“`html

Ah, Bitcoin—the only financial adventure where phrases like “volatile” and “existential dread” seem to go hand-in-hand. If you’re still holding onto those dreams of a Lambo, it might be time to consider the bus timetable. Why? Because according to Xanrox, a crypto analyst on TradingView, Bitcoin’s price might be headed for a crash to $40,000 by 2026. And no, that’s not a typo; the word “crash” is doing a lot of heavy lifting here. 🚀📉

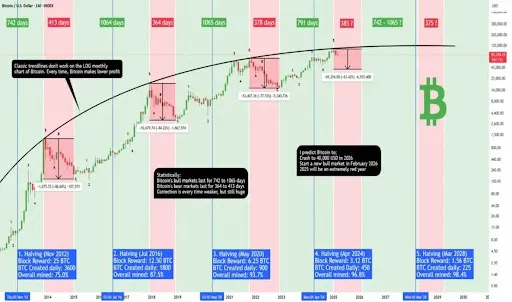

Apparently, Bitcoin has a four-year cycle pattern, blessed (or cursed, depending on your portfolio) with halving events. These halving events are exactly what they sound like—Bitcoin sets up a tent, splits itself in half, and performs an act resembling financial mime. Historically, bull markets, where prices go up faster than you can shout “HODL,” last for 742 to 1,065 days. Meanwhile, bear markets lurk about for approximately one year, making themselves the unwelcome guests of your wallet. Naturally, this always ends with Bitcoin taking a long walk off a short digital cliff.

This Bear Market Indicator is More Accurate than Aunt Mildred’s Weather Predictions

Xanrox also brandished a snazzy price chart, showing Bitcoin’s bull runs diminishing in strength as its market capitalization balloons. Picture Bitcoin as an aging footballer who still dreams of scoring goals but is more likely to miss a penalty than achieve greatness. And if you think Bitcoin’s journey to a $300,000 price tag or beyond is a steaming pile of possibility, think again; physics suggests otherwise—or maybe it’s just basic math.

If you’re betting big on 2025 ushering in yachts and champagne, Xanrox has news for you: it’s probably shaping up to be a bearish year instead. But wait until 2026! That’s when the champagne might start flowing again—provided, of course, you haven’t already sold your soul (and portfolio) for scrap.

The Grim Algorithm and CryptoQuant’s Dire Crystal Ball

Sharing Xanrox’s penchant for bad news delivery, CryptoQuant’s CEO, Ki Young Ju, has grimly declared the recent Bitcoin bull cycle DOA. Expect 6 to 12 months of price turbulence, which is about the financial equivalent of flying during a thunderstorm on an airline budget so tight they charge you for oxygen. 💺💀

Ju also noted that on-chain metrics are looking worse than Uncle Bob’s attempts at cooking, as Bitcoin’s liquidity appears to be drying up faster than spilled coffee in the Sahara. Whales—the giant players in the crypto ocean—are busy selling at prices you wouldn’t brag about at dinner. At the time of writing, Bitcoin is doing the financial limbo at $82,549. For context, that’s a nosedive from its previous all-time high of over $109,000. Seems Bitcoin decided to check out gravity after all. 🌌↘️🐋

“`

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- The Babadook Theatrical Rerelease Date Set in New Trailer

- The games you need to play to prepare for Elden Ring: Nightreign

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

2025-03-19 00:05