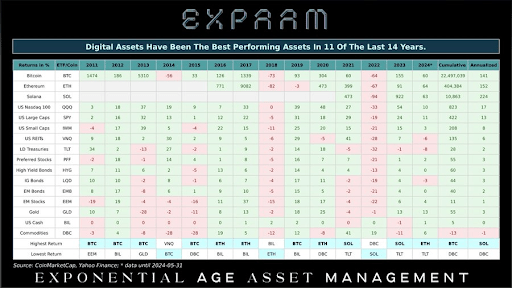

As a researcher with a background in finance and experience in the crypto market, I find the recent data on the outperformance of Bitcoin, Ethereum, and Solana over traditional assets quite intriguing. The report from EXPAAM, showing annualized returns of 141%, 152%, and 224% for Bitcoin, Ethereum, and Solana respectively, compared to NDX’s 17%, is a clear indication of the significant gains crypto assets have provided in recent years.

As an analyst, I’ve observed that although the cryptocurrency market has seen modest growth since Bitcoin reached its latest record high in March, Bitcoin, Ethereum, and Solana have consistently outperformed traditional investments such as gold. This trend was underscored in a recent analysis which demonstrated that crypto assets have delivered superior returns over the past period.

Bitcoin, Ethereum, And Solana Outperform Traditional Assets

Raul Pal, the Co-Founder of Exponential Age Asset Management (EXPAAM), recently released the firm’s latest monthly report, highlighting the annualized yields for all significant asset classes.

As a financial analyst, I’ve observed some striking differences in the performance of cryptocurrencies like Bitcoin, Ethereum, and Solana compared to traditional assets. Specifically, Bitcoin, Ethereum, and Solana have delivered annualized returns of 141%, 152%, and 224% respectively, outperforming the benchmark set by NASDAQ’s NDX index with its annualized return of just 17%.

Over the past 14 years, cryptocurrencies have been the top-performing assets in no less than 11 instances, based on data from CoinMarketCap. These digital currencies, including Bitcoin, Ethereum, and Solana, are projected to surpass the returns of traditional assets once again this year. As of now, these three cryptocurrencies have recorded remarkable year-to-date (YTD) gains of over 67% for Bitcoin, 66% for Ethereum, and an impressive 70% for Solana.

From my perspective as an analyst, while Gold has delivered a impressive 13% year-to-date (YTD) gain, the Technology-heavy NDX and broad market SPY have also posted respectable YTD returns of 10% and 11%, respectively. Notably, despite criticisms regarding their volatility, crypto assets have been a major driving force behind their outperformance against traditional assets this year.

The Director of Global Macro at Fidelity Investments, Jurrien Timmer, has previously pointed out that Bitcoin has offered the most favorable risk-reward since the beginning of 2020. He also acknowledged Bitcoin’s price volatility, explaining that its significant drops have been accompanied by substantial gains. A similar observation applies to crypto tokens, as an illustration, Solana, which plunged to $10 in late 2022, is now trading above $170.

More Gains Ahead For BTC, ETH, SOL

Bitcoin, Ethereum, and Solana are likely to achieve greater year-to-date (YTD) growth as the crypto market continues to experience a bullish trend. Several positive indicators have emerged in the cryptocurrency sector that favor these digital assets. For instance, there has been a significant surge in demand for Spot Bitcoin Exchange-Traded Funds (ETFs). According to Farside Investors’ data, these funds reportedly attracted $886.6 million in net inflows on June 4, marking their strongest day since March.

During this period, Ethereum-linked Spot ETFs are projected to debut around July. According to crypto analysts such as Michael van de Poppe, these exchange-traded funds may ignite a substantial surge in Ethereum and other alternative coins. Furthermore, the anticipation of a “Solana Summer” is growing, as the Solana token exhibits potential indicators of an upcoming parabolic growth trend.

As I analyze the current market trends, Bitcoin has surpassed the $70,000 resistance barrier and is now trading near $71,000, representing a nearly 3% price increase in the past 24 hours based on data from CoinMarketCap.

Read More

- Oblivion Remastered Spellmaking: The ULTIMATE Guide!

- Gold Rate Forecast

- Weak Hero Class 2 Ending: Baek-Jin’s Fate and Shocking Death Explained

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Odin Valhalla Rising Codes (April 2025)

- POPCAT PREDICTION. POPCAT cryptocurrency

- King God Castle Unit Tier List (November 2024)

- Leaked Video Scandal Actress Shruthi Makes Bold Return at Film Event in Blue Saree

- Jurassic World Rebirth Trailer’s Titanosaur Dinosaur Explained

- Thunderbolts* Box Office Update: MCU Movie Eyes Big Opening Weekend

2024-06-05 19:52