As a seasoned crypto investor with a decade-long journey in this digital wild west, I’ve learned to navigate through the unpredictable tides of the market with a mix of caution and excitement. The recent surge in Bitcoin ETF inflows, particularly from heavyweights like Fidelity and BlackRock, is indeed an intriguing development. It’s reminiscent of the gold rush days, but instead of panning for gold, we’re mining for Satoshis!

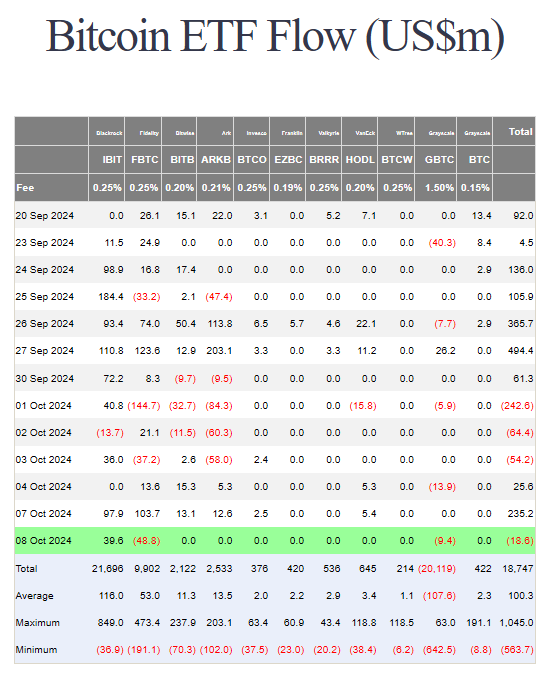

Bitcoin-based Exchange-Traded Funds (ETFs) are once again making news due to an unprecedented surge in investments. On October 8, a staggering $235.2 million was invested into Bitcoin ETFs, suggesting a significant rise in investor interest. This sudden influx of funds, as per Farside Investors’ data, follows a rather quiet start to the month but points towards a renewed faith among investors in the crypto market.

Fidelity And BlackRock Lead The Way

Today, the inflow into Fidelity’s Bitcoin ETF (FBTC) amounted to $103.7 million, while iShares Bitcoin Trust (IBIT), managed by BlackRock, saw an influx of $97.9 million. In addition, Bitwise ETF BITB and ARK Invest ETF Arkb also contributed with $13.1 million and $12.6 million respectively. The total trading volume of all Bitcoin ETFs surged to a significant $1.22 billion, marking a substantial increase from the previous day’s figures.

Despite Bitcoin’s fluctuating prices, it’s quite striking how inflows into ETFs have made a resurgence. At the time of writing, Bitcoin was being traded around $62,485, showing a slight decrease from its peak of $66,000, indicating some downward market pressure. However, the continued interest in Bitcoin ETFs by institutional investors suggests they are prepared to capitalize on potential future price hikes.

Bitcoin Edges Ethereum ETFs

Contrary to the positive vibe surrounding Bitcoin ETFs, Ethereum’s ETFs paint a distinct picture: On October 6, Ethereum exchange-traded funds (ETFs) recorded relatively small inflows of approximately $7.4 million, and there was no new activity on October 7. This lack of momentum stands in stark contrast to the lively trading within Bitcoin ETFs. Financial analysts suggest that this discrepancy might be indicative of shifting investor preferences or concerns about Ethereum’s market behavior.

As a crypto investor, I can’t help but ponder if the recent decline in inflows into Ethereum ETFs isn’t a sign that the broader market sentiment might be leaning more towards Bitcoin. The waning interest in Ethereum is evident, yet the magnetism of institutional capital towards Bitcoin remains undeniable. This leaves me questioning whether there’s a stronger pull towards altcoins at this moment.

Market Sentiment And Future Outlook

The surge in Bitcoin ETF investments indicates a broader market pattern, fueled by speculation about potential Federal Reserve interest rate cuts. Many financiers anticipate this move will boost the market and maintain rising prices. Historically, monetary easing tends to stimulate further investment in riskier assets such as cryptocurrency.

According to Bloomberg analyst Eric Balchunas, the impressive track records of FBTC and IBIT make them crucial for the development of Bitcoin ETFs moving forward. These funds might even reach “textbook” status with more than $10 billion in assets under management. Furthermore, he predicts that institutional interest, which is growing rapidly, could potentially trigger a bull market by the end of 2024.

Currently, ETFs based on Ethereum are seeing a slowdown, contrasting with the surge of Bitcoin ETFs marked by large influxes and heightened trading activity. As market conditions shift and monetary policies evolve, investors are keeping a close eye on developments. The coming weeks could be decisive for both Bitcoin and Ethereum as they navigate through these changing tides.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-10-10 06:40