As a seasoned crypto investor with a decade of experience under my belt, I’ve seen market fluctuations that would make even the most hardened traders question their sanity. The recent warnings about Bitcoin potentially plummeting toward $70,000 or even $60,000 have me feeling a mix of apprehension and déjà vu.

Following a setback at the $100,000 mark, prominent financial experts have issued a series of alerts, urging caution about Bitcoin potentially experiencing a substantial drop to around $70,000 or even $60,000. Analyst Ali Martinez (@ali_charts), specializing in crypto analysis, has gathered the insights of various market veterans on this topic, providing a comprehensive outlook on the possible occurrence of a correction.

Bitcoin Price Crash Incoming?

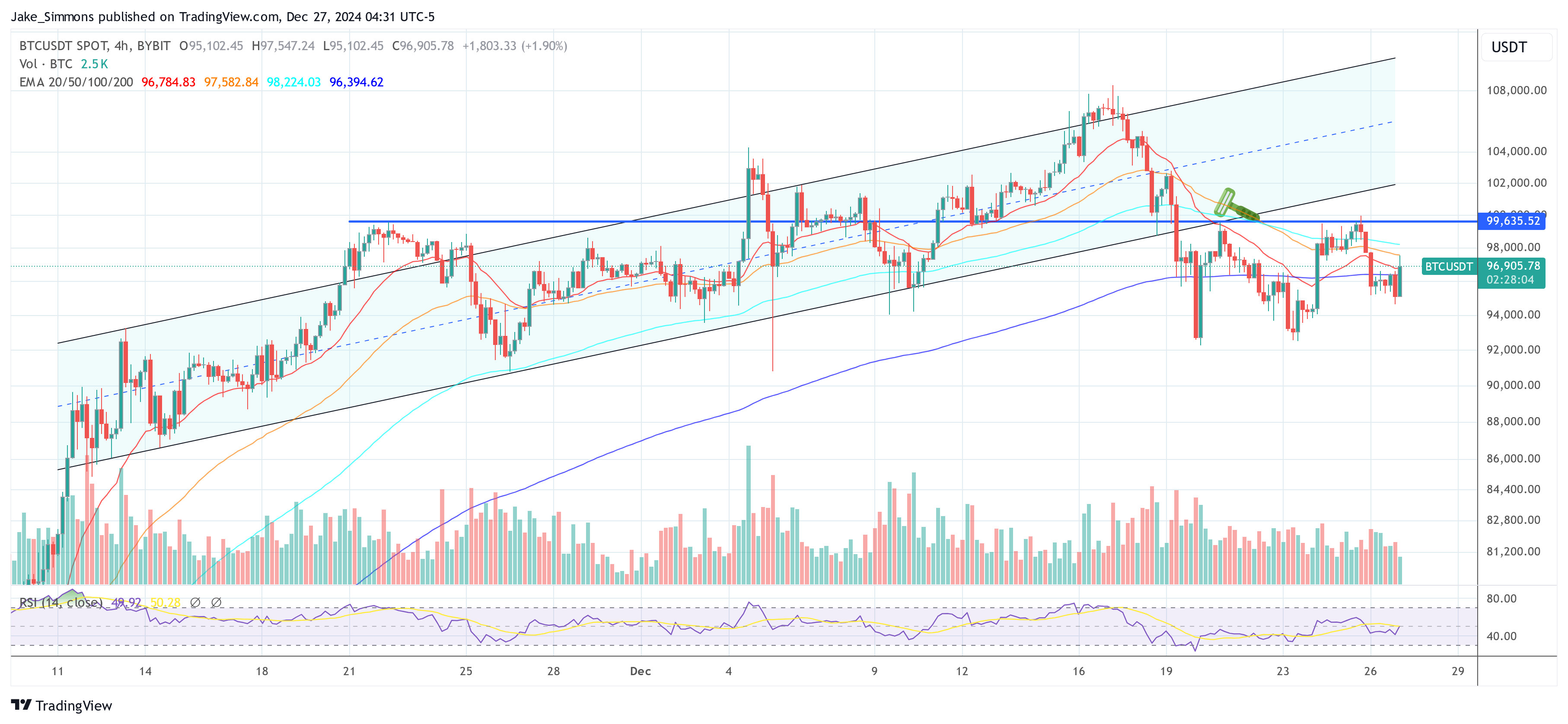

In this conversation, one of the participants is Tone Vays, a renowned trader who has expressed significant worries about Bitcoin’s future direction. Vays stated that Bitcoin trading below $95,000 is “extremely unfavorable” and increases the possibility of a correction towards approximately $73,000.

In a recent video, Vays explained, “We’re currently considering day trading for the month when Bitcoin is below $95,000. Approaching the $92,000 range could potentially trigger a large-scale crash, leading to a drop as low as $73,000. I’m not predicting that it will definitely reach $73,000, but the chances of such a drop have become considerably higher.

Peter Brandt, another well-known analyst, fueled growing worries by talking about the emergence of a “broadening triangle” in Bitcoin’s price graph. This pattern, as interpreted by Brandt, might suggest a possible drop back to the $70,000 area. However, it is important to note that Brandt did stress that his statements should not be seen as definite predictions. Instead, he highlighted the increased likelihood of such a price movement.

Brandt clarified, “Trolls, I’m not making a prediction here. Instead, I’m simply highlighting potential scenarios for Bitcoin. The BTC right-angled broadening triangle might lead us back to the $70,000s and possibly a retest of its parabolic trend.

From my researcher’s point of view, while I understand the bearish sentiments, I find myself aligning more with Fundstrat’s long-term optimism. They predict that Bitcoin could potentially soar to $250,000 by 2025. However, it’s important to note that Mark Newton, their Global Head of Technical Strategy, anticipates some short-term volatility. This might mean a temporary dip in Bitcoin’s price, possibly down to $60,000, before it begins its upward journey.

In a video posted by Martinez, Tom Lee, CEO of Fundstrat, expressed his viewpoint: “I believe Bitcoin will be around $250,000 within a year. Keep in mind that it’s highly volatile, which many find uncomfortable. However, our technician, Mark Newton, predicts that the Bitcoin cycle might dip slightly earlier next year, so Bitcoin could potentially reach the $60,000 range.

In line with other warnings, Benjamin Cowen, head of Into The Cryptoverse, suggests that Bitcoin’s price trend might resemble the Nasdaq 100 (QQQ). This similarity could lead to a sudden drop in value, referred to as a “flash crash,” which may happen around the same time as Donald Trump’s inauguration day.

According to Martinez’s on-chain assessment, there’s a strong likelihood of a bearish trend. He points out that if Bitcoin drops below the price point of $93,806, it might easily slide down to around $70,085, which he describes as an “unobstructed path” or “open terrain”. The key support level he identifies is between $97,041 and $93,806. If this range isn’t held, it could lead to a significant drop in price.

It appears that some investors are gearing up for a potential market downturn, as over 33,000 Bitcoin (valued at approximately $3.23 billion) have been moved to exchanges within the past week. Furthermore, there seems to be an increase in profit-taking activity, with about $7.17 billion worth of Bitcoin profits being realized on December 23rd alone. Moreover, the number of Binance traders holding open long positions on Bitcoin has dropped from 66.73% to 53.60%, indicating a growing pessimism in the market.

Essentially, Martinez emphasizes that Bitcoin regaining its $97,300 support level can counteract the pessimistic predictions. He explains that Bitcoin has dropped below one of its major support levels at $97,300. Therefore, if Bitcoin is to refute the bearish perspective, it must re-establish this crucial support area and maintain a daily close above $100,000, according to him.

If Bitcoin can consistently close at prices above $100,000, as suggested by Martinez, it could trigger a substantial rise, potentially peaking at around $168,500 according to the Mayer Multiple. On the other hand, if it fails to maintain such levels, there’s a chance the anticipated corrections will come into play.

At press time, BTC traded at $96,905.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Ford Recalls 2025: Which Models Are Affected by the Recall?

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-12-27 13:34