As a seasoned researcher with extensive experience in financial markets, I find the recent surge in Bitcoin ETF options trading nothing short of intriguing. The debut of IBIT’s options trading, with a staggering $1.9 billion in notional exposure traded on its first day, is a testament to the growing institutional interest in Bitcoin and digital assets as a whole.

On their debut, Bitcoin (BTC) ETF options, particularly those linked with BlackRock’s Bitcoin ETF named IBIT, saw an impressive inflow of approximately $2 billion in notional value, markedly altering Bitcoin’s market behavior on November 20th.

Bloomberg Intelligence analyst James Seyffart highlighted the extraordinary volume, stating:

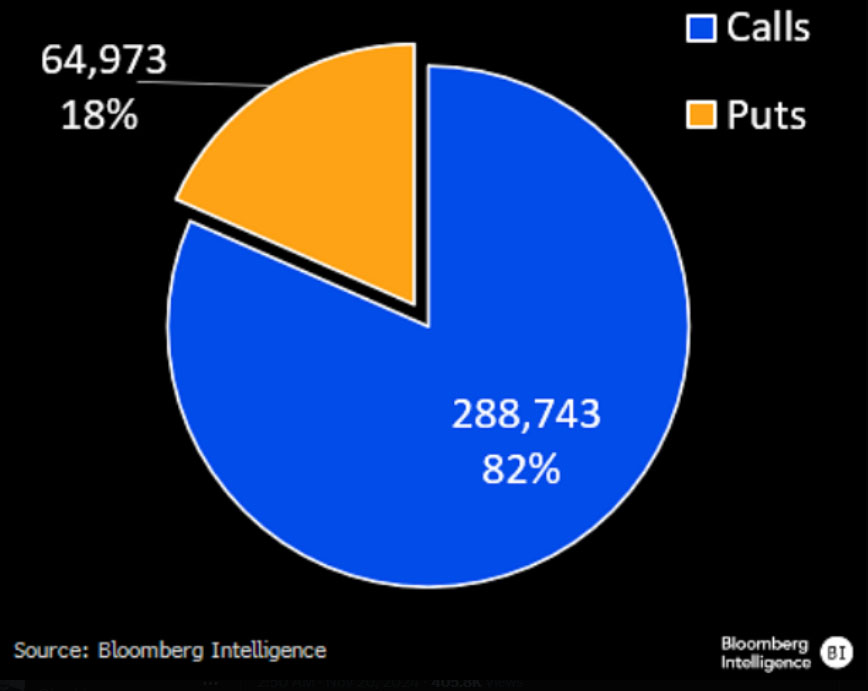

On the first day, approximately $1.9 billion worth of bitcoin options were traded through 354,000 contracts. Out of these, 289,000 were calls and 65,000 were puts, giving a ratio of about 4.4 calls for every put. This suggests that the majority of these options were likely associated with the rise in bitcoin’s all-time highs today.

The introduction of IBIT options signifies a significant turning point for Bitcoin investors, particularly institutions. Many market players are excited about this development, believing it will draw more institutional involvement in Bitcoin. This anticipation comes after the US Securities and Exchange Commission’s approval in September for options on several Bitcoin ETFs across various exchanges, with more such products set to be rolled out soon.

Bitcoin Sees 80% Bullish Options Surge

As reported by James Seyffart in his post, IBIT’s introduction of options trading got off to a strong start, involving a whopping $1.9 billion in potential transactions spread across 354,000 agreements. This suggests growing market enthusiasm, mirroring Bitcoin’s ascension to unprecedented record highs. A significant majority (82%) of these contracts were call options, suggesting a robust optimistic outlook among traders.

Source: Bloomberg Intelligence

354,000 contracts were traded on IBIT’s opening day, with a vast majority being calls (289,000) compared to puts (65,000). This implies a call-to-put ratio of approximately 4.4:1, indicating a strong inclination towards bullish Bitcoin predictions among traders. The significant increase in options trading indicates that investors are confident about Bitcoin’s price growth as part of the ongoing cryptocurrency surge.

Financial derivatives provide purchasers with the opportunity to either buy or sell an asset at a specific price over a certain timeframe. A call option grants the privilege to acquire the asset at the agreed price, while a put option allows for the sale of the asset at the same pre-agreed cost. Investors tend to prefer call options when anticipating price rises since they can make profitable transactions if the market goes upwards. Alternatively, put options shield against price decreases or allow for speculation on falls, permitting holders to sell the asset at the agreed price even if its actual value drops in the market.

The growth in the use of IBIT for trading options has provided seasoned investors with innovative strategies, boosting market liquidity and influencing the overall market environment. Institutions, wary of unregulated sites, can employ IBIT options to protect their bullish investments and generate additional income by selling calls. On the other hand, speculators leverage both call and put options on Bitcoin to gain profits from its volatility without having to own the asset directly.

Can Bitcoin Options Reduce Long-Term Volatility?

Over time, an increase in IBIT call options could influence Bitcoin’s expected volatility. Analysts propose that large quantities of these call options could lead to decreased volatility in the future. However, in the short term, high demand during bullish trends might spark price spikes similar to GameStop’s gamma squeeze. This happens when intensive buying on leveraged positions results in rapid price escalations.

On Wednesday, Bitcoin reached an all-time peak of $93,800, continuing its strong surge following the elections. Over the weekend, the price hovered around $91,000, a reflection of last week’s climb that saw it breach the $80,000 and $90,000 thresholds for the first time. This significant leap is a notable achievement in the cryptocurrency market.

The surge of Bitcoin can be connected to the “Trump trade,” driven by President-elect Donald Trump’s hints about crypto-friendly policies. Exciting suggestions such as creating a national Bitcoin reserve have sparked enthusiasm in the market, illustrating Bitcoin’s growing influence in both political and global financial arenas.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-11-20 12:40