As a researcher with a background in financial markets and cryptocurrencies, I have closely monitored the recent price action of Bitcoin (BTC). The fact that BTC has broken below the $60,000 support level for the first time in two months is an interesting development. This decline comes after a prolonged period of euphoria and price appreciation, driven largely by the launch of Spot Bitcoin ETFs in the US market.

For the first time in two months, Bitcoin has dipped below the $60,000 mark, signaling a potential shift from the asset’s exuberant phase that began early this year. The recent surge in Bitcoin’s price was largely fueled by the introduction of Spot Bitcoin ETFs in the US market. However, the current price stabilization suggests that the market’s fervor could be waning.

As a analyst at Glassnode, I’ve been closely monitoring Bitcoin’s market trends. Over the past 6.5 months, there’s been palpable excitement in the Bitcoin community, which is often indicated by increased buying activity and rising prices. However, recent data suggests that this euphoria may be waning.

Selling Pressure Rises

In March 2024, Bitcoin attained its peak price of over $73,737. Since then, it has experienced a significant decline of approximately 18%, causing concern among investors who have opted to cash out their profits. This downward trend in the cryptocurrency’s value has been accompanied by an increase in the number of addresses showing losses, suggesting heightened selling pressure. Concurrently, the proportion of profitable addresses has decreased from over 99% to 86%.

Related Reading: Ethereum Flashes Bullish Signals, Can It Rally 50% From Here?

As a researcher studying cryptocurrency trends using on-chain analytics tools, I’ve recently observed that Glassnode reported consolidation in the market. The Net Unrealized Profit & Loss (NUPL) metric indicates that Bitcoin entered a state of euphoria earlier in this cycle than in past cycles based on my analysis. Specifically, the NUPL value surpassed 0.5 around 6.5 months prior to the most recent halving event, which coincided with heightened anticipation regarding Spot Bitcoin ETFs approvals.

Compared to the 2021 market trend, the NUPL entered a profitable zone approximately 8.5 months following Bitcoin’s halving. This indicator implies that the market has been in an exuberant phase for the previous seven months. However, it has noticeably calmed down over the past two months due to market corrections.

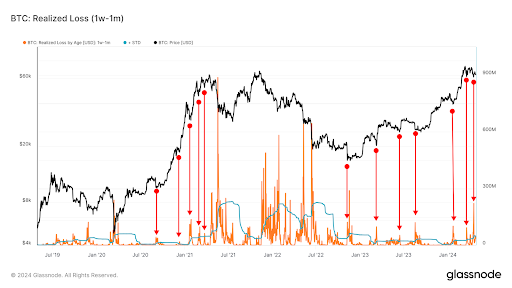

As an analyst, I find it intriguing that the report revealed a significant increase in net withdrawals spanning all wallet sizes during April. This observation suggests traders are currently experiencing sell pressure across the market. Additionally, a substantial number of short-term investors have been incurring losses on their positions since March, when viewed against the 90-day +1 standard deviation benchmark.

What Does This Mean For Bitcoin?

Investors might be concerned about the high “fear” level, but a decline following such a significant price increase is typically seen as beneficial by crypto experts. Many dedicated investors remain optimistic and are prepared to endure this dip, with the anticipated halving event on the horizon. Currently, Bitcoin is priced at $59,899 and has decreased by 5.35% in the last 24 hours.

Recent Trend: Crypto Investment Funds Experience Third Successive Week of Redemptions Totaling $435 Million

With a current cost basis of $66,700 for short-term holders (STH), and a realized price of $59,800, it’s likely that numerous STHs have moved into a loss position.

Based on the analysis of crypto expert Ali Martinez, it’s worth keeping an eye on the $59,800 mark for Bitcoin. Historically, Bitcoin has often rebounded above its strong resistance and realization price levels.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-05-02 05:28