As a seasoned crypto analyst with several years of experience in the industry, I’ve seen my fair share of market ups and downs. The recent prediction by Justin Bennett that Bitcoin could drop to $52,000 is concerning, but not entirely unexpected.

A cryptocurrency expert has revealed several factors that may cause the price of Bitcoin to drop further towards the $52,000 mark. Based on the analysis, Bitcoin has breached crucial support thresholds, suggesting a possible transition from an uptrend to a downtrend.

Analyst Projects Bitcoin Crash To $52,000

As a researcher studying the cryptocurrency market, I came across a post on X (formerly Twitter) dated June 21 by crypto analyst Justin Bennett. In his post, Bennett expressed his belief that Bitcoin’s price might experience a significant drop, potentially reaching key levels between $52,000 and $54,000. He accompanied this prediction with a chart depicting Bitcoin’s recent price fluctuations, emphasizing the lack of a clear trend in its trading pattern. The price continues to oscillate within a range, bouncing off both support and resistance levels without any consistent direction.

As a crypto investor, I’ve been following Bennett’s analysis with great interest, and while his prediction that Bitcoin could dip down to $52,000 has raised some concerns, I think it’s important to understand the reasons behind his bearish outlook.

I’ve noticed that there’s a substantial amount of liquidity lurking beneath the $56,500 mark for Bitcoin. Markets tend to be drawn towards price points with greater buying and selling activity due to this concentration. Consequently, the likelihood of Bitcoin dipping below the $60,000 level increases as a result.

Bennett has indicated that Bitcoin could experience a bullish reversal and surge above $72,000, drawing in additional investors at those price points. Nevertheless, he deems this outcome as less probable considering the current trend of the Bitcoin market.

Bennett has been backing cryptocurrencies since joining the scene in 2020. However, it’s important to acknowledge that the current trend isn’t promising, as indicated by the less-than-ideal chart patterns. The only thing preventing crypto from experiencing a significant decline is the performance of the stock market.

Investor Interest In BTC Is Waning

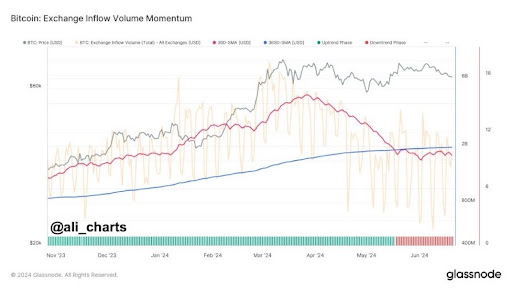

In his recent post, crypto expert Ali Martinez revealed that investor enthusiasm for Bitcoin has been waning. This is indicated by a noticeable decrease in on-chain activities related to exchanges. Furthermore, Bitcoin’s network usage is currently dropping significantly, implying a possible change in the demand for this pioneering cryptocurrency.

Martinez posits that there’s increasing interest in Ethereum, the leading altcoin, among crypto market participants. He noted a growing sense of optimism towards Ethereum, evident in the significant increase in its social media buzz.

As a crypto investor, I believe the shifting attitude among investors could be due to the upcoming launch of Ethereum Spot ETFs. This anticipated event is predicted to bring in substantial investments into the Ethereum market, potentially pushing up its price. Similarly, crypto analyst Martinez and I share the view that Bitcoin might experience a correction, possibly leading it back to the $54,930 price mark.

Currently, Bitcoin is priced at $64,265 during this writing, representing a 2.87% decrease in value over the last seven days based on data from CoinMarketCap.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-06-23 04:16