As a seasoned crypto investor with a keen eye on market trends and on-chain metrics, I find the recent analysis by CryptoQuant on the bullish signals for Bitcoin and Ethereum particularly intriguing. The firm’s findings of increasing demand from permanent holders and whales in both cryptocurrencies is a promising sign that institutional investors are re-entering the market with renewed interest.

As an analyst at CryptoQuant, I’d explain that based on our on-chain analysis, both Bitcoin and Ethereum have shown signs of potential acceleration in their price movements lately. Specifically, we’ve observed increasing demand for these cryptocurrencies as indicated by rising transaction volumes and network activity. Additionally, the supply held by exchanges has been decreasing, suggesting less selling pressure from that source. These trends, when considered together, suggest a bullish outlook for both Bitcoin and Ethereum in the short term.

Bitcoin & Ethereum Are Looking Bullish In On-Chain Metrics

The CryptoQuant team brought up some noteworthy on-chain signals for Bitcoin and Ethereum in a fresh discussion on their platform, X.

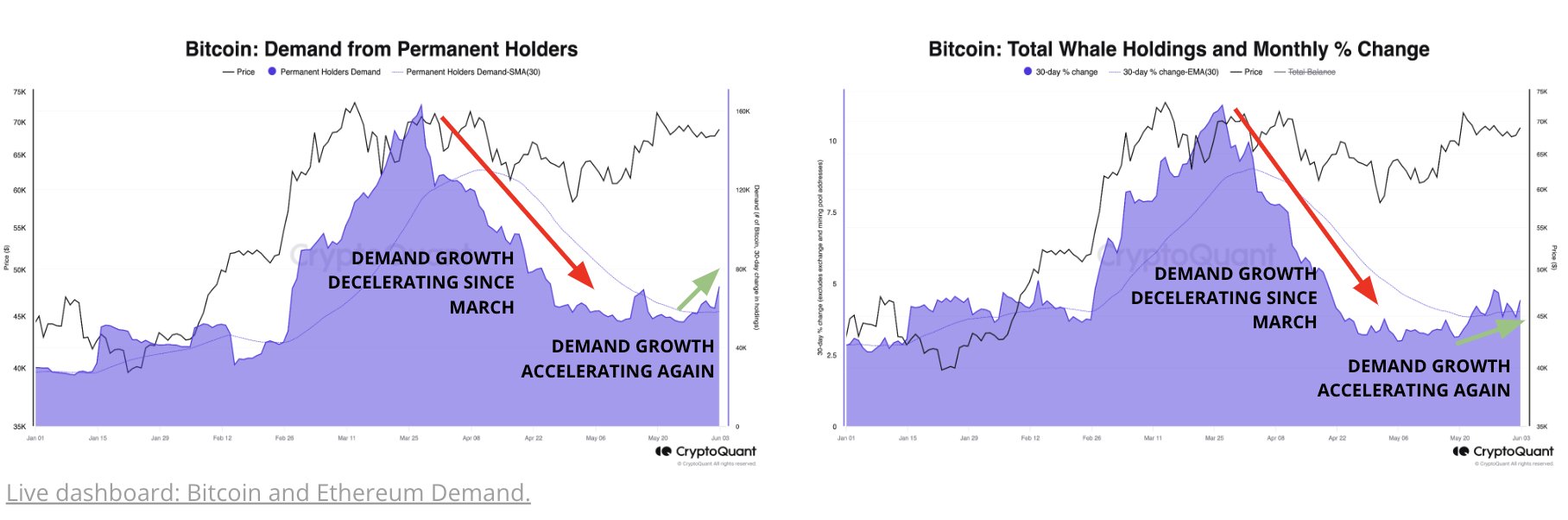

In the following discussion, we will focus on the initial two key performance indicators, which monitor the buying activity of large investors, specifically permanent holders and whales, in relation to Bitcoin. Here are the corresponding graphs for your reference regarding BTC:

The demand from long-term investors, or HODLers, had been decreasing since its peak in March, but more recently, there’s been a shift. In the last month alone, these investors have increased their holdings by adding approximately 70,000 Bitcoin to their wallets.

Large-scale Bitcoin investors, identified by addresses holding over 1,000 BTC, have shown a comparable increase in activity. As reported by the analytical company, there’s been a 4.4% rise in monthly demand from these significant investors.

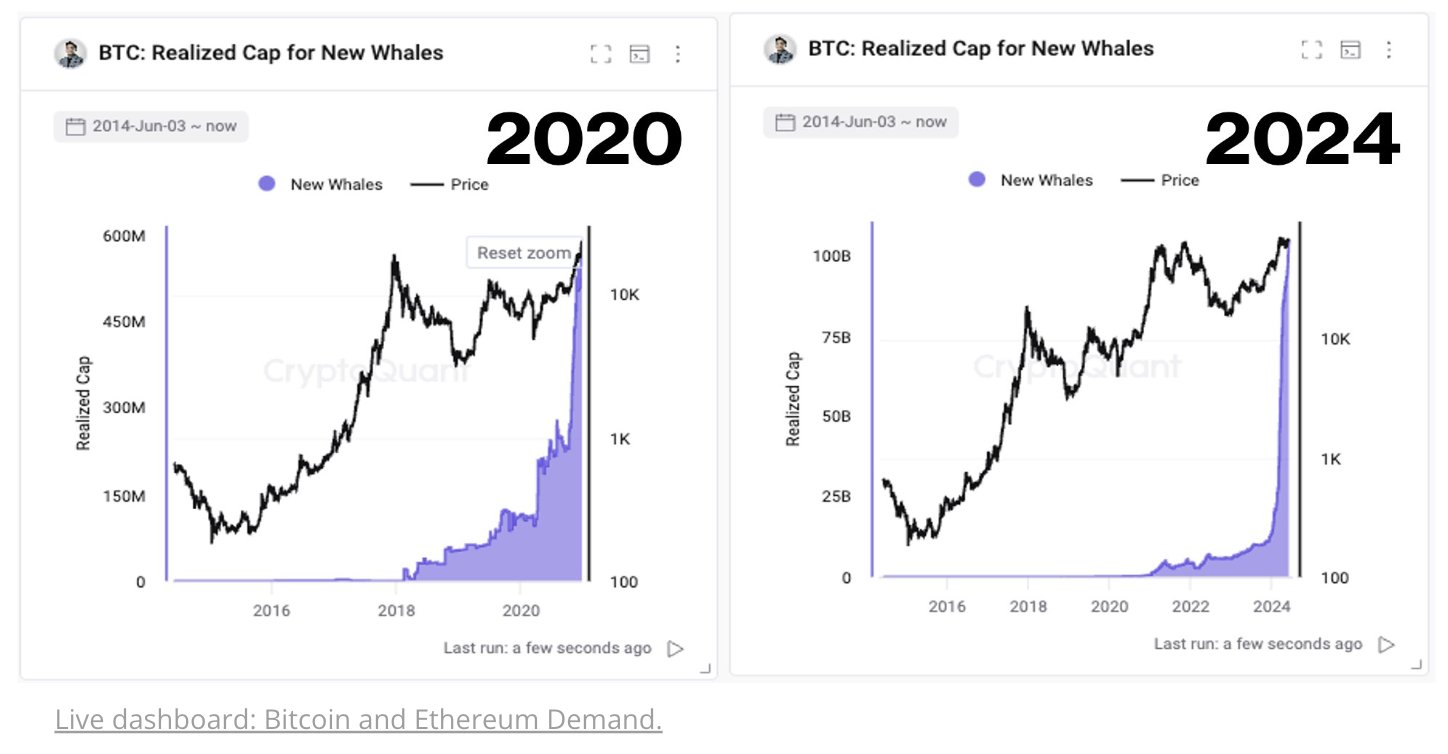

As a crypto market analyst, I’ve noticed an intriguing development based on data from CryptoQuant. New investors, referred to as “new whales,” have been pouring substantial funds into the sector, causing a significant increase in their “Realized Capital.” This influx of new capital could be a positive sign for the market’s growth.

The Realized Capitalization (Realized Cap) indicates the total amount of Bitcoin purchased by a specific investor group. Consequently, the growth in the Realized Cap for recently emerged “new whales” – entities that have acquired Bitcoin within the previous 155 days – signifies the escalating demand from substantial investors entering the BTC market.

Based on the graphs provided, the trend for this metric in 2021 bears a striking resemblance to its pattern in the previous year, 2020. The surge in demand back in 2020 initiated the bull market that continued into 2021.

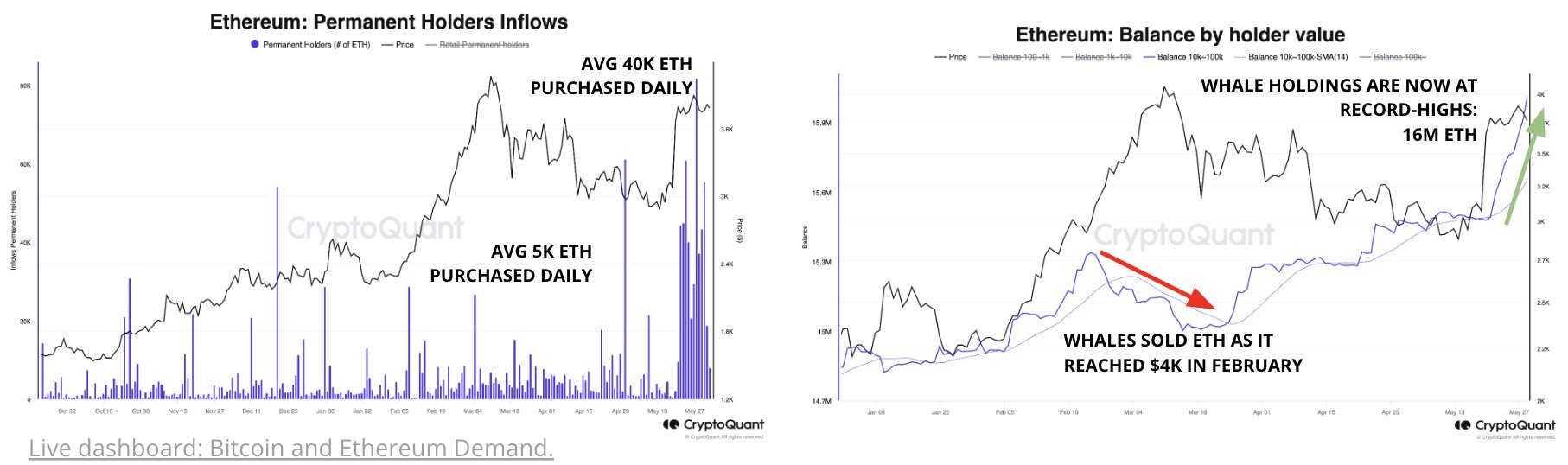

Let me describe the recent pattern of permanent holder inflows and whale balances in Ethereum.

I’ve analyzed the data presented in the graphs, and it’s clear that there’s been a significant surge in Ethereum demand from various investor groups following last month’s approval of spot Exchange-Traded Funds (ETFs).

On a daily basis, the large-scale investors, referred to as permanent holders, are currently purchasing an average of 40,000 Ether (ETH). Meanwhile, the category of investors holding between 10,000 and 100,000 ETH, known as whales, have significantly boosted their holdings, reaching unprecedented levels of approximately 16 million Ether.

The optimistic trend for Bitcoin and Ethereum due to increasing demand is noteworthy. However, a potential threat looms over the crypto market as a whole. The deceleration in the expansion of stablecoins could be this ominous factor.

As a crypto investor observing the market, I’ve noticed that the market capitalization of Tether (USDT) experienced a significant surge during the Bitcoin rally leading up to its all-time high. However, despite continued inflows, the demand for this largest stablecoin has started to taper off.

As a crypto investor, I’ve observed that stablecoins have historically served as essential entry points for capital inflow into the cryptocurrency market. Consequently, a steady demand for stablecoins is crucial for maintaining sustained rallies within the sector.

BTC Price

At the time of writing, Bitcoin is trading at around $70,200, up more than 4% over the past week.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- Justin Bieber ‘Anger Issues’ Confession Explained

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- All Elemental Progenitors in Warframe

2024-06-08 04:17