As a seasoned researcher with years of experience tracking the volatile world of cryptocurrencies, I’ve seen more market swings than a playground in recess. This week has been no exception, with Bitcoin flirting with new highs and then taking a tumble that made my heart skip a beat or two.

This week, I’ve noticed an interesting dichotomy in the price trajectory of Bitcoin. It soared to a record-breaking high, marking a new all-time peak, only to plummet approximately 13% a few days later. On December 20th, Friday, the BTC price dipped down to as low as $92,000.

After the U.S. Federal Reserve announced a rate cut, I saw the Bitcoin price plummet unexpectedly, which also caused other financial markets to lose value. However, it’s encouraging to note that the leading cryptocurrency is displaying signs of recovery and is currently hovering around $97,000.

Can Growing Demand Push BTC Price Back Above $100,000?

In a recent report from December 2020, the cryptocurrency market analysis platform CryptoQuant highlighted a fascinating shift in the supply-demand relationship of Bitcoin. The blockchain company suggests that the Bitcoin market is currently experiencing a resurgence in investor attention.

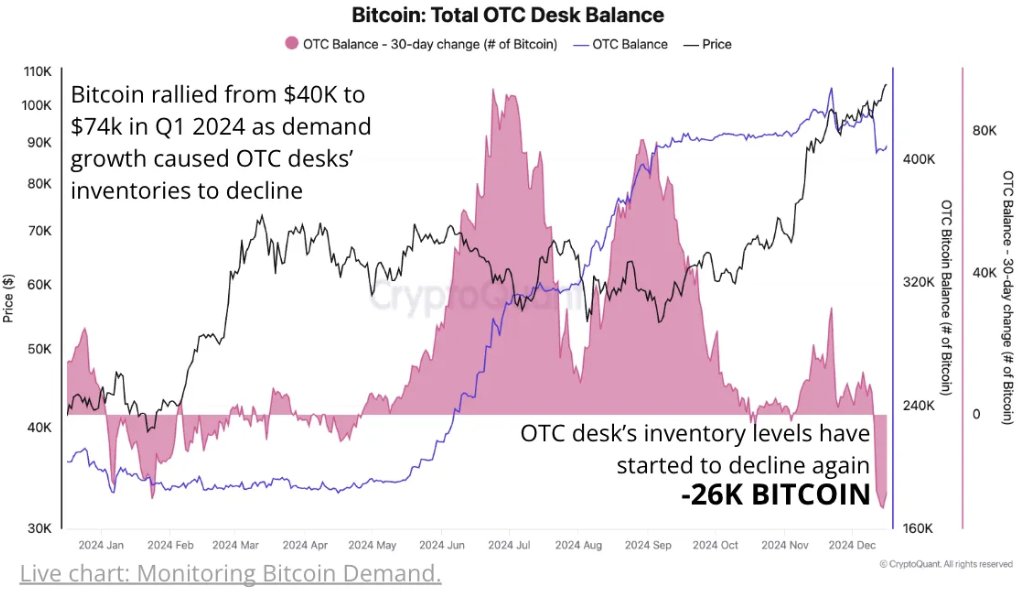

The relevant indicator here is the Total OTC Desk Balance, which tracks the amount of Bitcoin held in addresses associated with Over-The-Counter (OTC) desks. This metric provides an insight into the supply of BTC readily to large investors and institutional players.

Based on information from CryptoQuant, OTC desks have seen a record monthly reduction of approximately 26,000 Bitcoins in December alone, and this decrease has been even more pronounced over the past 30 days, with the balance falling by an additional 40,000 Bitcoins since November 20th.

The decrease in the overall Over-the-Counter (OTC) Bitcoin balance suggests a positive trend, indicating increased appetite for Bitcoin while simultaneously reducing its availability. This contraction in supply might lead to a time of substantial price growth.

As a crypto investor, I’ve been keeping an eye on the Bitcoin price movements, and it’s fascinating to note that in the first quarter of 2024, Bitcoin surged from $40,000 to approximately $74,000. This impressive rally was driven by increased demand that depleted the Over-The-Counter (OTC) desks’ inventory. Now, market intelligence suggests that these OTC desk inventories are once again approaching the levels seen during that first-quarter rally. This could potentially indicate another price surge for Bitcoin in the near future.

According to information from CryptoQuant, Bitcoin’s demand is increasing by approximately 228,000 coins each month since entering an expansion phase in late September. Simultaneously, the number of Bitcoin addresses holding the cryptocurrency (accumulation addresses) is rising at a record pace of about 495,000 BTC per month.

Bitcoin Price At A Glance

Currently, the cost of a Bitcoin is approximately $97,655, showing a minor decrease of 0.1% over the last day. On a weekly basis, the leading cryptocurrency has decreased by almost 4%, as per CoinGecko’s data.

Featured image created by DALL-E, chart from TradingView

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-21 18:04