As a seasoned researcher with over two decades of experience in the financial markets, I’ve witnessed countless bull and bear cycles, and I must admit that the recent surge in Bitcoin ETF inflows is nothing short of astonishing. In my career, I’ve seen trends come and go, but the demand for Bitcoin ETFs far exceeds anything I would have predicted pre-launch.

On October 14th, US Bitcoin exchange-traded funds (ETFs) experienced their largest one-day influx in approximately four months, accumulating more than $500 million. In total, eleven ETFs recorded a net inflow of $555.9 million, the highest since early June, as reported by Farside Investors. This increase was prompted by Bitcoin’s price spike to a two-week peak of $66,400 during late trading.

Nate Geraci, head of ETF Store, referred to it as a “tremendous day” for Bitcoin ETFs that are traded on spot markets. He emphasized that over the past ten months, these ETFs have seen approximately $20 billion in total investments. In a post on October 15th, he pointed out that the demand has surpassed initial expectations, with financial advisors and institutional investors being the primary drivers, rather than individual retail traders.

Today marked a monstrous day for Bitcoin spot ETFs, with $550 million in inflows. This brings the total net inflows over the past ten months close to an astounding $20 billion. In my opinion, this is not just “degenerate retail” money. Instead, it appears to be advisors and institutional investors gradually adopting this asset class, which far surpasses any pre-launch demand projections.

— Nate Geraci (@NateGeraci) October 15, 2024

Fidelity’s FBTC Leads the Pack

In the latest updates, Fidelity’s Wise Bitcoin Origin Fund recorded the highest investment influx of $239.3 million since June 4th. Bitwise’s Bitcoin ETF came second with more than $100 million, while BlackRock’s iShares Bitcoin Trust reported an inflow of approximately $79.6 million. The Ark 21Shares Bitcoin ETF managed to attract close to $70 million, and Grayscale Bitcoin Trust saw its first October investment of $37.8 million, marking the largest influx since May.

In a post dated October 14th, Eric Balchunas, senior ETF analyst at Bloomberg, made a comparison between the performance of Bitcoin ETFs and gold ETFs. Over the past seven months (since January), Bitcoin ETFs have reached new record highs on five separate occasions, while gold ETFs have surpassed their previous records no less than 30 times this year. However, despite this significant difference in frequency, gold ETFs only attracted approximately $1.4 billion in additional investments, whereas Bitcoin ETFs saw inflows exceeding $19 billion.

It’s fascinating that since the introduction of Bitcoin ETFs, Bitcoin has reached new all-time highs five times, compared to gold’s thirty record-breaking instances. However, it’s important to note that while Bitcoin ETFs have attracted $19 billion in net inflows, only $1.4 billion has flowed into gold ETFs. This tweet comes from @psarofagis.

— Eric Balchunas (@EricBalchunas) October 14, 2024

The performance of funds invested in Ethereum hasn’t been stellar. Specifically, Bitwise, VanEck, Franklin, and Grayscale recorded no new investments, whereas Fidelity and Invesco observed minimal increases. Interestingly, BlackRock’s iShares Ethereum Trust (ETHA) experienced an inflow of $14.3 million, raising its total to a sum of $17 million.

Uptober Brings Hope for Bitcoin

On October 15, Bitcoin saw a 6% increase, pushing its price up to $66,400 – the highest it’s been since July 30. This rally was beneficial for U.S.-based companies tied to crypto, as many reported impressive gains following the surge. In a post on October 14, Dan Tapiero, founder of the crypto investment firm 10T Holdings, expressed that Bitcoin could potentially break through the $70,000 mark.

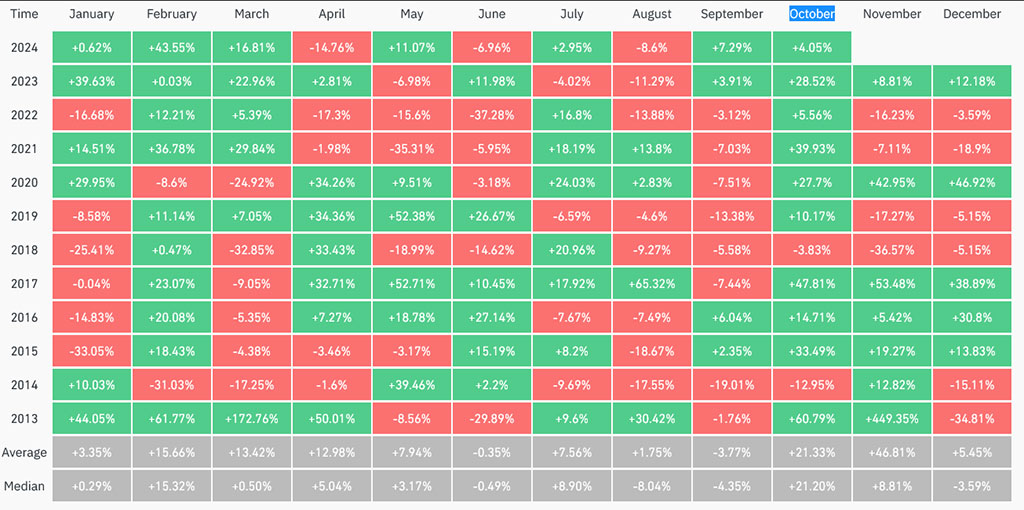

In simpler terms, “Uptober” is a positive term for October, as it refers to the tendency of Bitcoin’s price increasing in nine out of the past eleven Octobers. This pattern often sets the stage for a robust fourth quarter performance for the cryptocurrency based on data from CoinGlass.

The current rise in prices coincides with election periods, during which contenders such as Kamala Harris and Donald Trump are advocating stricter regulations for the cryptocurrency market. Notably, Harris is viewed as having a more favorable stance towards crypto compared to President Biden, whereas Trump is seen as being more supportive of the industry.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- The games you need to play to prepare for Elden Ring: Nightreign

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- The Babadook Theatrical Rerelease Date Set in New Trailer

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

2024-10-15 14:16