As a seasoned researcher with over two decades in the financial industry, I have witnessed the rise and fall of countless investment trends. However, the meteoric surge of Bitcoin ETFs in 2024 has left me genuinely astounded. The rapid influx of retail investors, coupled with the growing interest from institutional giants like Morgan Stanley and Goldman Sachs, is a testament to the enduring allure of cryptocurrencies.

Last week, Bitcoin ETFs experienced a surge with $997.70 million in incoming investments, reaching their peak demand level in six months. It’s clear that these ETFs have signaled a significant shift for Bitcoin and other digital currencies since the start of the year, as they’ve enabled inflows from all directions, broadening access to cryptocurrency investment.

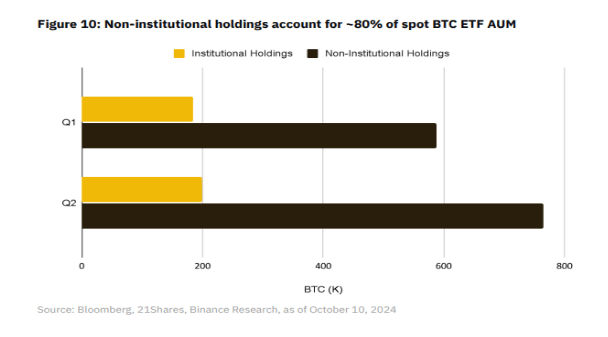

It’s worth noting that retail investors, in fact, make up the majority of the demand for Spot Bitcoin ETFs. They manage about 80% of the total assets invested in these funds.

Bitcoin ETFs Changing The Narrative

In 2024, Bitcoin and Ethereum ETFs have taken the lead in the ETF market, occupying the top four spots for investments among all newly launched ETFs this year. Out of the 575 ETFs introduced so far, a significant number (14 out of the top 30) are Bitcoin or Ethereum-focused funds. The BlackRock IBIT fund, in particular, has been the most popular, pulling in over $23 billion in investments this year.

Over the past week, Spot Bitcoin ETFs showcased their robust performance yet again, even as the coin’s price remained below the $68,000 mark. As per data from SosoValue, the inflow of funds began positively on Monday, October 18, with approximately $294.29 million invested, and concluded the week with a total inflow of around $402.08 million by Friday, October 25.

It’s noteworthy to mention that Spot Bitcoin Exchange-Traded Funds (ETFs) currently hold approximately 938,700 Bitcoins after being launched 10 months ago, and they are fast approaching the 1 million Bitcoin milestone. While these ETFs have provided a gateway for institutional investors, a recent study by crypto exchange Binance suggests that retail investors are primarily responsible for this surge in demand, representing around 80% of the holdings in Spot Bitcoin ETFs.

Initially designed to grant access to Bitcoin for institutional investors, Spot Bitcoin ETFs have evolved into a popular choice among individual investors who appreciate their regulatory transparency. Despite this shift in preference, there remains a consistent institutional interest, as institutional holdings have increased by 30% since the first quarter.

This quarter, investment advisors have been the swiftest-expanding group among institutional investors regarding Bitcoin ownership. Their holdings surged by an impressive 44.2%, culminating in a total of 71,800 Bitcoin under their management.

What’s Next For Spot Bitcoin ETFs?

In just under a year, an astounding 1,179 financial entities, including industry titans like Morgan Stanley and Goldman Sachs, have invested in Bitcoin exchange-traded funds (ETFs). To put this into perspective, gold ETFs managed to garner interest from only 95 institutions during their initial year on the market.

The trend of larger financial institutions investing in Bitcoin is expected to persist in the coming times, indicating a positive outlook for Bitcoin’s price. As more ETFs draw institutional funds, they may spark additional effects such as increased influence of Bitcoin, enhanced market efficiency, and reduced volatility that could positively impact the cryptocurrency sector.

At the time of writing, Bitcoin is trading at $67,100.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-10-27 22:34