As an experienced analyst, I believe that the recent dip in Bitcoin’s price presents both opportunities and risks for investors. Santiment’s insights suggest that further dips are possible due to FUD and market participants looking to offload their holdings. However, institutional investors seem to be taking advantage of these dips by buying more Bitcoin through ETFs.

As a crypto investor, I’ve found Santiment’s on-chain analytics to be an invaluable tool in my decision-making process. According to their recent insights, the Bitcoin dip might not have reached its bottom yet. The flagship crypto could still experience further price dips before finding solid footing within its current range.

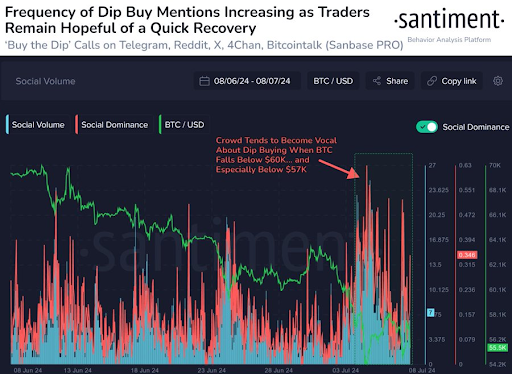

In a recent update on X, formerly known as Twitter, Santiment advised potential investors considering purchasing during market dips. They indicated that market players also expect a market rebound. Furthermore, Santiment warned that such significant market drops, similar to Bitcoin’s recent experience, often trigger FUD (Fear, Uncertainty, and Doubt) among investors.

Those considering purchasing Bitcoin at its current dip should exercise caution as the cryptocurrency’s price might decrease even more. Panic selling from holders could cause a further drop in Bitcoin’s value, potentially reaching the $40,000 range. Consequently, such pessimistic outlooks may contribute to a downward trend for Bitcoin’s price.

During this period, Santiment observed that Bitcoin often bounces back after significant declines when most traders have lost faith in cryptocurrency. In a recent post on the X forum, crypto analyst CrediBULL advised potential investors considering purchasing Bitcoin at its current pricing. He emphasized that these buyers should be prepared to endure a prolonged period where their investment is underwater.

I recommend that individuals who feel uneasy about prolonged underwater positions should hold off until there are signs of a market turnaround. This recovery might materialize through significant liquidation events, which can reset open interest levels, or it could take the shape of short-term impulsive price movements.

As a researcher closely monitoring the cryptocurrency market, I’d like to reassure those who recently purchased Bitcoin at current prices not to be alarmed. While it’s true that we’re experiencing a downtrend, Bitcoin might still drop lower on the higher time frame (HTF) without disrupting the overall bullish structure. In fact, this correction is a normal part of the bull market and could potentially propel Bitcoin towards its predicted target of $100,000.

Institutional Investors Are Buying The Dip

New information from Farside reveals that institutional investors have been purchasing Bitcoin during its recent downturn. Specifically, on July 8th, there were net inflows of approximately $294.8 million into Spot Bitcoin ETFs. Notably, BlackRock’s IBIT, Fidelity’s FBTC, and Grayscale’s GBTC reported significant additions of $187.2 million, $61.5 million, and $25.1 million respectively.

On July 5, Bitcoin ETFs tracking Spot Bitcoin recorded net investments totaling $143 million, marking a shift from the previous two days of outflows. This infusion of funds into Bitcoin has played a role in the recent price rally observed in the leading cryptocurrency.

Currently, Bitcoin is priced approximately at $57,100 based on information from CoinMarketCap, representing a 2% increase within the past 24 hours.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-07-09 20:10