As a seasoned analyst with over two decades of experience in the financial markets, I have learned that every market movement holds its own unique story. The recent consolidation of Bitcoin (BTC) near $68K is no exception. While it may seem like a simple price action on the surface, delving deeper reveals interesting trends and potential future directions.

Starting from October 16th, Bitcoin (BTC) has been holding steady around the $68,000 mark after a surge earlier in the week that was fueled by robust demand in the spot market. However, it seems some investors were cashing out during this price increase, as suggested by peaks in deposits to exchanges. This influx of Bitcoin into centralized platforms suggests selling activity, which might account for the drop to $66,000 observed on Thursday.

Source: CryptoQuant

It’s worth noting that when Bitcoin’s price dipped slightly to around $66,600, it was observed that the ‘whales’ (large investors) were reducing their long positions. This can be seen by the gradual decrease in the Whale vs Retail Delta on Binance exchanges, where green bars are receding (indicating less whale activity). This metric measures how much whales are accumulating compared to retail traders. A drop in this measure suggests fewer long positions held by whales, a trend that often follows Bitcoin price corrections.

In other words, it seems the latest data indicates that experienced investors on Binance took a somewhat lower risk stance, potentially concerned that the drop in price might go below the $66K mark.

Source: Hyblock

This week’s pump has strengthened the optimistic ‘Uptober’ perspective, overturning an underwhelming beginning earlier in the month. The positive and risk-taking attitude was also noticeable among US spot ETF products, which have experienced a four-day winning streak since October 11th. These products recorded $470.48 million net inflows on Thursday.

Based on QCP Capital’s assertion, a cryptocurrency trading company based in Singapore, robust inflows might propel Bitcoin closer to its record high reached in March.

Increasing and robust incoming data could signal more price increases ahead for Bitcoin, approaching its previous record of $73,790, according to the company’s latest report.

Source: Soso Value

Additionally, the trading company mentioned an uptick in purchasing for longer-term options, particularly ones set to expire in March 2025, on their trading floor.

During U.S trading hours, there was significant purchasing activity for long-term options expiring on March 28th, specifically 600 contracts at the 120k strike level. This suggests that confident, high-risk buyers are reemerging during this market uptrend, as noted by QCP Capital.

The sentiment among options traders for Bitcoin’s future prices in the last quarter of 2024 and the first quarter of 2025 was optimistic. Yet, there was a degree of ambiguity in the short term due to the ongoing earnings reports and the approach of the U.S. elections.

Since Bitcoin tends to follow the same pattern as U.S. stocks, the upcoming earnings season might significantly influence the prices of various assets, particularly those related to MicroStrategy, whose earnings will be announced on October 30th.

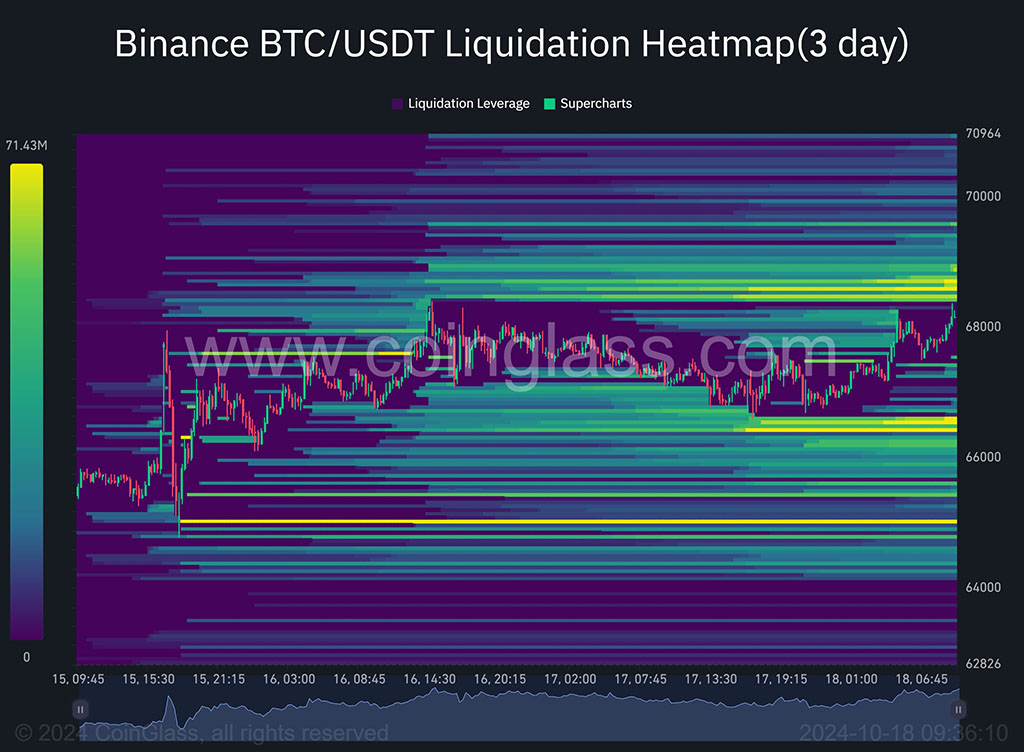

Source: Coinglass

From my analysis perspective, I’ve noticed substantial short positions emerging near $68.6K, while long positions are prevalent at $66.4K on the liquidation heatmap. These liquidity clusters, highlighted as bright yellow levels, are often exploited by market makers to shape prices. Therefore, these potential price manipulation points could significantly impact Bitcoin’s short-term direction, making them vital levels to keep an eye on.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-10-18 12:15