This past week saw Bitcoin Spot ETFs, a currently buzzing financial sector, experience net investments for the third week in a row, marking three consecutive weeks of growth. Simultaneously, Ethereum Spot ETFs also demonstrated a generally positive trend, registering their initial weekly net inflows of 2025.

Bitcoin At Risk Of Supply Shock As ETF Issues Buy More BTC Than Was Produced In December

Bitcoin Spot ETFs Register $2.42 Billion Net Flows In 2025

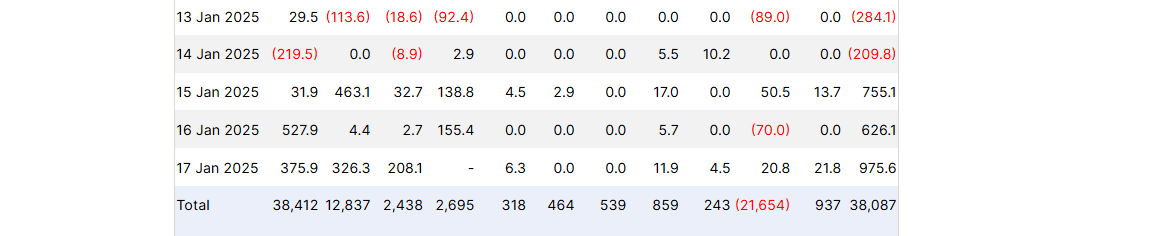

After a rocky closing in December 2024, US Bitcoin Spot ETFs kicked off 2025 on an optimistic note, drawing substantial market investments, much like their robust growth during most of Q4 2024. Data from Farside Investors shows that these Bitcoin ETFs attracted a collective inflow of $1.862 billion in the third week of trading in 2025, resulting in a total net flow of $2.42 billion for the new year.

This week began on a downbeat, losing ground as these ETFs experienced withdrawals totaling $493.9 million from January 13th to the 14th, coinciding with a sudden drop in Bitcoin’s value below $90,000 – a flash crash. However, over the next three trading days, Bitcoin prices rebounded, which seemed to boost investor confidence, resulting in an influx of approximately $2.35 billion into these funds during that span.

As a researcher, I find it noteworthy to share the recent trends in our analysis of net inflows for various investment products. Last week, BlackRock’s IBIT led the pack with an impressive $745.7 million in inflows. Following closely was Fidelity’s FBTC, garnering investments worth approximately $680.2 million. Additionally, Bitwise’s BITB and Ark’s ARKB also experienced substantial inflows, amounting to around $216 million and $204.7 million respectively.

During the recent week, various ETFs like Invesco’s BTCO, Grayscale’s BTC, WisdomTree’s BTCW, VanEck’s HODL, and Franklin Templeton’s EZBC experienced relatively small inflows totaling approximately $40.1 million. It’s worth noting that only Grayscale’s GBTC saw outflows for the week, amounting to $87.7 million. Additionally, Valkyrie’s BRRR showed no change in net flows.

Currently, BlackRock’s IBIT is leading the market with a total net inflow of $38.41 billion. Moreover, this figure represents nearly half of the overall net assets ($120.95 billion) in the Bitcoin Spot ETF market, as IBIT also manages $59.28 billion in net assets within this sector.

Ethereum ETFs Return To Positive $212 Million Inflows

Beyond the robust growth seen in Bitcoin Spot ETFs, Ethereum ETFs also experienced a significant inflow of approximately $212 million. This suggests a rebound to positive returns after a challenging beginning to 2025. The BlackRock ETHA was the primary focus of these inflows, attracting about $151.3 million in investments over the course of a week.

Currently, the combined value of Ethereum Spot ETFs stands at approximately $12.66 billion, making up about 2.99% of Ethereum’s total market capitalization. On the open market, Ethereum is being traded at around $3,297, while Bitcoin’s current worth is roughly $104,837.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- The games you need to play to prepare for Elden Ring: Nightreign

- Paul McCartney Net Worth 2024: How Much Money Does He Make?

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

2025-01-19 14:28