As a seasoned analyst with over two decades of experience in finance and technology, I have witnessed firsthand the ebb and flow of market trends, from the dot-com bubble to the 2008 financial crisis. The current situation with Bitcoin (BTC) is intriguing, to say the least.

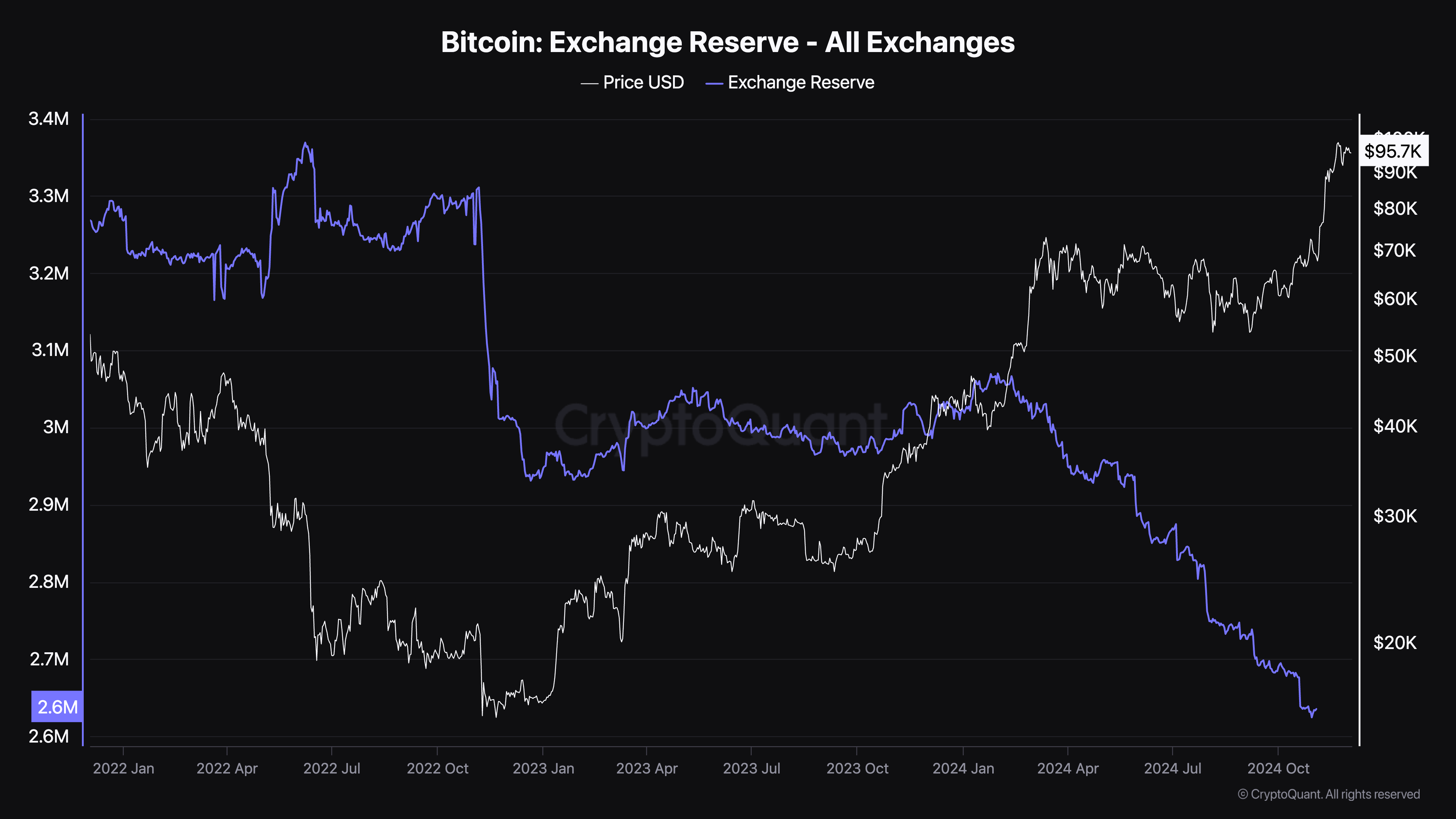

Based on information from CryptoQuant, Bitcoin (BTC) reserves held on cryptocurrency exchanges are at a record low over several years. This decrease occurs during an ongoing bull market, which is pushing the value of this digital currency towards $100,000. Such a substantial drop in reserves might significantly impact the asset’s supply-demand balance.

Investor Confidence Increasing In Bitcoin?

In contrast to typical bull markets, where Bitcoin stored on exchanges rises due to long-term and short-term investors moving their assets for profit, this ongoing bull market shows a reversal – the amount of Bitcoin on trading platforms is decreasing instead.

According to Cryptoquant’s data, approximately 171,000 Bitcoins have been taken out of cryptocurrency exchanges since Donald Trump, a pro-crypto Republican candidate, won the US presidential election in November. This significant withdrawal could mean that Bitcoin owners are transferring their assets into offline wallets (cold storage), implying a strong belief in Bitcoin’s long-term potential.

As an analyst, I’ve been monitoring the Bitcoin (BTC) exchange reserves, and here’s what I’ve observed: Starting from November 5, 2022, there was a significant drop in the BTC reserve amounts. By December 21, these reserves had decreased from approximately 3.33 million BTC to around 2.93 million BTC.

In February 2024, there was another significant decrease in Bitcoin holdings, possibly due to expectations surrounding the Bitcoin halving in April and the subsequent scarcity of this digitally-controlled asset. Over an eight-month period ending on October 30, reserves dropped from approximately 3.05 million BTC to 2.63 million BTC, representing a decrease of about 13.77%.

Currently, Bitcoin’s reserve exchanges hold approximately 2.46 million coins, marking the lowest level in years. This continuous decrease suggests a possible shortage of Bitcoin supply, which might trigger an increase in its value over the next few months.

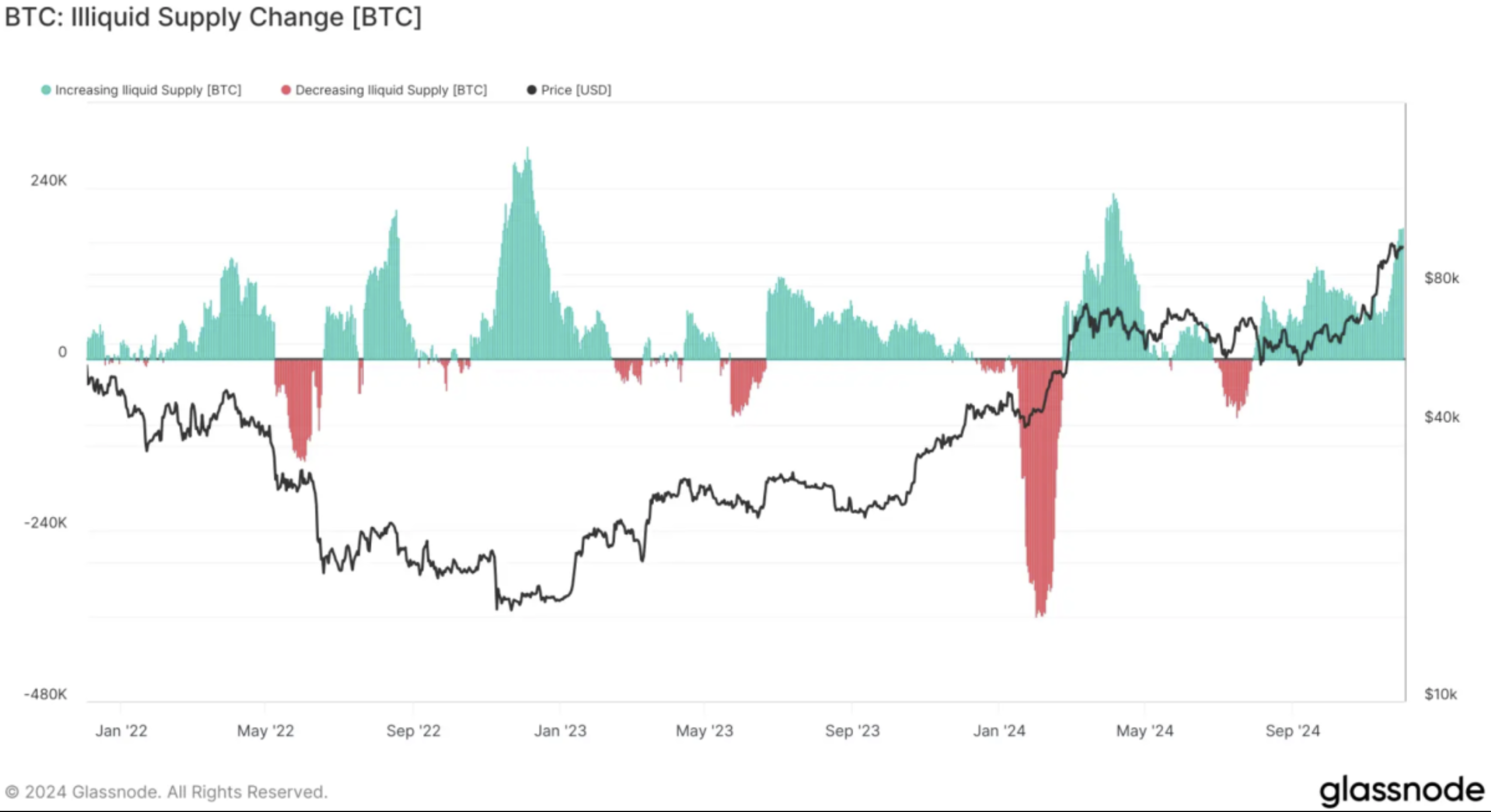

BTC Illiquid Supply Continues To Grow

Another data point that supports the long-term holding hypothesis for BTC is Glassnode’s illiquid supply metric. The chart shared below shows that the digital asset’s illiquid supply has grown by 185,000 BTC in the past 30 days.

Of particular note is that around 74% of the current Bitcoin supply (totaling about 14.8 million out of 19.8 million in circulation) is currently illiquid. This trend could potentially lead to a considerable increase in Bitcoin’s price due to scarcity, but it may also cause increased volatility.

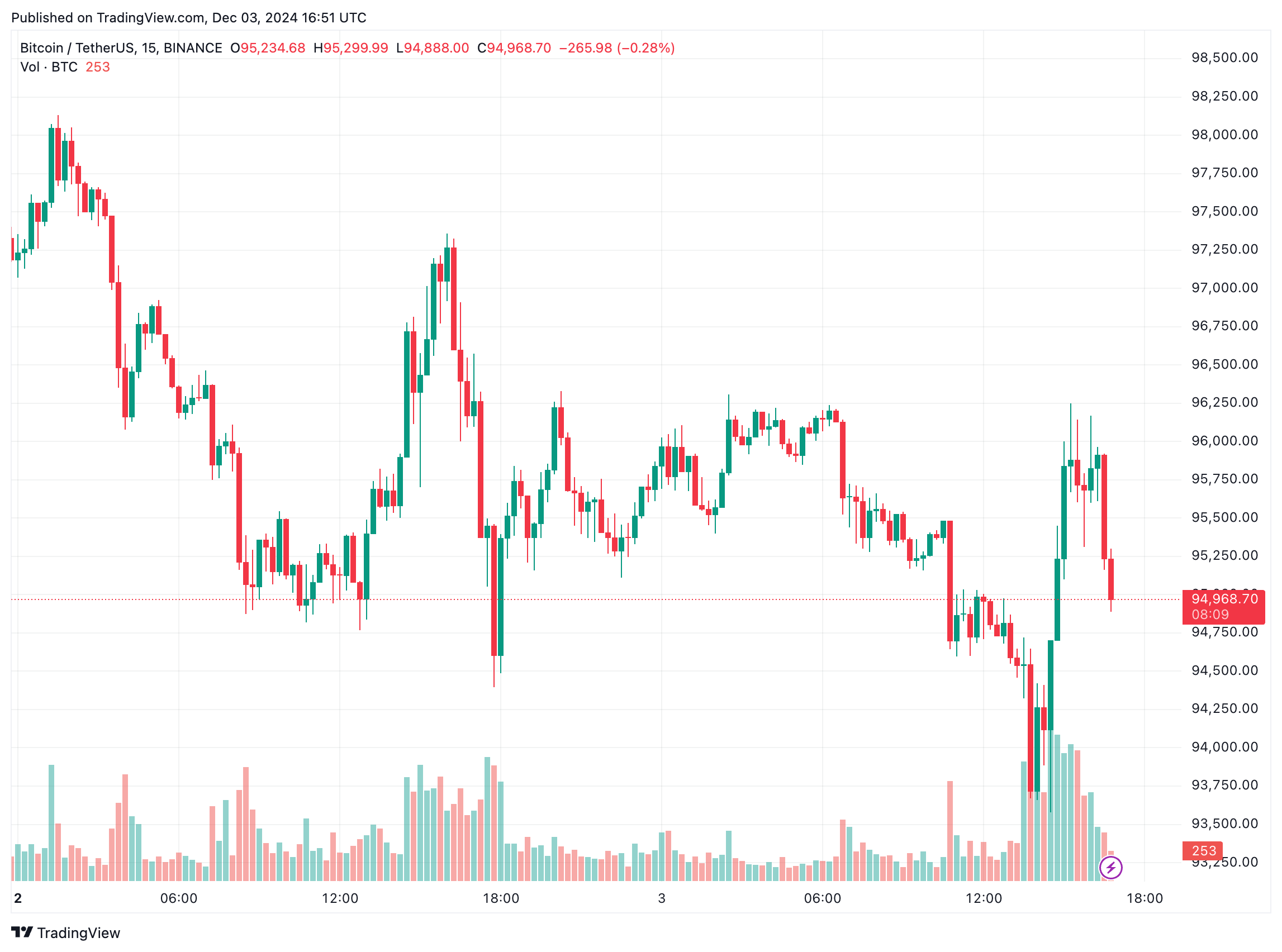

Although a decrease in Bitcoin’s exchange reserves and an increase in illiquid supply suggest a positive long-term outlook for its price, there might be a temporary drop first. Crypto analyst Ali Martinez suggests that Bitcoin has developed a head-and-shoulder pattern on the hourly chart, which could lead to a sell-off potentially driving its value down to $90,000.

According to another experienced crypto analyst named Rekt Capital, Bitcoin (BTC) briefly reached a price of $98,000 and has now entered the accelerated growth phase, or parabolic phase, of its rally. At this moment, BTC is trading at $94,968, which represents a 1.4% decrease in the past 24 hours.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

2024-12-04 10:34