As a seasoned analyst with over two decades of experience in various financial markets, I have witnessed countless bull runs, corrections, and consolidations throughout my career. The current state of Bitcoin is reminiscent of the dot-com boom at the turn of the millennium – full of excitement, anticipation, and a hint of caution.

Over the past weekend, Bitcoin‘s trading activity remained relatively stable, fluctuating between approximately $91,700 and $88,700. This steady movement suggests strong price dynamics. Even though there were no major price surges, Bitcoin’s ability to maintain itself within this range is a testament to its current resilience and increasing market trust.

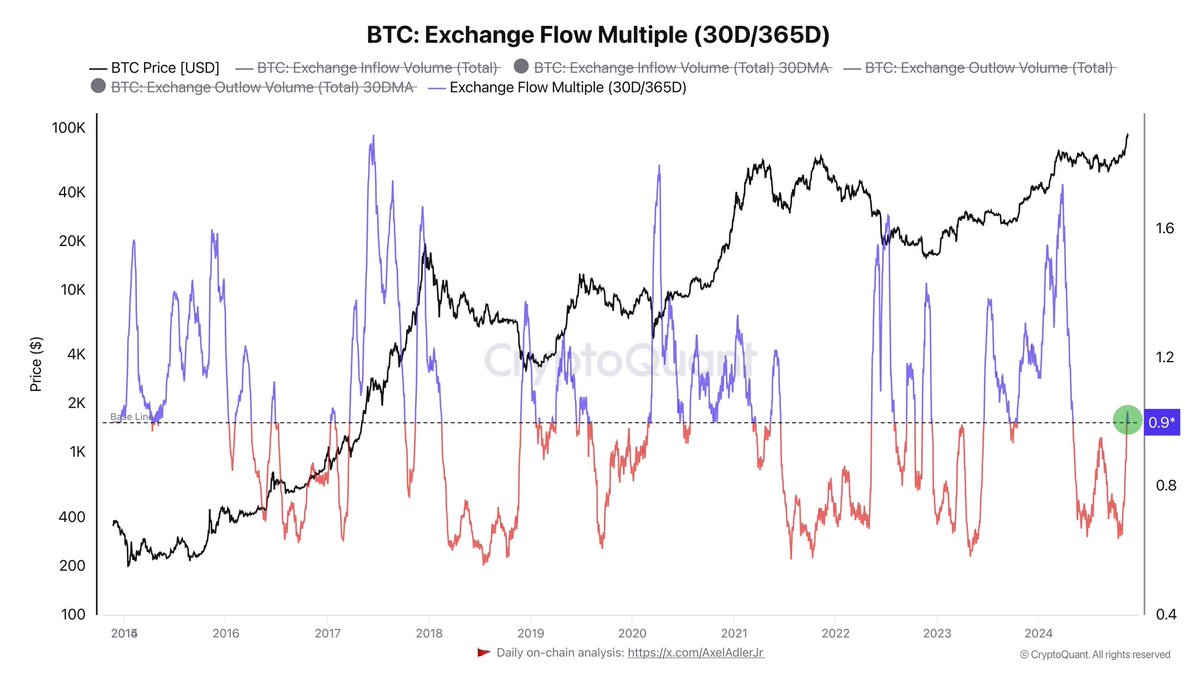

Information from CryptoQuant lends more positivity to the outlook, as it shows a significant decrease in selling pressure. This means that there are fewer sellers active in the market, which coincides with the broader optimism driving Bitcoin’s recent rise. With the supply side becoming increasingly limited, demand could potentially push Bitcoin prices even higher, supporting the robust price movements observed during the weekend.

Under a positive outlook, analysts anticipate strong increases in the upcoming months as Bitcoin appears poised to take advantage of advantageous market trends. They propose that due to reduced selling activity and persisting buyer interest, Bitcoin might be preparing for another major surge.

Observers are keeping a keen eye on whether this robustness could spark a fresh surge, propelling Bitcoin towards unexplored regions, as the market braces for the next significant shift during this bullish trend.

Bitcoin Flow To Exchanges Supports Bulls

Bitcoin has experienced a thrilling fortnight, skyrocketing by 39% in only nine days, which represents one of the most significant upward spikes during this cycle. This recent upswing has caused analysts and investors alike to feel both exhilarated and apprehensive as Bitcoin demonstrates its strength above crucial thresholds. However, even though there’s a widespread belief that BTC will sustain its bullish momentum, chances to acquire it at lower costs are progressively dwindling.

Insights from crypto analyst Axel Adler, as reported by Data from CryptoQuant, shed light on the recent market trends. Specifically, Adler highlights that the daily average transfer of Bitcoin to exchanges within the past month has not exceeded the average exchange volume experienced over the past year.

This suggests that not many Bitcoin holders are eager to sell during this surge, preferring instead to keep their Bitcoin. With fewer people selling and demand growing, Bitcoin’s price could potentially rise even higher.

Analysts generally concur that a period of stability within the existing price range is beneficial before the market sees further increases. This consolidation might help the market become more secure, draw in new investors, and create robust support levels for the upcoming expansion stage.

BTC Less Than 2% Away From ATH

Currently, Bitcoin is trading near its peak value of $93,483, sitting approximately 2% below that mark at around $91,700. This close approach to historic highs has sparked enthusiasm among investors, as there seems to be a strong possibility that the price could surpass this record-breaking level once more within the coming days. The market performance of Bitcoin continues to demonstrate resilience, bolstered by growing interest and optimistic sentiment among traders.

The consistent high price of Bitcoin is often linked to its capacity to hold vital points during phases when it’s not experiencing significant growth or decline. This durability suggests that buyers are still in control, increasing the likelihood of a new surge surpassing the $93,483 threshold. Experts predict that crossing this level could ignite another burst of intense buying activity, possibly propelling Bitcoin into unexplored price realms.

Nevertheless, it’s important to stay vigilant. A fall below $87,000 might indicate a reversal for Bitcoin, possibly triggering a brief correction in the near future. This could create a stronger base for the next expansion period, enabling BTC to stabilize and attract more investment.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-11-18 14:10