As a seasoned financial analyst with extensive experience in cryptocurrency markets, I find the recent surge in crypto investment products quite intriguing. With Bitcoin rebounding after a period of correction, it is not surprising to see institutional investors taking advantage of these dips and pumping in substantial funds – $1.44 billion over the past week alone. This represents a significant shift in sentiment, indicating growing confidence among investors despite market downturns.

Last week, Bitcoin‘s steady recovery was mirrored by a significant surge in investments in crypto products worldwide. Approximately $1.44 billion flowed into these assets during this timeframe.

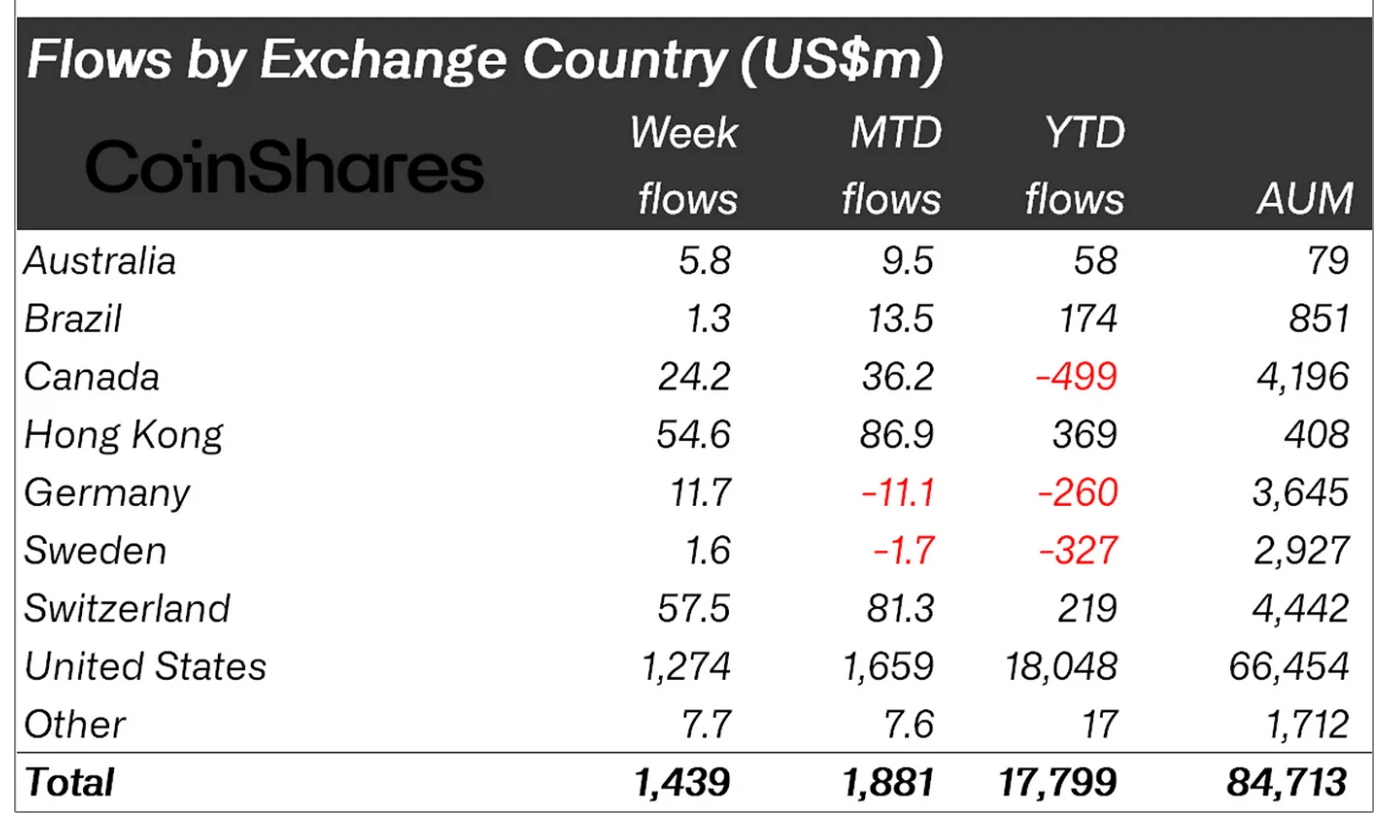

Based on information from CoinShares, a prominent crypto asset management company, this upward trend has caused the year-to-date investment in digital assets to surpass $17.8 billion, indicating increasing trust from investors amidst previous market fluctuations.

Surge In Crypto Fund Inflows

Based on the information provided by CoinShares in their recent report, the past week saw one of the largest inflows of funds into crypto assets on record, exceeding the $10.6 billion amassed throughout the entirety of the 2021 bull market.

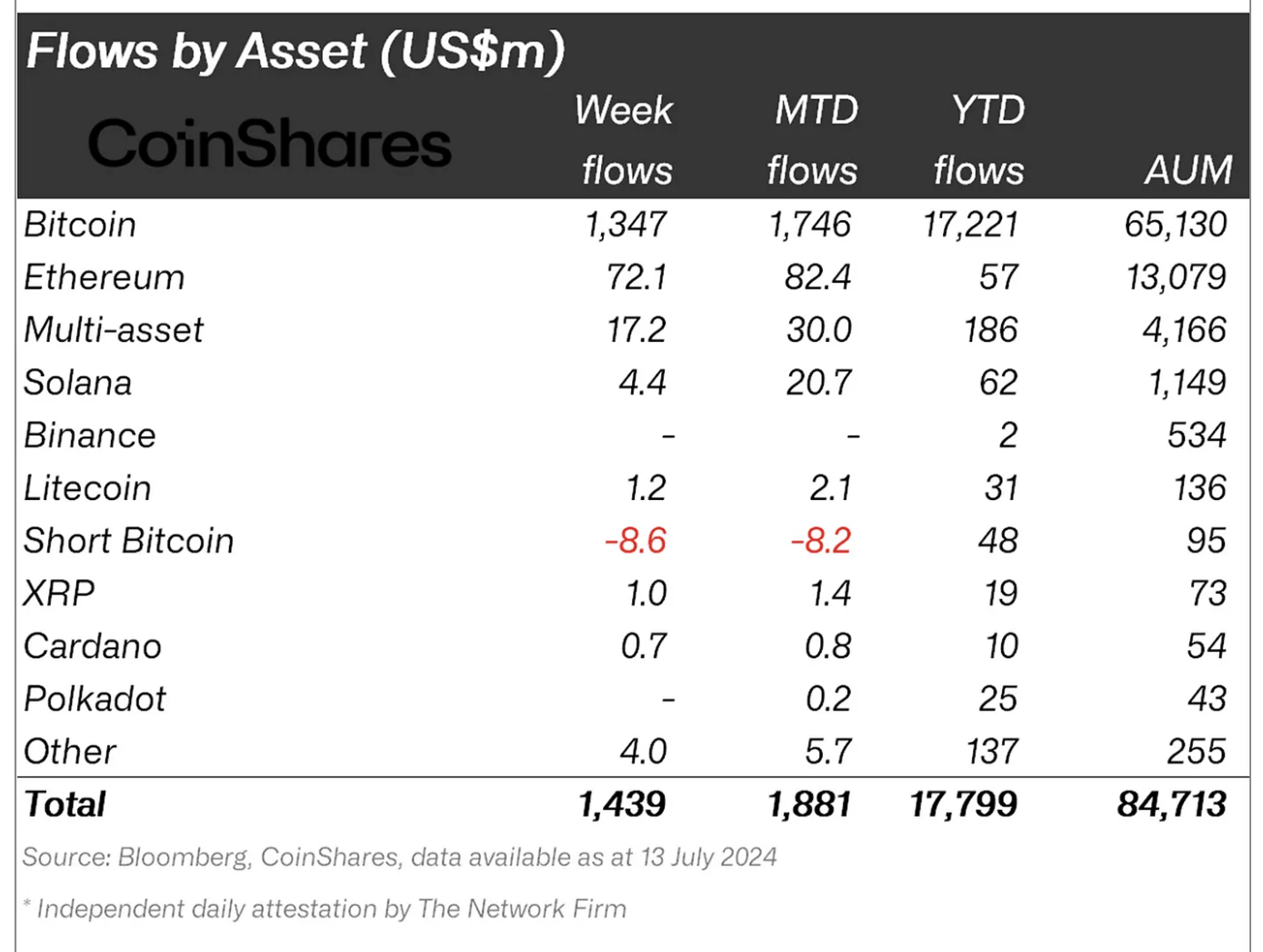

A substantial portion of this growth can be explained by investors seizing opportunities presented by the price drops of various cryptocurrencies. Bitcoin investment funds spearheaded this trend, contributing around $1.35 billion to the overall increase.

The strong demand from investors for the top cryptocurrency is evident, as it remains the market’s dominant player amidst occasional price fluctuations.

In contrast, there was a turnaround for investments that wagered against Bitcoin (short-Bitcoin investments), resulting in a net withdrawal of $8.6 million – the largest since April.

James Butterfill, the head of research at CoinShares, pointed out that the change in investments suggests a shift in perspective. This alteration could be a result of improved market circumstances or possibly just tactical adjustments to portfolios for major investors.

It’s thought that the German Government’s bitcoin sell-offs and unexpectedly low US Consumer Price Index (CPI) figures caused investors to buy more, driven by weak prices and a shift in market sentiment.

As a financial analyst, I’ve observed that the global inflow into our investment market experienced a significant surge, totaling over $1.3 billion. Notably, US-based funds emerged as the largest recipients of these investments. Nevertheless, it’s important to acknowledge that other regions also witnessed substantial inflows during this period.

For example, Switzerland contributed around $36 million, while Hong Kong and Canada combined brought in over $137 million, demonstrating a widespread appetite for cryptocurrency investments.

As an analyst, I’ve noticed an intriguing development in the Ethereum investment landscape. Specifically, there was a noteworthy surge in inflows, totaling $72 million into Ethereum-based products. This increase, according to Butterfill, can be attributed to investors’ anticipation of the upcoming approval of a spot-based ETF for Ethereum in the United States.

Gradual Recovery: Bitcoin And Ethereum Market Performance

Last week’s crypto market inflows seem to have influenced Bitcoin and Ethereum’s prices, resulting in noteworthy rebound after their corrections. The corrections caused Bitcoin to dip as low as $53,000 and Ethereum to drop below the $2,900 mark.

In the last 24 hours, Bitcoin has experienced a significant gain, rising by 6.1% and reaching a value of $63,764. However, it’s still around 13.9% lower than its peak in March when the price went above $73,000.

Just like Bitcoin, Ethereum has shown similar price trends in the last 24 hours, with an increase of 6.4%, bringing its current value to $3,396.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- Simone Ashley Walks F1 Red Carpet Despite Role Being Cut

- How to Update PUBG Mobile on Android, iOS and PC

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

2024-07-16 10:19