As a seasoned researcher with years of experience observing and analyzing market trends, I find the recent surge in Bitcoin’s correlation with Gold intriguing. The 0.75 correlation between these two assets suggests a significant positive relationship that hasn’t been this strong since March, indicating that investors are increasingly viewing Bitcoin as a digital form of gold during times of economic uncertainty and dollar distrust.

As a researcher, I’ve noticed an intriguing trend: The relationship between Bitcoin and Gold appears to be strengthening, suggesting a resurgence in the ‘Digital Gold’ narrative.

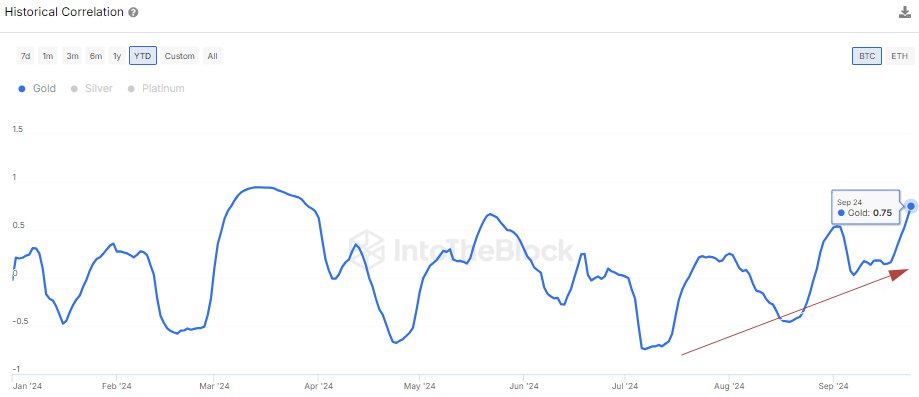

Bitcoin Correlation With Gold Has Risen To 0.75 Recently

In a new post on X, the market intelligence platform IntoTheBlock discussed the latest trend in Bitcoin’s Correlation to Gold. The “Correlation” here is a metric that tracks how closely related the prices of two given assets are. In the current case, of course, the assets are BTC and Gold.

When the metric’s value is greater than zero, it indicates that Bitcoin (BTC) tends to follow changes in the Gold price, moving in the same direction. The more the indicator approaches a value of 1, the stronger this correlation becomes.

In contrast, when the correlation is less than zero, it means there’s a negative relationship between the two assets. This implies they move in opposite directions. When the correlation reaches -1, it indicates the strongest possible inverse relationship. A correlation of exactly 0 signifies no connection at all, implying the assets are independent statistically speaking.

Currently, let’s take a look at this graph demonstrating the correlation between Bitcoin and Gold since the beginning of 2024.

Over the past few months, the correlation between Bitcoin and Gold has been on a steady climb. In fact, the correlation reached its lowest point for the year in July, but since then, it has been increasing significantly. Currently, the correlation stands at 0.75, indicating a strong positive connection between these two assets. Notably, this is the highest the correlation has been since March.

According to the analysis by the firm, the increasing association between Bitcoin’s price and recent investor concerns about a potential economic downturn and uncertainty over the U.S. dollar suggests that Bitcoin is becoming more significant as a means of protection against broader economic risks. This trend indicates a shift towards Bitcoin being used as a hedge in macroeconomic terms.

The Correlation can be a useful indicator to follow for investors looking for diversification options for their portfolios. In general, assets with a high value of the indicator may not be ideal options to keep together, like Bitcoin and Gold right now.

At present, IntoTheBlock notes that the relationship between Ethereum and gold remains relatively weak, indicating a unique position for Ether within the market compared to Bitcoin.

As for what it is, the analytics firm comments:

The fact that Ethereum’s price fluctuations aren’t closely tied to gold suggests it functions more like a risky, expansion-focused investment. Instead of being heavily swayed by broader economic conditions, its value tends to be determined more by internal factors, such as DeFi activities and staking.

BTC Price

Bitcoin has continued to show stale action recently, as its price is still trading around $63,500.

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- How to get all Archon Shards – Warframe

- Mindhunter Season 3 Gets Exciting Update, Could Return Differently Than Expected

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- MobLand Season 2: Tom Hardy Show Gets Big Update, Paramount Gives Statement

- Rashmika Mandanna’s heart is filled with joy after Nagarjuna praises her performance in Kuberaa: ‘This is everything…’

- ‘Tom Cruise Coconut Cake’ Trends as Fans Resurface His $130 Tradition

- A Supernatural Serial Killer Returns in Strange Harvest Trailer

- Tyler Perry Sued for $260 Million Over Sexual Assault Allegations by The Oval Actor

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2024-09-26 01:16