Ah, the delightful dance of digits! This week, the spot Bitcoin ETFs, those shimmering vessels of speculative delight, have devoured a staggering $2.75 billion, a sum that makes last week’s paltry $608 million look like mere pocket change. Prices, oh those capricious prices, have leapt past the $109,000 mark, a dizzying height not graced since the frosty days of January. And on the 22nd of May, Bitcoin, that elusive digital sprite, flirted with the tantalizing figure of $111,980. Investors, like moths to a flame, flocked to this rally with a fervor that would make even the most ardent gambler blush.

Spot Bitcoin ETF Inflows Surge

According to the ever-reliable Farside data, our beloved spot Bitcoin ETFs have attracted a jaw-dropping $2.75 billion this week, a sharp ascent from last week’s meager $608 million. This meteoric rise coincided with Bitcoin’s audacious leap over its January all-time high of $109,000. On the 21st of May, investors, in a fit of enthusiasm, injected $607 million, coinciding perfectly with Bitcoin’s new peak. The following day, the coin soared to $111,980, a spectacle of money chasing fresh highs, as if it were a game of financial tag.

BlackRock’s IBIT Leads Flows

Reports indicate that on the 23rd of May, ETF flows totaled a mere $212 million, yet BlackRock’s IBIT stood alone in the verdant green, raking in a remarkable $431 million, extending its inflow streak to an impressive eight days. Meanwhile, Grayscale’s GBTC saw $89 million slip through its fingers, and ARK 21Shares’ ARKB lost $74 million, as investors seem to prefer the low fees and expansive reach of the titans of finance.

Market Sentiment Pulls Back

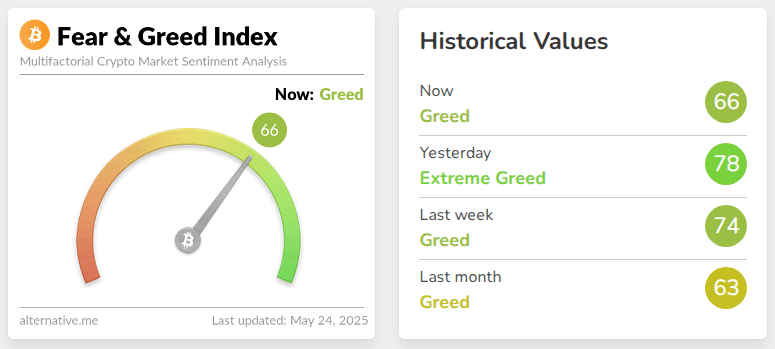

But alas, the ascent of Bitcoin has paused, trading at a modest $108,150 at publication. The Crypto Fear & Greed Index, that whimsical barometer of market sentiment, has dipped from an “Extreme Greed” reading of 78 to a more pedestrian 66, or “Greed.” This slight retreat hints at a smattering of profit-taking, as if investors were suddenly reminded of the fickle nature of fortune.

CryptoQuant analyst, the ever-astute Crypto Dan, remarked on May 22 that “overheating indicators such as the funding rate and short-term capital inflow remain low compared to previous peaks, and profit-taking by short-term investors is limited.” His perspective suggests that this rally is not merely a product of reckless speculation, but rather a calculated dance of financial acumen.

Record Monthly Inflows In Sight

As May unfolds, spot Bitcoin ETFs have amassed approximately $5.40 billion. The previous monthly high, a lofty summit reached in November 2024, stood at $6.50 billion. With five trading days remaining in May, the potential for a new record looms large. This steady demand underscores the transformation of ETFs into the preferred method for many to embrace Bitcoin, sans the wrestling match with wallets and private keys.

Indeed, the appetite for spot Bitcoin ETFs has surged. Investors, it seems, are enamored with simple, regulated products. The major players, led by the indomitable BlackRock, appear poised to maintain their dominance. As for Bitcoin itself, should sentiment cool, prices may retreat slightly. Yet, with institutional flows so robust, many believe there remains ample room for further ascension.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2025-05-24 15:06