As a seasoned crypto investor with over a decade of experience navigating the digital asset landscape, I can confidently say that yesterday’s Bitcoin surge to $76,990 was nothing short of exhilarating. The historic influx of institutional capital, as evidenced by the record-breaking daily inflows into Bitcoin ETFs, is a testament to the growing maturity and recognition of Bitcoin as a legitimate store of value.

As an analyst, I’m thrilled to share that yesterday witnessed one of Bitcoin‘s most bullish days ever, surging beyond its previous record to hit $76,990. This latest achievement has sparked a wave of enthusiasm and faith among investors, fueling the belief in potential future growth.

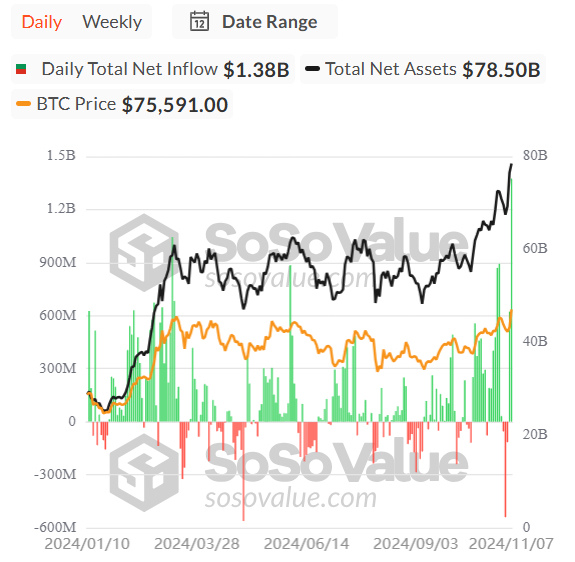

According to data from Carl Runefelt, Bitcoin ETFs saw an unprecedented increase, recording a massive $1.38 billion in daily investments. This significant amount underscores the growing institutional interest in Bitcoin, as heavyweights such as BlackRock are purchasing Bitcoin, predicting long-term expansion.

1) The growing inflow into Bitcoin ETFs signifies a wider trend of institutional investment, as more financial heavyweights see Bitcoin’s potential as a safe asset and a means to protect against economic volatility. According to Runefelt’s assessment, the current level of interest is exceptional, possibly indicating a significant shift that could prolong Bitcoin’s upward price trend.

The significant increase we’ve seen recently isn’t just about a technical event, but it also represents a major change in the underlying structure due to strong institutional support. This could mean that Bitcoin might reach even higher prices since big-time investors are continuing to pour into the market.

Bitcoin Hits New ATH

In simple terms, the value of Bitcoin has soared to unprecedented levels, exceeding its old record highs yet again and hitting a new pinnacle that’s sparked excitement in the cryptocurrency world. This remarkable climb follows closely on the heels of the U.S. presidential election, where Donald Trump secured his win.

As a crypto investor, I find myself encouraged by the positive vibes surrounding President Trump’s pro-cryptocurrency stance. This optimism seems to have ignited renewed trust among American investors, who view Bitcoin as a viable hedge during these times of shifting economic policies.

Building on this trend, more and more conventional investors are funneling their resources into Bitcoin via ETFs, signaling a substantial change in institutional appetite. As reported by SoSo Value and highlighted by prominent analyst Carl Runefelt on X, Bitcoin ETFs broke daily inflow records yesterday, amassing an incredible $1.38 billion.

This significant influx emphasizes the increasing interest among institutional investors, who are increasingly treating Bitcoin as an essential component in their investment portfolios.

Over the past seven months, many institutions have been slowly amassing Bitcoin, creating a period of accumulation that left some investors questioning if Bitcoin could reach new heights in 2021. As the market fluctuated and doubts about its future growth persisted, many investors remained hesitant, their confidence shaken by the volatile and unpredictable nature of the market.

Supported by robust institutional investments at an all-time high, Bitcoin’s current surge might mark the start of a prolonged upward trend. Major players such as BlackRock are investing in Bitcoin via ETFs, which many market observers interpret as a sign of restored vigor. Now, everyone is eagerly watching Bitcoin to see what its next steps will be. Analysts believe that this recent price movement could just be the opening act of a larger bullish trend for the world’s leading cryptocurrency.

BTC Pushing Up: Strong Price Action

Currently, Bitcoin is trading at approximately $76,000 following fresh record highs. At present, BTC appears to be in a robust consolidation phase above its previous peak of around $73,800. This significant price range is pivotal for bullish investors, as maintaining this level could offer Bitcoin’s upward trend some stability and potential continuation. Analysts are keeping a close eye on this level; should BTC uphold it, the bullish momentum might prolong, leading to additional increases.

Yet, the current surge of optimism might result in a temporary consolidation period around $77,000 – a point some analysts consider a short-term peak. Overcoming this resistance could prove challenging as the market processes recent advancements and waits for new triggers to push through for another rally.

Regardless of any possible consolidation, demand for Bitcoin remains high and data from the blockchain indicates strong buying interest that might keep pushing prices higher. Technically speaking, if Bitcoin manages to stay above $73,800 over the next few days, there could be more upward momentum. Optimistic investors are hopeful that this could lay a solid base for the upcoming surge in Bitcoin’s price increase trend.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

2024-11-08 18:40