As a seasoned crypto investor with over a decade of experience navigating the volatile and ever-changing cryptocurrency market, I find myself increasingly optimistic about Bitcoin’s future despite its recent price volatility. The analysis presented by CryptoCon and Kyledoops resonates deeply with my own observations of Bitcoin’s historical trend patterns.

1. The dramatic fluctuations in Bitcoin‘s recent pricing, including its fall below $50,000 last month, have noticeably slowed down the pace of the bull market that some analysts were expecting. However, despite this price slump, a particular crypto expert remains optimistic and forecasts a steep increase beyond $100,000 once the current adjustments in pricing have settled down.

Bitcoin Bull Run Still Going Strong

crypto expert CryptoCon views Bitcoin’s recent price decrease as a temporary obstacle, implying that the eagerly awaited bull market for Bitcoin remains undeterred. On August 28th, the analyst shared a positive outlook for Bitcoin on X (previously Twitter), predicting a bullish trend for Bitcoin based on its current pricing trends in comparison to historical patterns.

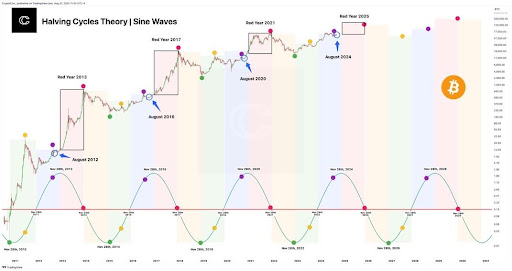

In simpler terms, CryptoCon suggests that the recent fluctuations in Bitcoin’s price and market instability might be diverting investors’ attention away from the overall trend. However, an analyst presented a comprehensive Bitcoin price graph showing all past halving cycles since 2013, each demonstrating a similar uptrend pattern.

The analyst found a consistent pattern in the fluctuations of Bitcoin’s value prior to and post each halving event, emphasizing an initial downward trend followed by a strong surge in buying activity. It was revealed that in August 2012, there was a substantial drop in Bitcoin’s price, later followed by reaching new peak values in 2013.

In the following bitcoin halving events – August 2016 and 2020 – we saw prolonged phases of relatively stable pricing, often referred to as “boring” periods, before a significant surge that led to record highs in 2017 and 2021. The year with this distinctive bullish trend has been coined by CryptoCon as the “Red Year.”

The analyst refers to the year 2024 as a “Calm Year” with predictable or unspectacular market movements. He hinted that this stage may be a period of accumulation or readying, leading up to a “Peak Year,” where Bitcoin’s value is projected to reach an unprecedented new record high.

Based on his study of past Bitcoin halving events, CryptoCon has significantly increased his cautious prediction for the peak price, revising the potential range from $90,000 to $130,000 to a new range of $110,000 to $160,000.

Other Analysts Share Similar Sentiment

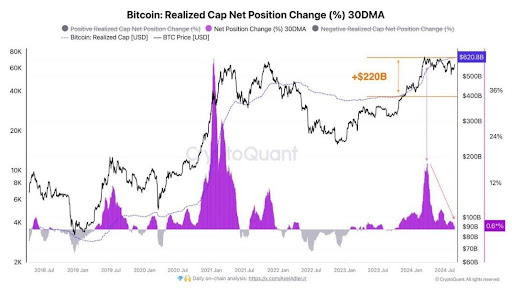

A well-known crypto analyst known as ‘Kyledoops’ on X platform expresses optimism about Bitcoin’s future price predictions. Kyledoops notes that the rate at which capital is flowing into Bitcoin is decreasing substantially, suggesting a delicate equilibrium where investors’ profits and losses are almost equal.

As a researcher examining historical trends in cryptocurrency markets, I’ve observed that periods of reduced capital inflow, such as the one Bitcoin is currently experiencing, have historically been preceded by substantial price fluctuations and spikes in volatility. This downturn could potentially signal imminent, large-scale price swings for Bitcoin.

In my current research, as I write this, Bitcoin’s price stands at approximately $58,051, marking a significant 9.07% drop over the last week. Despite recurring bearish tendencies, it appears that Bitcoin is determined to break through and maintain stability above the $60,000 price point.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-09-03 02:10