As a seasoned crypto investor with over a decade of experience under my belt, I firmly believe that Bitcoin will continue to shine and make significant strides in 2025. Having witnessed its remarkable growth and resilience since its inception, I’ve learned to appreciate the power of this digital coin.

Over the past few weeks, Bitcoin has been registering solid numbers, which have raised analysts’ hopes for further breakthroughs. Its performance this year is particularly impressive given the advantageous market conditions, including the recent US elections that saw Donald Trump’s victory.

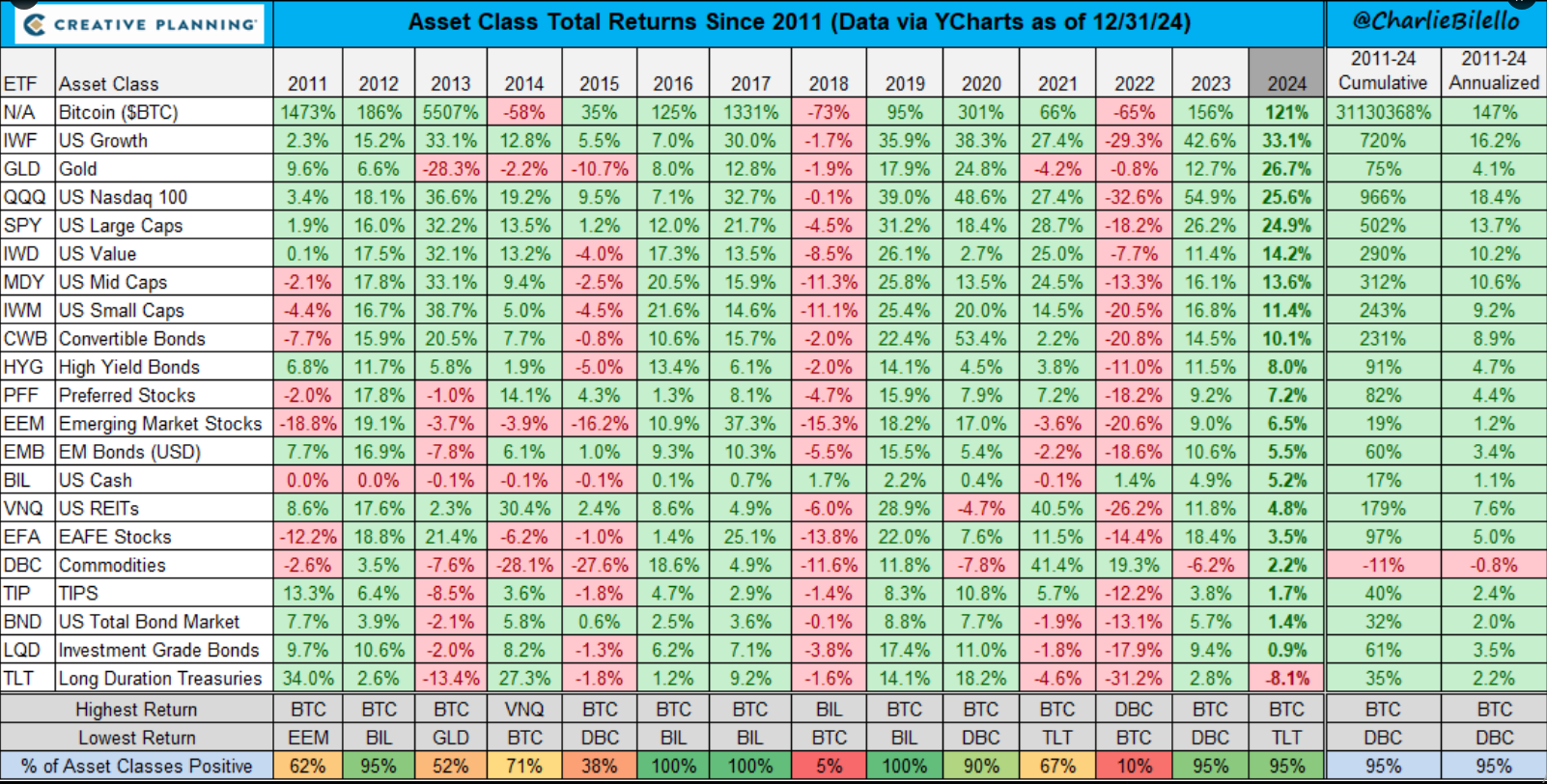

The latest research shows that Bitcoin has surpassed conventional asset classes such as gold, underscoring the optimism behind the coin. Compared to other asset classes like the Nasdaq 100, US large caps, mid-caps, and convertible bonds, Bitcoin’s performance has been exceptional, with returns dwarfing those of gold (26%) and even outperforming the Nasdaq 100 (25%).

While Bitcoin’s volatility remains a concern for many investors, its consistent performance over the past 14 years speaks volumes about its potential. Despite the occasional disappointments in yield, such as the -73% return in 2018, Bitcoin has generally proven to be a reliable performer, with some instances of yields reaching as high as 1,437%.

In light of these factors, I am confident that Bitcoin will continue to edge out gold and other US indexes in the coming years. That being said, investing in Bitcoin always comes with its fair share of risks, such as erratic price swings and policy announcements. However, for those who are willing to take on the challenge, the potential rewards could be substantial.

On a lighter note, I’ve often joked that my crypto portfolio is like a roller coaster ride – exciting, nerve-wracking, and filled with ups and downs. But hey, that’s part of the fun! The key is to buckle up tight and enjoy the ride!

Among all cryptocurrencies, Bitcoin seems poised for significant growth by the year 2025. This leading digital currency has shown impressive performance as it approaches 2025.

Over the past few weeks, analysts have seen promising increases in Bitcoin’s value and are confident it will continue to achieve significant advancements. According to recent studies, Bitcoin now outperforms traditional assets like gold, reinforcing the positive expectations surrounding this digital currency.

This year’s prosperity of the digital coin isn’t really a shock, given its rise due to various favorable market conditions, one of which being Donald Trump’s victory in the latest U.S. elections.

As a crypto investor, I’ve been thrilled to see Bitcoin outshine various investment avenues, especially gold. A report from Creative Planning and a tweet by Charlie Bilello highlighted this fact, revealing that Bitcoin’s performance was significantly more robust than gold, which only managed returns of 26%. This underscores the potential for digital currencies to deliver exceptional returns in today’s dynamic investment landscape.

As an analyst, I’ve observed some intriguing trends in the market. Specifically, the Nasdaq 100 has surged by a substantial 25%, followed closely by US large caps at 24%. Mid-caps aren’t far behind with a 13% increase, and convertible bonds are up by 10%. These numbers suggest a robust market performance. However, it’s important to remember that Bitcoin remains a volatile asset, prone to dramatic price fluctuations.

In contrast to Long Duration Treasuries, all significant assets experienced an increase in value during 2024, with Bitcoin taking the front position for the second consecutive year.

— Charlie Bilello (@charliebilello) January 1, 2025

Bitcoin Edges Gold And Other US Indexes

Despite facing some criticism and regulatory scrutiny, Bitcoin consistently ranks among the highest-performing asset categories. Since its inception in 2011, Bitcoin has outpaced all other asset classes, with the exception of a few years where it produced negative returns for holders. For instance, Bitcoin’s yield was as low as -73% in 2018.

For the majority of its history, Bitcoin has often shown strong performance, with some instances where returns exceeded an impressive 1,000%. In fact, as depicted in the same graph, Bitcoin provided a staggering yield of 1,437% back in 2011. This is significantly higher than long-term treasuries that only managed a “modest” return of 34% during the same period.

Occasionally, Bitcoin’s returns have fallen short of expectations for its owners and investors. A look at its yields this year will show that they are lower compared to the impressive 156% return it gave last year. Remarkably, Bitcoin outperformed all major asset classes, including gold, in the previous year as well.

Bitcoin Shows Strength, But Volatility Remains

For the last 14 years, Bitcoin has generally outperformed many other investment options. However, its high volatility continues to spark debate. Investing in Bitcoin, as well as other cryptocurrencies, carries risks associated with sudden price fluctuations and unexpected policy changes.

2024 saw Bitcoin’s value increase significantly, with its price surpassing double the initial start point around $40k. Currently, it is being traded at a price ranging from $95,000 to $97,000.

On December 5th, Bitcoin reached a price of $100k, but fell below this level the next day. Similarly, Ether experienced a surge and volatility, with a nearly 50% increase in value for the year, and is currently trading at around $3,400.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2025-01-04 04:17