As a seasoned analyst with over two decades of experience in financial markets, I find the recent price action of Bitcoin intriguing and thought-provoking. My life experiences have taught me that markets can be unpredictable, much like a roller coaster ride, filled with ups and downs but always moving forward.

Yesterday, Bitcoin experienced a significant decline of around 8%, falling from its record peak of $108,300, following the Federal Reserve’s decision to lower interest rates by 0.25% and adjust their policy to suggest fewer rate cuts in 2025. However, despite this drop, Bitcoin maintained its position above $98,000, an important level that analysts are keeping a close eye on due to its connection with liquidity.

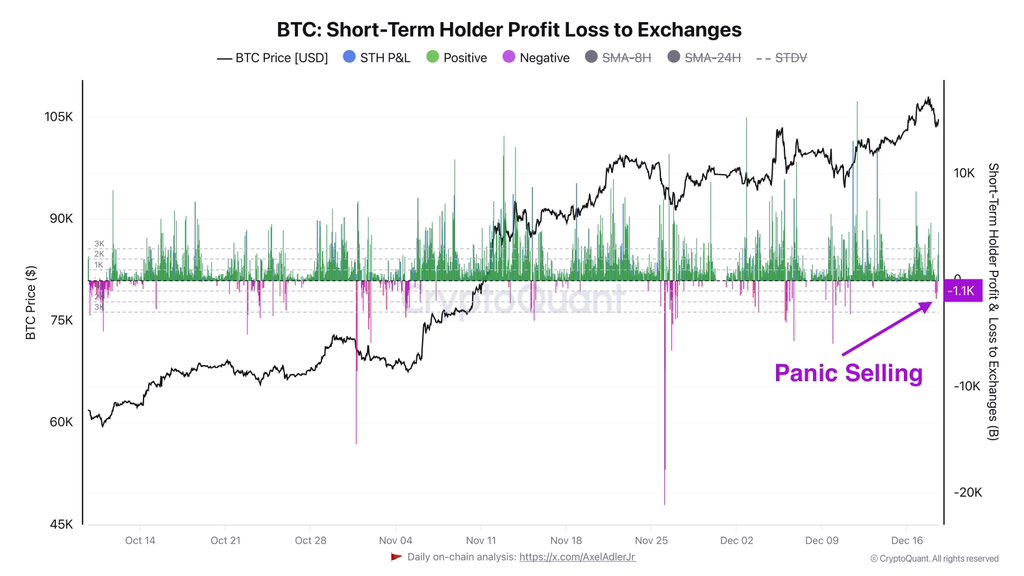

This latest movement in prices poses a critical query: could this be the beginning of a larger price drop or merely a turbulence to propel Bitcoin’s upward trend even further? CryptoQuant analyst Axel Adler shared valuable perspectives, pointing out that there seems to be no widespread panic selling occurring in the market—an indication that investor trust remains relatively strong at this time.

Bitcoin’s toughness at present levels indicates that the market is adjusting following the Federal Reserve’s recent actions. As traders and investors process these changes, everyone is watching to see if Bitcoin can regain momentum and move back towards its previous peaks, or if it might experience further setbacks. With the market mood uncertain, the upcoming days will be crucial in deciding Bitcoin’s next move.

Bitcoin Remains Strong

As a crypto investor, I’ve noticed the recent dip and the change in market sentiment, but I remain optimistic about Bitcoin. Despite these turbulences, Bitcoin has managed to stay above significant liquidity levels, which is a testament to its long-term bullish structure. The price drop, triggered by broader market reactions to the Federal Reserve’s policy announcement, has indeed stirred some concerns. However, Bitcoin’s steadfastness in holding crucial support points reflects its underlying robustness, and I believe this could pave the way for potential recovery.

Top CryptoQuant analyst Axel Adler recently shared data on X, shedding light on the market’s current dynamics. According to Adler, no significant panic selling is evident, even after Bitcoin’s sharp decline.

He highlighted a chart tracking the BTC short-term holder profit-loss to exchanges, revealing that this metric is currently at a higher level than seen during early December selling events. This indicates that the recent sell-off may have been less driven by fear and more of a strategic shakeout.

Based on my extensive experience in the cryptocurrency market, I believe that this recent shakeout could potentially stimulate liquidity and fuel Bitcoin’s ongoing rally. However, I must stress a word of caution: this event might signal the start of a broader correction that may take some time to fully unfold. I have witnessed similar market fluctuations in the past, and I know from experience that such corrections can be unpredictable and require a great deal of patience. It’s crucial for investors to remain vigilant and adapt their strategies accordingly.

Over the next few weeks, Bitcoin’s fate could become clearer. As the market finds its balance, there’s much anticipation about whether Bitcoin will regain its high points or if it may experience more contraction instead.

Price Action: Technical Levels To Hold

At present, Bitcoin is being exchanged for around $101,800, having passed a favorable test of local demand at approximately $98,695 earlier today. The overall structure of Bitcoin’s price remains solid, with it displaying a clear trend of successively higher peaks and troughs, indicating persistent bullish energy. Despite the recent fluctuations, the general market outlook remains optimistic as BTC manages to stay above crucial support thresholds.

To keep moving upward, Bitcoin needs to surpass the $103,600 mark decisively. This level was crucial last week, acting as a pivotal point where both buyers and sellers took notice. Overcoming this resistance could indicate renewed energy, paving the way for more growth as Bitcoin aims for new record-breaking heights.

Failing to surpass $103,600 might spark a change in investor sentiment. If Bitcoin (BTC) also falls below the $100,000 psychological threshold, it would possibly signal the onset of a broader price adjustment. This situation could push the price down towards lower support levels as the market reevaluates its position.

Over the coming days, Bitcoin’s immediate trajectory will significantly depend on the situation. Investors are keeping a close eye on the $103,600 barrier as potential resistance and the $100,000 mark as possible support. These key levels will help decide whether Bitcoin will continue its upward trend or experience a correction period instead.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Gold Rate Forecast

2024-12-19 17:46