As a seasoned crypto investor with a decade of experience under my belt, I find myself closely monitoring the latest insights from on-chain analytics firms like Glassnode. The recent post discussing the trend in Bitcoin short-term holder profit-loss status caught my attention, particularly the emphasis on the Realized Price and Market Value to Realized Value (MVRV) Ratio.

Having seen market cycles come and go, I can attest that these indicators are crucial in understanding the overall sentiment of the network. In this case, the Bitcoin short-term holder MVRV Ratio being above 1 suggests that the group is still holding unrealized profits, which historically has been a red flag for potential selloffs.

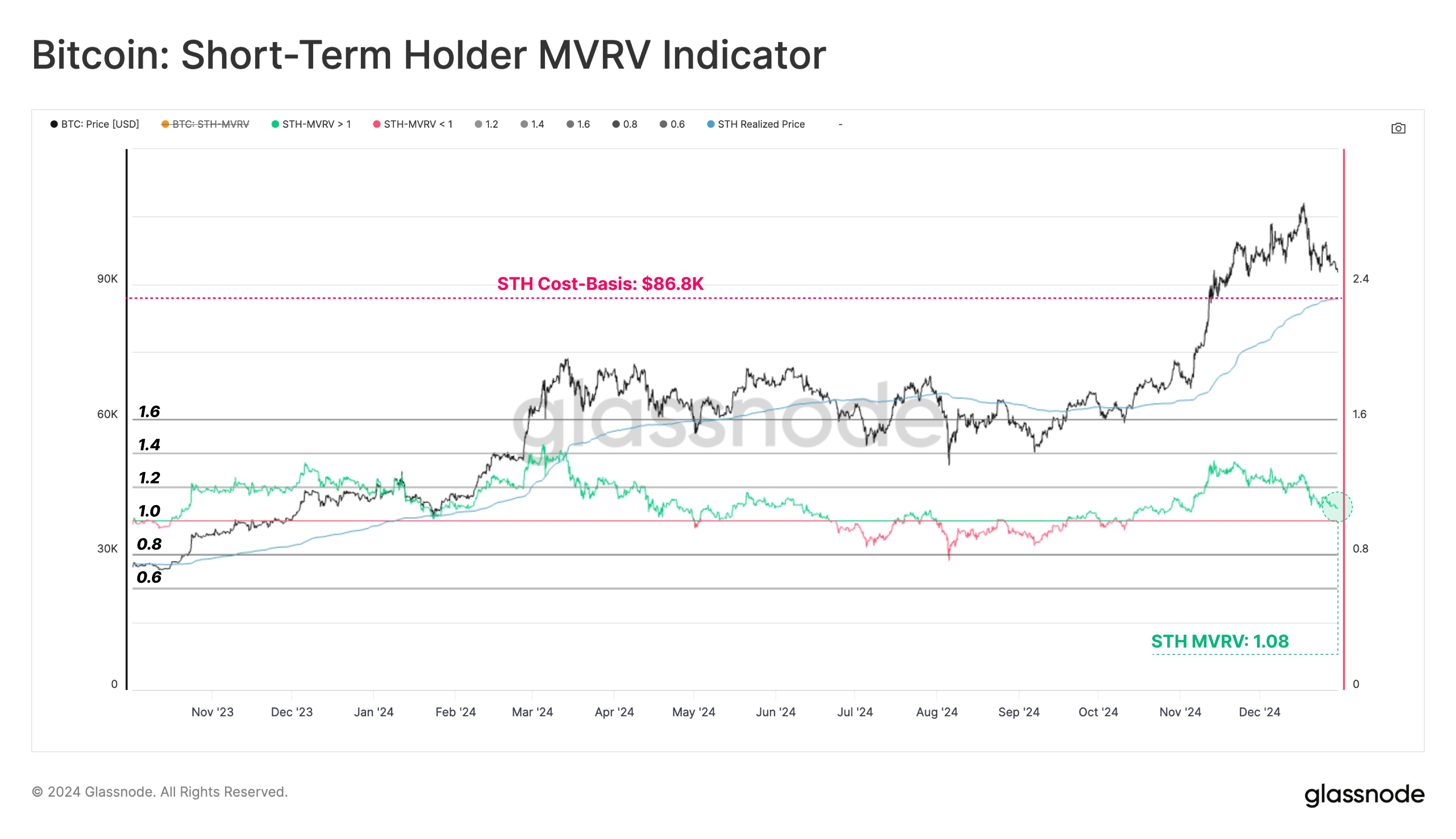

The Realized Price of $86,800 for short-term holders is noteworthy; it represents the break-even point for this cohort. If Bitcoin were to fall to this level, they would no longer be in profit – a situation that could potentially trigger selling pressure. However, as I always say, “Bitcoin is like a rollercoaster ride; it’s all about timing your entry and exit points.”

Currently, the price of Bitcoin is hovering around $94,500, having briefly dipped under $92,000 yesterday. While this may seem volatile to some, I view it as part of the natural ebb and flow of the market. As a wise man once said, “In the world of cryptocurrency, nothing is certain except for taxes and volatility.”

So, while it’s important to keep an eye on these indicators and price movements, remember to always do your research, invest responsibly, and never forget the old crypto adage: “Not your keys, not your coins!”

And as a final note, I’d like to share a light-hearted thought: “The only thing certain about Bitcoin is that it will continue to surprise us – and sometimes, it might even make us laugh.” After all, who would have thought that a digital currency created in the wake of the 2008 financial crisis would become one of the most influential assets in the world? Crypto investing can be a wild ride indeed!

At present, on-chain statistics indicate that the current Realized Price for short-term Bitcoin holders stands at approximately $86,800, a figure worth keeping an eye on.

Bitcoin Is Still At A Notable Gap From Short-Term Holder Cost Basis

In their latest update on platform X, Glassnode has delved into the shifting profit-loss situation among short-term Bitcoin holders. A key metric they’re focusing on is the “Market Value to Realized Value (MVRV) Ratio,” which compares Bitcoin’s Market Capitalization with its Realized Capitalization.

In this context, “Realized Cap” signifies a method used to calculate the total market capitalization of a cryptocurrency based on the price at which each token was previously traded within the blockchain network. It’s essentially considering the last transaction price as the true value for each coin in circulation.

In simpler terms, when a coin is transferred for the last time, that’s typically when it was last traded. The price at that point in time can be considered its current cost basis. So, the Total Realized Capital simply refers to the total amount of money investors collectively spent to acquire the cryptocurrency.

Instead, let’s say this way: Contrastingly, Market Cap signifies the current worth held by all the coin owners in the market. By comparing this with the MVRV (Market Value to Realized Value) Ratio, we can gauge the profit or loss status of the network.

In the context at hand, instead of using the traditional MVRV Ratio that gauges the entire market, we’ll focus on a variant tailored to short-term holders (STHs). These are individuals who have acquired their coins within the previous 155 days.

As a seasoned cryptocurrency investor with several years of experience under my belt, I have come to appreciate the value of using various indicators to gauge market trends and make informed investment decisions. One such indicator that has caught my attention lately is the Bitcoin STH MVRV Ratio, which provides valuable insights into the market dynamics of the world’s most popular digital currency.

In the chart shared by the analytics firm, we can see the trend in the Bitcoin STH MVRV Ratio over the past year or so. This ratio compares the realized price of Bitcoin held by long-term holders (STH) to its current market value. By analyzing this ratio, I can determine whether long-term holders are in profit or loss and make more informed decisions about my own investment strategy.

For instance, a high MVRV Ratio indicates that long-term holders are realizing significant profits, which could potentially lead to profit-taking and downward pressure on the price of Bitcoin. Conversely, a low MVRV Ratio suggests that long-term holders are experiencing losses, which could signal a buying opportunity for investors like myself.

Overall, I find the Bitcoin STH MVRV Ratio to be an invaluable tool in my investment arsenal, and I will continue to closely monitor this indicator as I navigate the ever-changing landscape of the cryptocurrency market.

According to the graph, the Bitcoin STH MVRV Ratio significantly increased beyond 1 during the recent surge in BTC prices. This means that the market value of the group exceeds its realized value, suggesting that most investors are currently in a profitable position.

Lately, since the cryptocurrency’s price dropped, it’s only natural that its indicator followed suit. However, this indicator is currently above the 1 level, implying that the group’s gains still exceed their losses, indicating they are still in profit.

Currently, the STH MVRV Ratio stands at approximately 1.08, indicating that investors within this group are currently sitting on around 8% unrealized gains. Historically, Shorters-to-Hodlers (STHs) have demonstrated a tendency to be more impulsive market participants prone to selling off, which means that when they accumulate large profits, it often serves as a warning sign for potential price drops.

After the reduction in funds, the group isn’t generating substantial earnings anymore, and it might be necessary for a period of relaxation if the danger of cashing out needs to decrease. A useful indicator to monitor when this could occur is the “Realized Price,” which is calculated by dividing the Realized Cap by the total quantity of tokens in circulation.

According to the graph, the current Realized Price for STH stands at $86,800. This implies that the group would recoup their initial investment if the price of Bitcoin drops down to this point.

BTC Price

Yesterday, Bitcoin dipped below $92,000, but it’s since bounced back and is currently being traded at roughly $94,500.

Read More

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The Babadook Theatrical Rerelease Date Set in New Trailer

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- Paul McCartney Net Worth 2024: How Much Money Does He Make?

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- Cardi B Sparks Dating Rumors With Stefon Diggs After Valentine’s Outing

2024-12-31 23:11