As a seasoned analyst with over two decades of experience in traditional and digital markets, I find this latest development in the Bitcoin market particularly intriguing. The significant decrease in Bitcoin reserves on centralized exchanges, reminiscent of the lows seen in 2018, points to a shift in investor behavior that I believe could signal an emerging trend for Bitcoin.

It seems that the Bitcoin market has experienced a fascinating shift, with the amount of Bitcoin stored in centralized exchanges reaching its lowest point since November 2018.

According to an analyst on CryptoQuant named Gaah, this recent development sheds light on a significant shift in Bitcoin’s investing patterns within the cryptocurrency market and hints at a potentially intriguing trajectory for Bitcoin.

Bitcoin Reserves On Exchanges Reach Five-Year Low

2024 saw a substantial decrease in Bitcoin holdings on exchanges, as per the analysis, indicating that investors are adopting a longer-term storage approach.

This pattern indicates that more and more investors are moving their resources into personal digital wallets, thereby decreasing the readily available amount for instant sale. This reduction in supply, in turn, exerts additional purchasing pressure on an already tight market where supply is scarce.

Based on G a a h’s analysis, this pattern of behavior suggests a significant change in perception, as investors seem to be growing more confident in Bitcoin as a form of financial savings, particularly during periods of economic instability and inflationary pressure.

Moving Bitcoin out of exchanges helps decrease the chance of abrupt selling, promoting price consistency. Yet, this could also cause more volatility, particularly if demand persists or stays strong, due to a lower supply available on these platforms.

The CryptoQuant analyst noted:

In other words, this situation suggests a Bitcoin market that might become more unpredictable yet stronger, experiencing reduced selling activity and an increase in the influence of long-term investors. This shift could pave the way for potential new record highs.

BTC’s Upward Momentum Cools Off

After reaching an unprecedented high of $93,477 on November 13th, Bitcoin has since experienced a significant correction, currently dropping by approximately 4% from that peak. This correction suggests that the asset’s continued growth has stalled, and there seems to be an increase in selling activity.

Currently, Bitcoin is being traded for around $89,779, which is a drop of about 1.4% compared to the previous day. As a result, the total value of all Bitcoins in circulation dropped by approximately $49 billion yesterday.

Currently, Bitcoin’s market capitalization stands at approximately $1.775 trillion, which is nearly a 5% decrease compared to the $1.835 trillion valuation it held just two days ago. The daily trading volume for Bitcoin has decreased significantly, dropping from over $100 billion earlier this week to less than $85 billion at present.

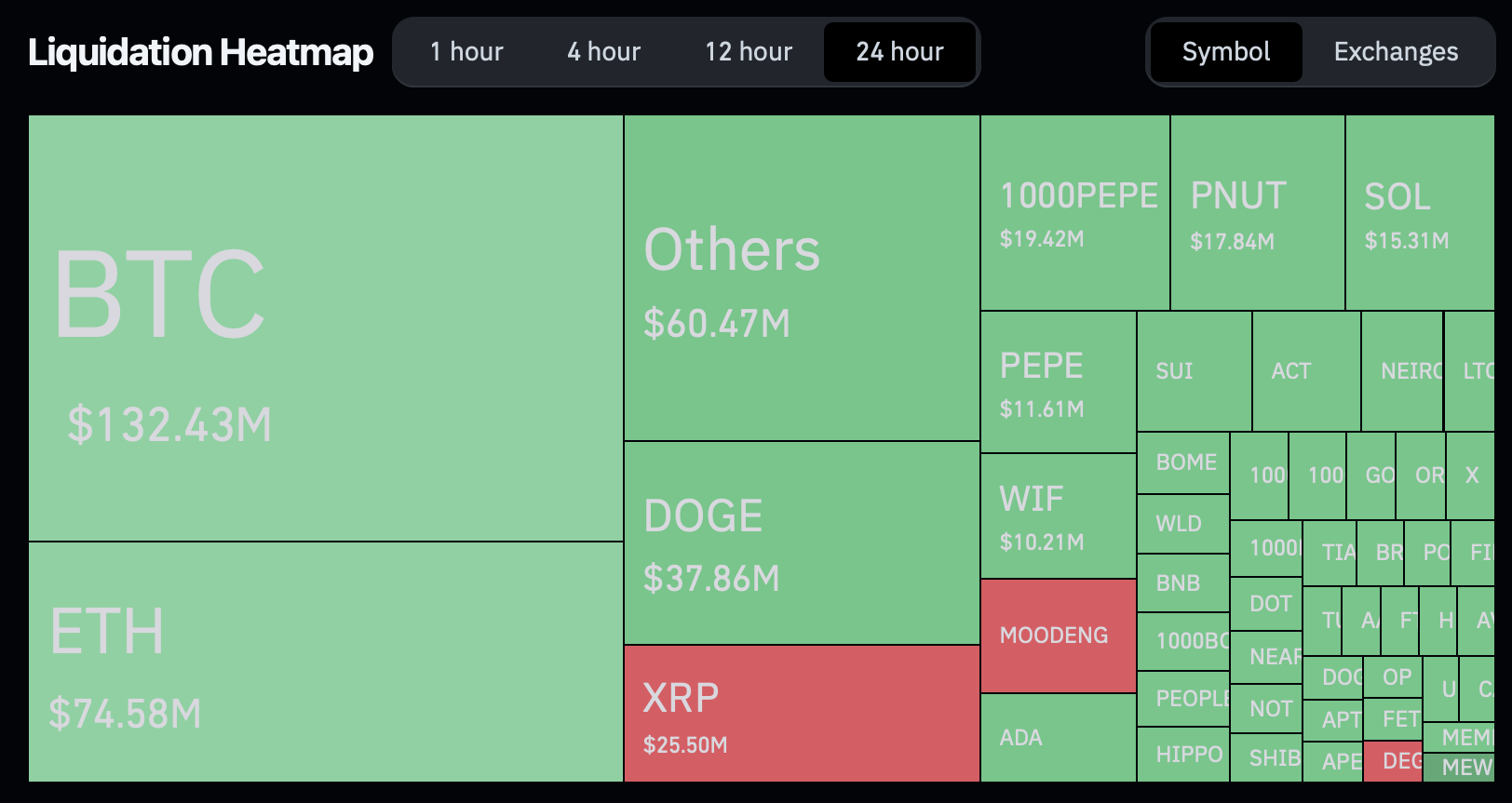

Apart from affecting its market value and trading activity, Bitcoin’s recent drop has had a substantial impact on numerous traders. As per Coinglass data, over 170,215 trades were liquidated within the last 24 hours, amounting to a total of $510.13 million in liquidations across the crypto market.

Among all these liquidations, Bitcoin represents approximately $132.43 million. Notably, most of these liquidations are associated with long positions, which means people were wagering that the price would keep rising.

Read More

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- General Hospital: Lucky Actor Discloses Reasons for his Exit

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- All Elemental Progenitors in Warframe

- Analyst Says Dogecoin Has Entered Another Bull Cycle, Puts Price Above $20

- KPop Demon Hunters 2: Co-Director on if Sequel Could Happen

2024-11-16 19:18