has dropped from $18 billion to $14.2 billion. As a result, there’s a drop in the excess leverage trading happening in the market. This comes after a period of high trading activity and could imply a temporary market stabilization.

Photo: CryptoQuant

According to CoinLupin, an analyst at CryptoQuant, Bitcoin has hit a key area in the Short-Term Holder Cost Basis Ratio (STH CBR). This means that short-term investors are currently selling their Bitcoins, potentially creating a buying opportunity. Historically, this stage has been followed by price growth.

Bitcoin to Become 2X Scarce than Gold After Halving

Each Bitcoin halving reduces the supply by half, which is significant. But the approaching halving this week is more noteworthy because analysts at Bybit predict that Bitcoin will then be scarcier than gold.

According to Bybit’s latest report, the BTC supply held on centralized exchanges is projected to be fully utilized within the next nine months following the halving event.

Based on Bybit’s perspective, the Bitcoin stock-to-flow (S2F) model lends credence to their claims since this metric suggests that the supply of Bitcoin becomes more scarce than gold after each halving event. The S2F ratio computes scarcity by calculating the number of units of a commodity available for circulation, then dividing it by the annual production rate.

According to the most recent figures, Bitcoin’s S2F ratio is around 56. This is a bit less than gold’s ratio of 60. But after the last halving event, experts predict that Bitcoin’s ratio will nearly double, reaching about 112. This increase highlights how much scarcer Bitcoin may become compared to gold.

The Bitcoin halving is expected to decrease the circulating supply by reducing new bitcoins being mined. At the same time, the increasing demand for Bitcoin from ETFs could further shrink the available supply. Currently, approximately two million Bitcoins are stored in centralized exchange reserves. With an estimated $500 million flowing into daily spot Bitcoin ETF purchases, Bybit indicates that about 7,142 BTC will be withdrawn daily from these reserves. This implies that the reserves may run out within nine months following the halving event.

Considering this, it’s no wonder that Bitcoin’s price might keep rising leading up to the halving, or possibly even afterwards, due to the supply compression pushing the price to a fresh high. (Bybit report)

Read More

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The Babadook Theatrical Rerelease Date Set in New Trailer

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Paul McCartney Net Worth 2024: How Much Money Does He Make?

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- Cardi B Sparks Dating Rumors With Stefon Diggs After Valentine’s Outing

2024-04-17 18:15