As a seasoned researcher with years of experience navigating the volatile crypto market, I have learned to always approach price movements with a healthy dose of skepticism and caution. The recent Bitcoin price action has certainly been no exception – the rollercoaster ride from an all-time high (ATH) to a sharp 15% correction in just a few days is a stark reminder of the unpredictable nature of this asset class.

Over the past few days, Bitcoin has experienced quite a rollercoaster ride. It reached an unprecedented peak on Tuesday but then plunged by 15% in a swift downturn. This volatile phase has caused disagreement among investors as some anticipate further growth, while others are preparing for more declines. The market is keeping a keen eye on Bitcoin’s potential to regain its bullish momentum.

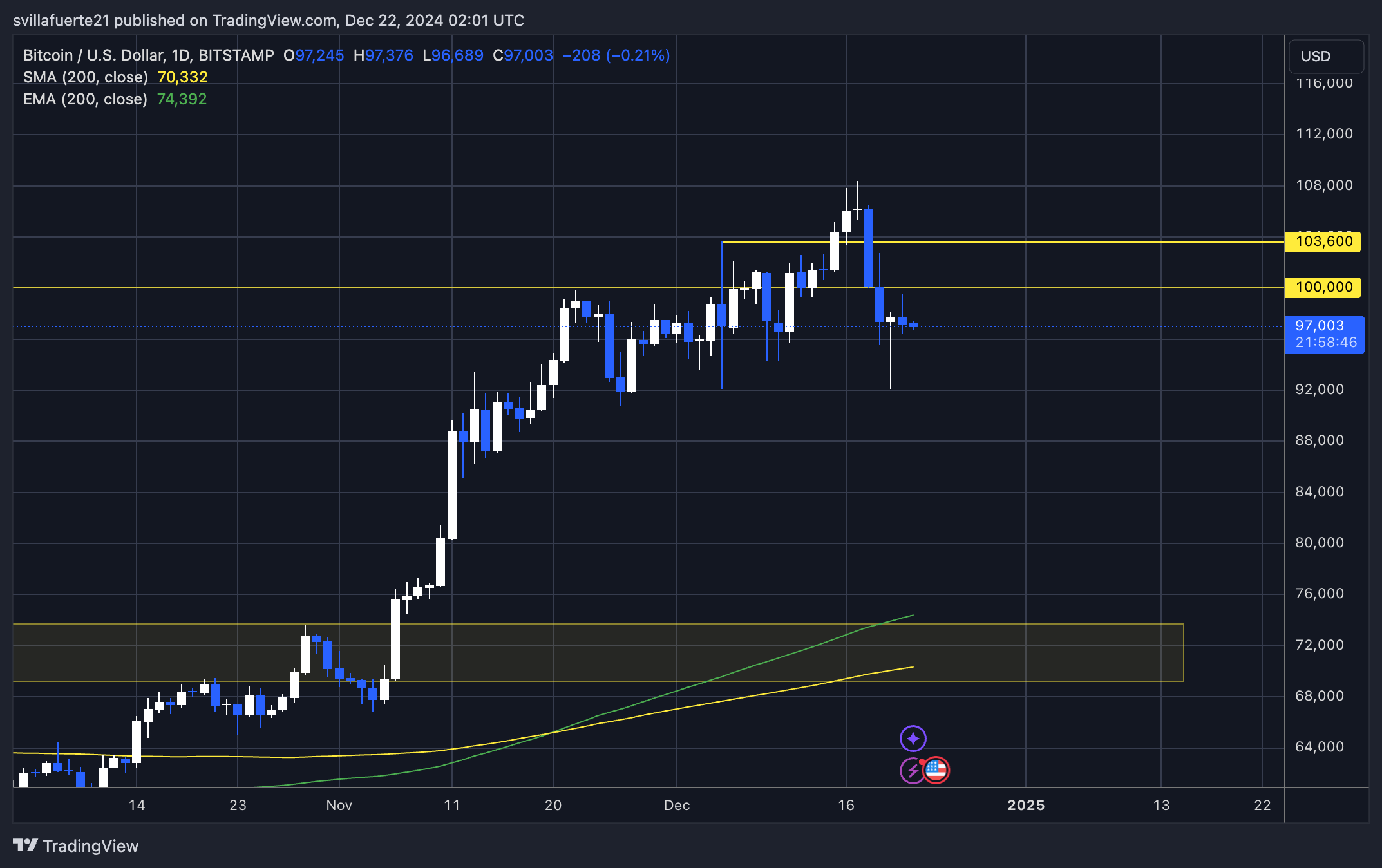

Analyst Ali Martinez has emphasized significant information from Bitcoin’s cost basis distribution, identifying $97K as a crucial support point. According to Martinez, it is vital for BTC to uphold this level to preserve its upward trajectory and resist more substantial adjustments. Nevertheless, Bitcoin’s price fluctuations are unpredictable as it grapples with the psychological resistance at $100K.

Despite some investors viewing the current dip as a necessary adjustment following Bitcoin’s rapid increase, if it fails to recover and push higher, it might indicate an extended period of consolidation. As Bitcoin hovers around crucial points, the upcoming days are vital for predicting whether it will continue its journey towards new records or encounter further obstacles.

Bitcoin Holding Above Key Demand

Bitcoin currently hovers above an important support zone around $97,000, providing optimism for investors (bulls) after the recent market fluctuations. The stability comes after a brief dip to test lower demand at approximately $92,000, demonstrating the market’s resilience against selling pressure. Although the swift recovery looks promising in the short term, Bitcoin is still at a crucial juncture that may influence its trend as we move into the new year.

More recently, Martinez has provided information about the distribution of costs associated with Bitcoin, underscoring the crucial role of the $99,000–$97,000 price range. His findings indicate that this area serves as a vital support level for Bitcoin, functioning as a key boundary in the ongoing upward trend.

Yet, Martinez cautions about the possible negative consequences should Bitcoin not maintain this price range: “It would be unfortunate if this price point were to serve as a barrier for further increases.

With Bitcoin holding steady at crucial points, there’s a lot of uncertainty in the market. On one hand, optimists hope to see Bitcoin regaining strength and reaching new record highs. However, the significant barrier at approximately $100,000 still casts a long shadow. At the same time, pessimists interpret the recent drop as a potential precursor to a bigger downturn.

The upcoming period is significant, especially with the end of the year approaching. As investors seek clarification, it’s essential for Bitcoin to maintain its current support level to avoid disrupting its bullish trend. The direction of the next substantial move – whether it’s an increase or a decrease – will largely hinge on how Bitcoin behaves within this price range.

BTC Testing Liquidity

Currently, Bitcoin is being traded at around $97,000, demonstrating strength as it recovers from recent dips at approximately $92,000. This surge suggests a robust appetite for the cryptocurrency at lower prices, supporting the optimistic outlook for the present time. The price structure remains steady above $97,000, hinting that Bitcoin could potentially mount another ascent towards its all-time high (ATH).

Nevertheless, the psychological barrier of $100,000 stands as a significant challenge on the horizon for the bulls. This level has shown resistance in the past, with previous attempts failing to surpass it. If Bitcoin manages to break through this barrier in the near future, it could rekindle bullish sentiment and pave the way for new all-time highs. This achievement would bolster investor and trader confidence once more.

From my perspective as a crypto investor, if Bitcoin fails to break through the crucial resistance at $100,000, it might not bode well for the market. The optimism could wane, potentially causing an uptick in selling pressure. In this unfavorable scenario, Bitcoin could once more encounter its key support levels, indicating a possible downturn.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Gold Rate Forecast

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

2024-12-22 11:10