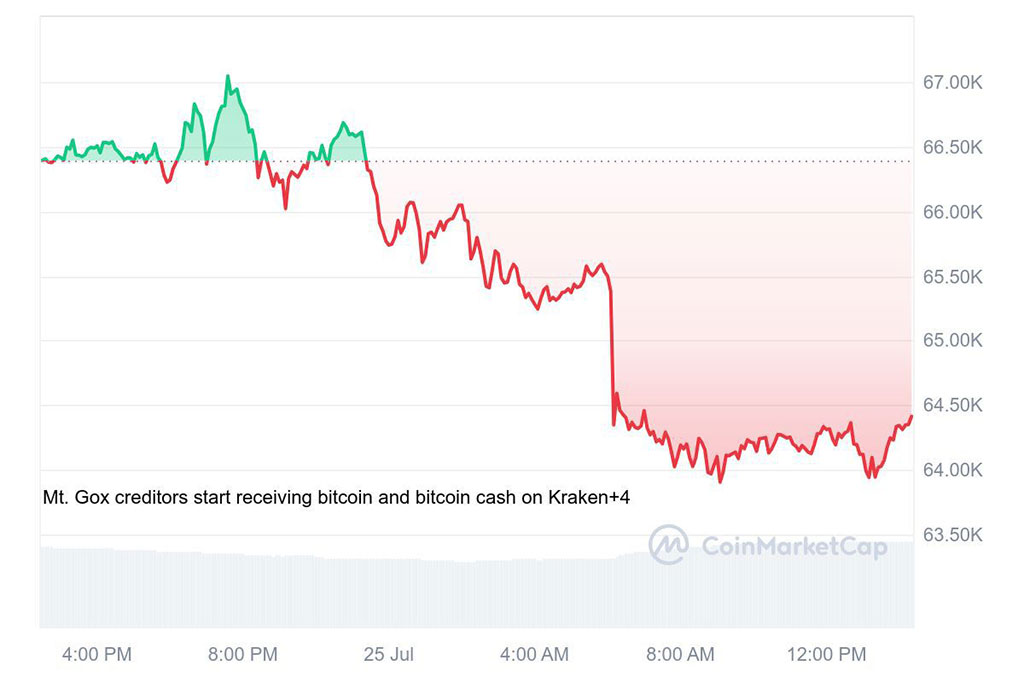

As a seasoned cryptocurrency analyst with over a decade of experience in the financial markets, I have seen my fair share of market fluctuations and price swings. The recent dip in Bitcoin (BTC) below the $65,000 level for the first time in a week has raised some concerns among investors, but I believe there are more plausible explanations than the ongoing Mt. Gox creditors’ sell-offs.

The price of Bitcoin (BTC) dipped under $65,000 for the first time in a week, causing unease among investors. Some suspect that selling pressure from Mt. Gox creditors may be contributing to this downturn, leading to forced liquidations for Bitcoin. Nevertheless, analysts argue that the price drop is most likely the result of seasonal influences and recent occurrences.

Concerns about a possible fire sale by Mt. Gox had been building up for weeks as the defunct cryptocurrency exchange made preparations to return the recovered Bitcoin to its creditors. However, CryptoQuant founder Ki Young Ju cast doubt on this hypothesis in a recent post on Reddit. He maintained:

Based on my extensive experience in financial markets and having closely monitored the events surrounding Mt. Gox, I can assure you that the feared instant dump did not materialize. Any price fluctuations we may observe would more likely be driven by market sentiment rather than Mt. Gox selling off its bitcoins.

Roman, a seasoned crypto trader, brushed off the Mt. Gox apprehensions, labeling them as “unfounded fears” or “baseless anxieties.”

Market Slump Signals “Uptober” Rally

Multiple analysts put forward different reasons for the price drop. Among them, Timothy Peterson of Cane Island Alternative Advisors highlighted historical patterns. “Based on our findings,” Peterson said, “there’s a recurring pattern of poor performance from late July to early September.” He further noted that this trend typically sets the stage for a robust market recovery, or “Uptober,” in the last month of the year.

As an analyst, I’d rephrase Charles Edwards’ perspective as follows: I, Charles Edwards, founder of Capriole Investments, hold a divergent view on the market impact of the first spot Ether ETF launch on July 23rd. In my opinion, the timing of this event may have dampened market sentiment. If the ETH ETF had been launched in 2024 instead, the overall market situation would have been more favorable. I argue that the ETF’s introduction has been detrimental to both Bitcoin and Ethereum, potentially confusing institutional investors.

Pseudonymous crypto trader “Roman” proposed another theory. He believes the decline is simply a correction following a recent Bitcoin price surge. This surge, he argues, was driven by the news of a failed assassination attempt on former US President Donald Trump. “This pump was artificial,” Roman stated. “And news-based moves often retrace quite a bit,” he added.

Buying Opportunity or Short-term Blip?

Despite the recent price drop, Bitcoin maintains a favorable image in the broader market. The Crypto Fear and Greed Index, which gauges investor emotions, indicates a “Greed” stance at present. Consequently, many investors view this downturn as an enticing chance to buy.

The causes of Bitcoin’s recent price decline are still up for debate among experts, but it seems that concerns about Mt. Gox have temporarily eased. Some analysts attribute the drop to seasonal trends, the debut of the Ethereum ETF, or even a market correction triggered by news events. Despite this setback, the overall outlook for Bitcoin remains optimistic, making this dip potentially just a brief interruption in its continued upward trend.

Photo: CoinMarketCap

Currently, Bitcoin is priced at $64,300, representing a 2.95% drop over the past 24 hours. Notably, the trading volume has reached $28.61 billion today, which is 6.37% higher than the $27.50 billion recorded yesterday.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

2024-07-25 13:51