As a seasoned analyst with over two decades of experience in financial markets under my belt, I find myself intrigued by the latest developments in the Bitcoin market. The recent dip below $93,000 has caught my attention, and upon closer examination, the Coinbase Premium Gap appears to be providing some insights into the current trend.

Over the last 24 hours, Bitcoin‘s value has dropped below the $93,000 mark. Let me share some insights about potential reasons for this decline based on the current market trend.

Bitcoin Coinbase Premium Gap Has Gone Cold

According to Maartunn’s latest post on X, it has been noted that the gap between Bitcoin’s price on Coinbase versus Binance has recently returned to its normal levels. This “Coinbase Premium Gap” is a measure that monitors the variation in Bitcoin’s price when listed against the USD pair on Coinbase and the USDT pair on Binance.

This measurement primarily highlights the distinctions in trading patterns between the user communities of the two cryptocurrency platforms, Coinbase and Binance. Notably, a significant portion of Coinbase’s traffic originates from American investors, particularly large institutional entities, while Binance caters to a global investor base.

When the Coinbase Premium Gap is greater than zero, this indicates that US-based whales are engaged in purchasing or reducing sales at a faster rate compared to Binance users, leading to the asset’s higher price on Coinbase. Conversely, when the gap is less than zero, it suggests that there is a stronger buying pressure among Binance users, causing the asset to be cheaper on that platform.

Here’s a graph illustrating the recent evolution of the Bitcoin Coinbase Price Differential:

Over the last graph I’ve been checking, it appears that the Bitcoin Coinbase Premium Gap, which previously held significant positive levels, has dropped down to the neutral zero point over the past day.

As an analyst, I’ve observed that Microstrategy’s recent $5.4 billion purchase, spearheaded by Michael Saylor’s firm, appears to be the origin of the positive premium we’ve seen. The lull in the indicator lines up neatly with the completion date of this acquisition. This substantial accumulation from the company played a crucial role in Bitcoin maintaining its recent highs. However, with the buying pressure now depleted, Bitcoin has experienced a dip and is currently trading below $93,000.

In 2024, there’s been a consistent correlation between Bitcoin (BTC) and the Coinbase Premium Gap. Therefore, it’s worth monitoring this metric in the coming days, as its movement might again predict BTC’s next direction. If it dips into negative territory, it could signal more downward price action for the asset.

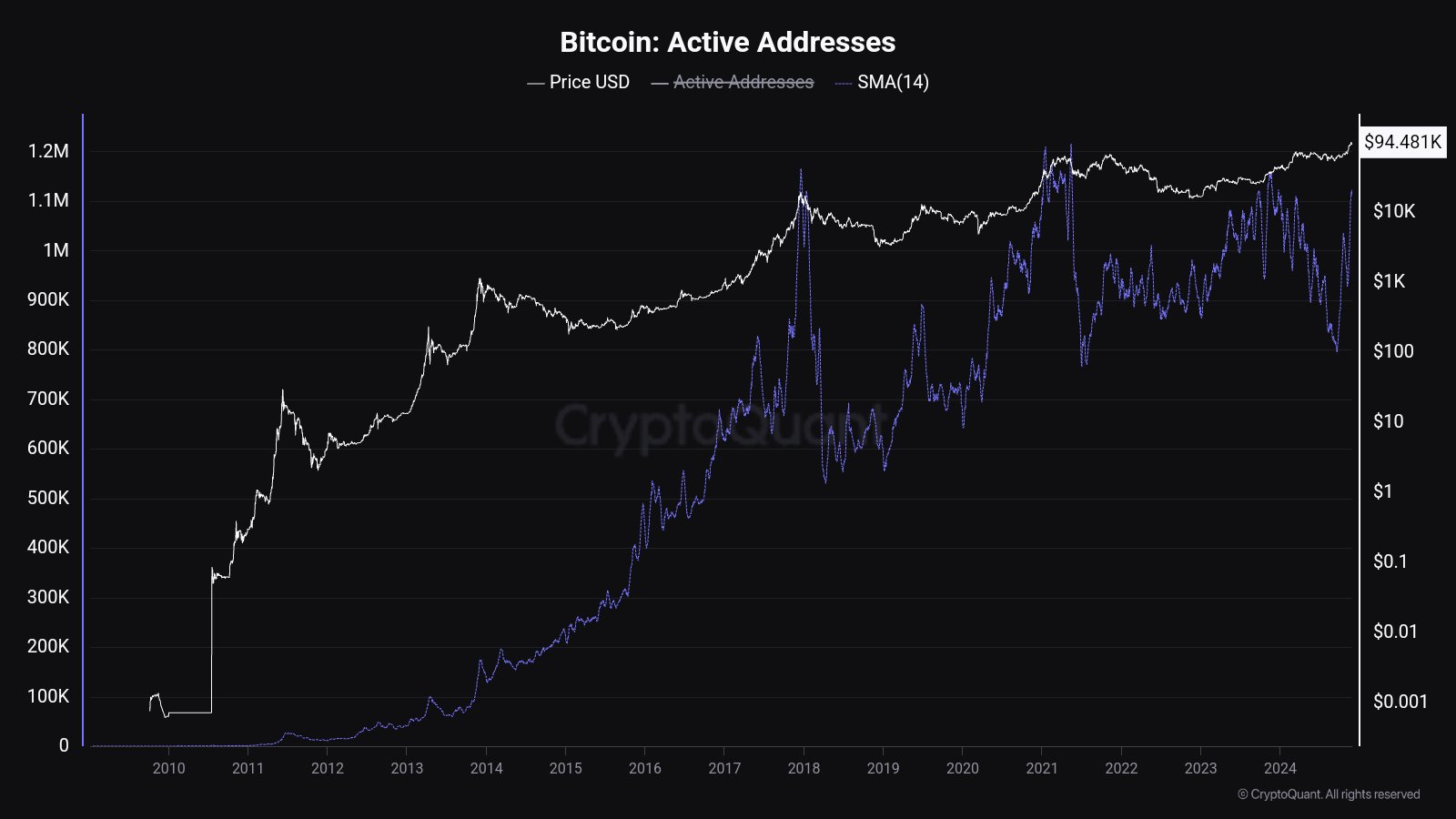

Meanwhile, it’s worth noting that the Bitcoin Active Addresses statistic has seen a significant spike lately, according to information provided by Maartunn in a different post. This figure represents the daily count of unique addresses involved in any sort of transactional activity within the Bitcoin network.

Here’s a graph provided by the CryptoQuant analyst, displaying the 14-day moving average of active wallet addresses in cryptocurrency.

In the last spike, the 14-day Simple Moving Average (SMA) of Bitcoin Active Addresses has hit its peak in over eleven months. This implies a significant increase in network activity lately. However, since the asset has decreased over the past day, it’s clear that the recent user interest is not driven by buying intentions.

BTC Price

At the time of writing, Bitcoin is floating around $92,400, down almost 6% over the last 24 hours.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Brody Jenner Denies Getting Money From Kardashian Family

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Connections Help, Hints & Clues for Today, June 17

- Nobuo Uematsu says Fantasian Neo Dimension is his last gaming project as a music composer

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

2024-11-27 03:05