As a seasoned crypto investor with a knack for spotting trends and navigating market volatility, I find the recent surge in Bitcoin inflows both exciting and reassuring. Having weathered the 2017 bull run and the subsequent bearish years, I can confidently say that this steady growth is a testament to the maturity and resilience of the crypto market.

In October, there was a significant rise in investment in digital assets across the board. This increase was particularly noticeable in cryptocurrency investment products, with Bitcoin-related investments seeing considerable influxes, as indicated by recent figures from CoinShares.

In just a single week, international cryptocurrency investment funds collected a total of $901 million, bringing the monthly total to an impressive $3.4 billion.

Bitcoin Dominates Inflows As Ethereum Sees Outflows

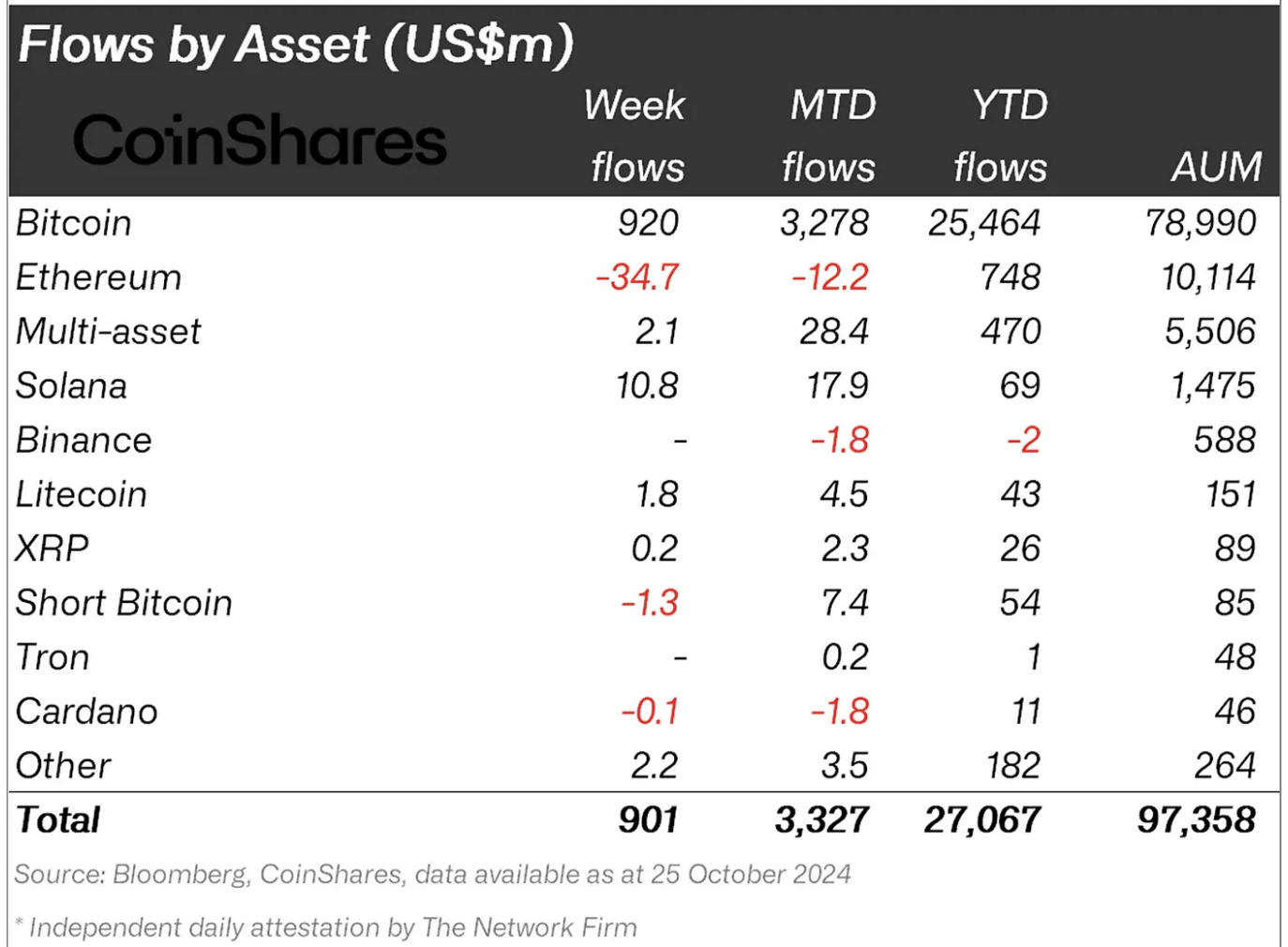

As reported by CoinShares, Bitcoin-focused investment funds accounted for the majority of incoming investments last week, attracting approximately $920 million.

Inflows into U.S.-based Bitcoin exchange-traded funds (ETFs) totaled approximately $997.6 million, with the majority coming from BlackRock’s iShares Bitcoin Trust (IBIT).

Inflows of $12.2 million went into blockchain stocks and products linked to Solana, while Bitcoin’s dominance was evidently strong as it attracted similar investments totaling approximately $10.8 million.

On the contrary, other investments tied to Bitcoin, even those operating beyond U.S. markets, experienced some withdrawals. Concurrently, Bitcoin saw robust investments pouring in. Meanwhile, Ethereum-related funds witnessed net outflows totaling $34.7 million during the previous week, suggesting a waning interest from investors.

As a researcher, I’ve noticed an intriguing development: the value ratio of Ethereum to Bitcoin, as reported by CoinShares, has reached its lowest point since April 2021. This shift might be playing a role in the current trend of outflows from Ethereum-related investment products.

It appears the data indicates that although Ethereum has experienced growth previously, it seems that investors are currently giving more attention to Bitcoin. This shift could be due to expectations of forthcoming regulatory clarification and increased mainstream acceptance, driven by advancements such as spot ETFs.

Regional Trends And Behind The Boom

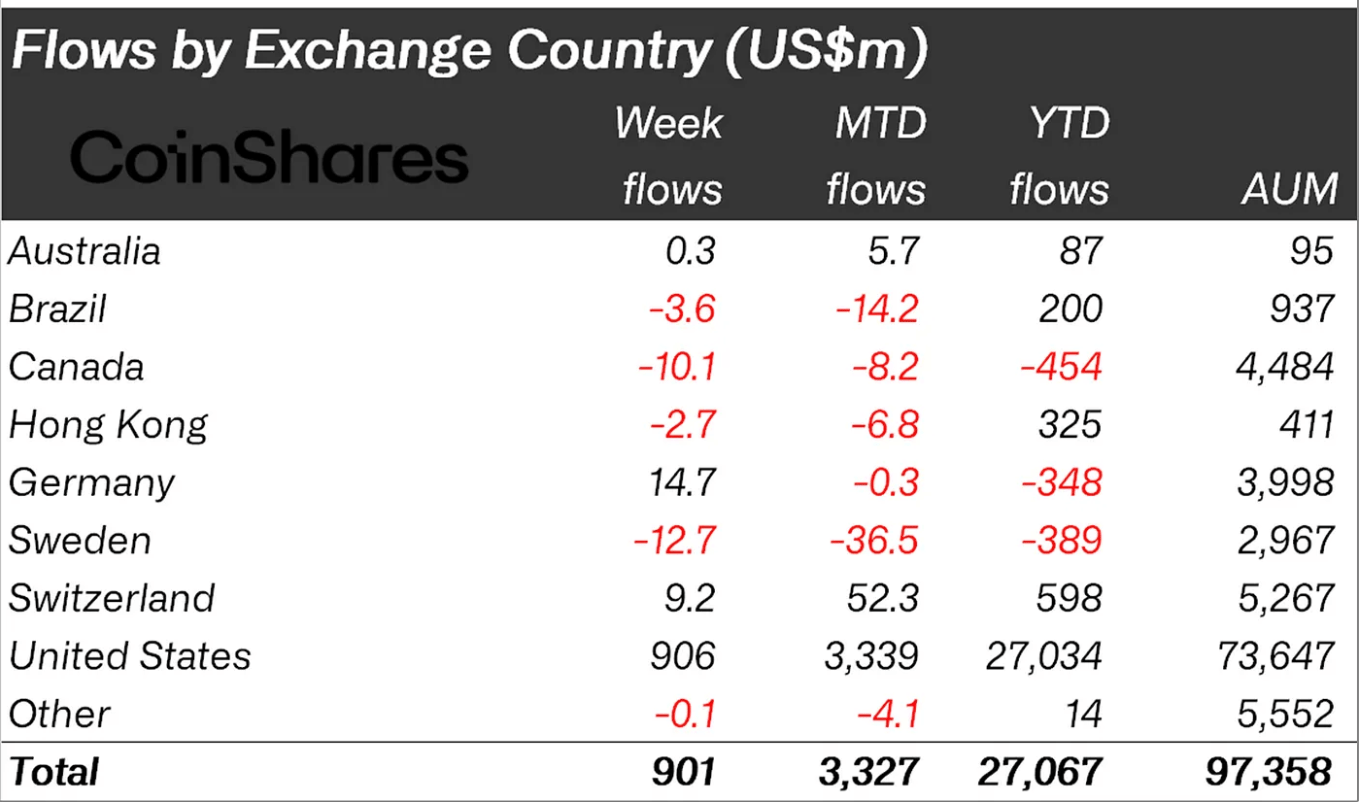

Last week, U.S.-located cryptocurrency investment funds received a significant amount of approximately $906 million in total inflows. On the other hand, investment funds from regions such as Sweden, Canada, Brazil, and Hong Kong collectively faced outflows amounting to around $29.1 million.

This disparity underscores the increasing influence of the U.S. in molding the worldwide cryptocurrency investment arena, particularly since prominent American corporations such as BlackRock and Fidelity are broadening their cryptocurrency services.

As per the Head of Research at CoinShares, James Butterfill, it appears that the current political climate could be a significant factor driving recent fluctuations in Bitcoin prices and an uptick in investment inflows. Intriguingly, he observed a correlation between Republican gains in polls and growing enthusiasm for Bitcoin investments.

It implies that some market players might consider a change in political control advantageous for digital assets, possibly leading to expectations of regulatory improvements or wider cryptocurrency approval.

According to a report by CoinShares, the money flowing into digital asset funds in October accounted for about 12% of their total assets. This influx is the fourth largest on record and pushes the year-to-date total to approximately $27 billion, more than doubling the previous high of $10.5 billion set last year.

Featured imahge created with DALL-E, Chart from TradingView

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-10-29 07:34