As a seasoned researcher with over two decades of experience in the financial markets, I have learned to take predictions with a grain of salt and always maintain a critical perspective. However, when it comes to Bitcoin, I’ve seen enough unprecedented price movements to not entirely dismiss these bullish forecasts.

Based on the analysis of Tony Severino, a cryptocurrency expert previously with Twitter, the price of Bitcoin might experience a substantial jump to around $120,000 within the coming week. His optimistic prediction is supported by the expanding daily Bollinger Bands (BB) and similarities in Bitcoin’s current price action compared to what was observed in 2023.

BTC Price Targets $120,000 ATH

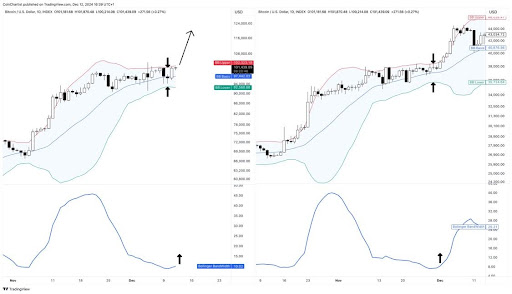

On December 12th, Severino posted a technical analysis diagram for Bitcoin based on Bollinger Bands and a historical trend of late 2023 pricing movements. The analyst speculated that if past events recur, the Bitcoin price might attain a new peak of $120,000 within the upcoming week.

Severino shared that the daily range of Bitcoin’s Bollinger Bands is growing wider, and its current trading pattern mirrors a bullish run similar to what was seen in 2023. Upon examining the analyst’s forecast for 2024, the upper and lower boundaries of these bands can be visualized as red and green trend lines respectively.

Generally speaking, when the Bollinger Band widens, it suggests that the price of a security like Bitcoin is becoming more volatile. If Bitcoin manages to move above the upper boundary of this band, it might signal the start of an uptrend or bullish phase. Conversely, if it falls below the lower band, it could indicate a downtrend or bearish phase. Notably, Bitcoin recently touched the lower Bollinger Band at approximately $92,560 and is currently moving towards the upper band at around $102,323. The analyst has also calculated that the midpoint of Bitcoin’s Bollinger Band is at roughly $97,442.

In December of 2023, Severino noticed that the Bitcoin price graph on the right demonstrated an event where BTC surpassed the upper boundary of the Bollinger band and subsequently experienced a substantial surge as it moved along the bands higher. This pattern from the past is mirrored in Bitcoin’s 2024 price structure, suggesting a possible large increase in value if conditions similar to those observed in 2023 are repeated.

If Bitcoin’s closing price surpasses its upper Bollinger Band and triggers a buy signal, it might ignite an upward trend potentially reaching $120,000. At present, Bitcoin is valued at $100,219, which means it would have to rise by approximately 20% to hit the predicted target within the next week.

Analyst Confirms Bitcoin Bollinger Band Bullish Signal

As an analyst at X, I’ve been closely observing Bitcoin’s recent price movement, and I believe there are strong indications pointing towards a potential continuation of the uptrend. Using Bollinger Bands and Bollinger Band Width (BBW), I noticed some interesting patterns.

According to Trader Tardigrade, the compression of Bitcoin’s Broadening Wedge formation has been exposed, which mirrors its price behavior in early November, right before it experienced a significant jump from $70,000 to $100,000. If Bitcoin maintains its current upward momentum, the analyst anticipates a potential rise that could propel the cryptocurrency towards a fresh record high of $136,000. This projected price escalation corresponds to an impressive 36% growth from Bitcoin’s current value.

Read More

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- How to get all Archon Shards – Warframe

- Fear of God Releases ESSENTIALS Summer 2025 Collection

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- Gold Rate Forecast

- What’s the Latest on Drew Leaving General Hospital? Exit Rumors Explained

2024-12-14 06:04